The Role Of AI In Credit, Banking, And Investment Services: Trends Shaping The Future

Lokesh Saini

Feb 07, 2026

“Why did my loan get approved in five minutes?”

“Because an algorithm already knows you better than your bank manager.”

What we mean is that AI is having a massive impact on credit, banking, and investment services today. Remember? When getting a loan required tons of paperwork, weeks of waiting, and embarrassing follow-up phone calls? And investing happened only with a human advisor who charged a commission? Those days are disappearing rapidly.

Now, artificial intelligence can scan your entire credit history in seconds or less and detect fraudulent transactions before they even hit your bank account. Pretty amazing, right?

Until you think about how many financial institutions are still stuck with outdated systems, manual decisions, and a lot of guesswork. Customers demand speed. Banks have risk concerns. Investors value returns based on facts and data. All of this creates an imbalance.

The balancing act is artificial intelligence.

This blog post is designed to educate you on the ways that artificial intelligence can change the way credit is issued, businesses are financed, and investments are made. Are you ready to learn about how smart the world of finance has become? Then keep reading.

What is AI in Fintech?

What exactly is AI in fintech? It’s when smart technology analyzes data, automates decisions, detects fraud, and makes financial services faster, safer, and more personalized for users.

AI in Fintech uses intelligent algorithms to create financial systems that are faster, smarter, and safer by creating intelligent algorithms. By combining analytical data, automated processes, and prediction-based theories, AI offers a smooth customer experience.

AI in finance allows real-time fraud detection, dynamic product recommendations, and advanced financial forecasting. AI in Fintech also enables an understanding of how customers use a platform through historical and current data analysis, and can project what a customer will do in the future with great accuracy.

Machine Learning in Banking powers most of these innovations by enabling the financial services sector to learn to get better as they process more information. This is why, over time, financial services are becoming more effective, accurate, and customer-oriented.

How AI Is Transforming Credit Services?

Now the question is - How is AI transforming credit services? AI analyzes real-time data, predicts risk, speeds loan approvals, and creates fairer credit decisions—making borrowing faster, smarter, and more inclusive.

Credit services have seen one of the most dramatic upgrades thanks to AI in fintech. Traditional credit evaluations were slow, rigid, and often unfair. AI has flipped that script in the Fintech software Development Services sector. Here is how:

1. Smarter Credit Scoring

Artificial Intelligence uses alternative data such as spending habits and live data to perform credit evaluations more quickly, accurately, and fairly than traditional methods.

2. Faster Loan Approvals

Instead of taking several days to approve the applicant, AI can cut the entire process down to mere minutes or seconds, giving borrowers an instant answer while also reducing the number of manual operations: reducing the amount of work for the lender and cutting down on the amount of time the lender takes to process an application.

3. Better Risk Assessment

AI can identify trends within large amounts of data and help lenders find new and innovative ways to improve lending and create safer, more reliable lending practices.

4. Personalized Credit Offers

AI can determine interest rates, limits, and payment plans based on the user's transaction history, allowing lenders to develop products that feel specifically tailored for the individual or organization rather than universally applicable.

5. Fraud Detection in Real Time

AI can detect questionable activity in real time by continuously monitoring users' transactions. This protects both the borrower and the lender from being affected by fraudulent actions and thus saves both parties potentially large amounts of money in future expenses related to recovering lost or unauthorised credit.

What is the impact of AI on Modern Banking?

AI in banking is the engine powering this evolution. Through AI-powered banking solutions, banks automate customer support, personalize user journeys, and detect fraud in real time. Chatbots, voice assistants, and smart alerts are now standard features in AI in digital banking ecosystems. Here is how AI has impacted modern banking.

1. Smarter Customer Support

AI chatbots and virtual assistants provide 24-hour support for common inquiries and allow customers to receive immediate assistance while banks lower their costs of support and allow their human agents to assist with more complex matters.

2. Personalized Banking Experiences

AI allows banks to analyze user behavior patterns in order to provide users with the most relevant offers, alerts concerning important activities, and personalized financial advice; thereby making banking more personal, convenient, and helpful.

3. Stronger Fraud Detection

AI can monitor transactions live, allowing it to detect unusual activity immediately and minimize losses due to fraud. Additionally, the ability of banks to keep customers' accounts safe exists while providing services to their customers.

4. Efficient Back-Office Operations

AI is used by banks to automate compliance audits and processes, along with reporting and information processing, enabling banks to improve their speed, accuracy, and ability to concentrate on innovative ideas as opposed to performing tedious tasks.

More AI-Driven Banking Benefits:

-

Predictive financial insights

-

Automated loan processing

-

Intelligent transaction monitoring

-

Voice-enabled banking

-

Real-time risk management

-

Smart compliance automation

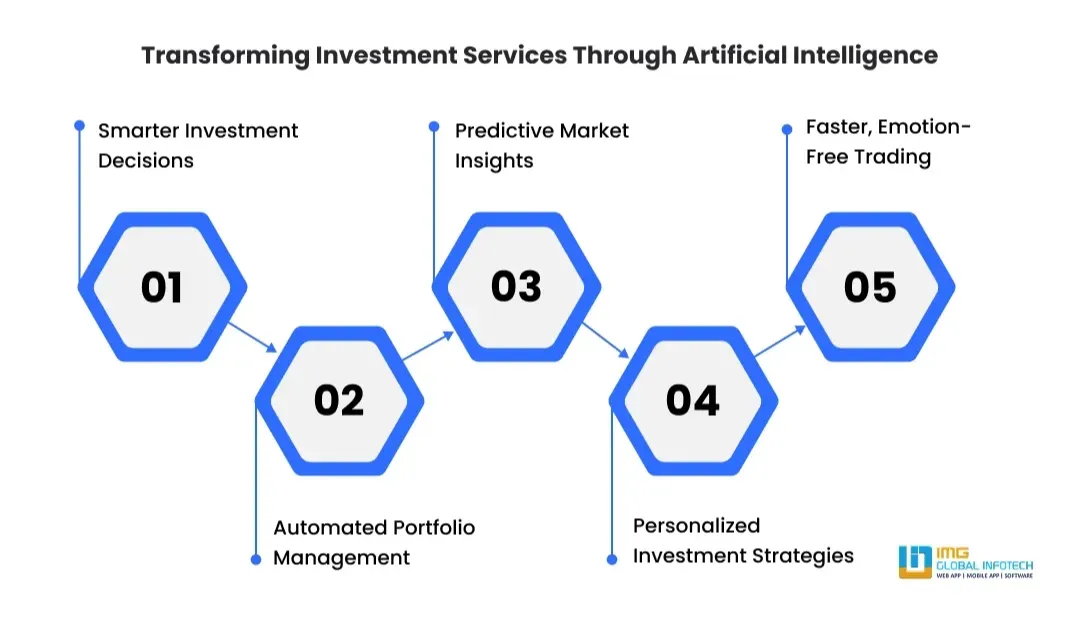

Revolutionizing Investment Services with AI

How is AI changing investment services? AI analyzes markets, predicts trends, manages portfolios automatically, and removes emotional decisions—helping investors make smarter, faster, and more confident choices.

Investment management has moved far beyond human-only decision-making. Here are the changes given below.

1. Smarter Investment Decisions

AI uses data from previous and current trends together with what is occurring at any given moment in order to give investors more confidence in making investment decisions rather than simply guessing what might occur next.

2. Automated Portfolio Management

AI is able to constantly rebalance portfolios by determining how to allocate assets, based on how the market is changing and each person's risk tolerance and long-term goals, so that they can maintain optimal investments with little-to-no manual intervention.

3. Predictive Market Insights

By finding things in the data that a human might not notice, the AI can then forecast where the market is going, allowing the investor an advantage in the timing of their trades and allowing them to better manage any volatility.

4. Personalized Investment Strategies

AI allows investors to create their own personalized portfolio based on their personal goals, risk profile, and behaviours. Creating a custom-built portfolio versus a generic, cookie-cutter type portfolio.

5. Faster, Emotion-Free Trading

Using an AI system to conduct trades ensures that the trade is executed with logic and no emotional bias associated with driving the investor to make panic-driven decisions to buy or sell during the ups and downs of the market.

Key Business Benefits of AI in Credit, Banking, and Investment

The adoption of AI in banking and AI in fintech brings powerful advantages for financial institutions and customers alike. Here are the key benefits given below.

1. Faster Decision-Making

AI enables businesses to provide instantaneous approval for loans, evaluate risk, and make investment decisions through rapid analysis of large amounts of data that would normally take an excessive amount of time if done through manual methods.

2. Reduced Operational Costs

AI automates repetitive processes such as verification, reporting, and monitoring, reducing operational costs while also freeing up employees to engage in more strategic positions that provide a greater sense of purpose.

3. Improved Risk Management

The use of AI allows for early identification of trends and outliers, allowing businesses to identify credit default rates, fraud schemes, and other market risks long before they become long-term costly challenges.

4. Enhanced Customer Experience

AI-based systems create personalized services, deliver instant support, and recommend relevant financial products to consumers, improving the customer experience across all financial interactions.

5. Scalable Financial Operations

AI systems provide businesses with seamless scalability to support growth by continuing to deliver high-quality service levels and increasing the volume of users, transactions, and data as the business grows while maintaining performance, reliability, and quality.

Challenges and Risks of Implementing AI in Fintech

Despite its advantages, AI in fintech doesn’t come without challenges. The Best AI Development Company copes with these challenges with its experience. They have tried and tested methods to deal with these issues. Here are some of the challenges given below.

1. Data Privacy and Security Risks

Massive amounts of data are required for an AI to operate effectively, making Fintech platforms prime targets for hacking and breaches of data security if proper security and privacy processes are not employed.

2. Algorithmic Bias

Alack of high-quality training data, or poorly curated training data can lead to an AI making an unfair determination for credit or lending decisions, resulting in potential harm to the end-users and exposing the financial institution to regulatory exposure.

3. Regulatory and Compliance Complexity

FinTech corporations must ensure that the AI systems their business is utilizing are compliant with strict regulations regarding the financial services sector. This has been and will continue to be difficult for Fintech companies, as the development of regulatory laws has and will continue to outpace the development of the relevant AI models.

4. Lack of Transparency

Many AI models are currently viewed as a black box, making it very difficult to explain how an AI made a particular decision regarding providing credit to an applicant due to the legal and ethical need to be transparent in the credit APP process.

5. High Implementation Costs

The amount of skilled employees, proven training methods, and infrastructure to support the ongoing management of an AI system will be a major obstacle, as many startups and smaller Fintech businesses have limited monetary resources available to build any of those capabilities.

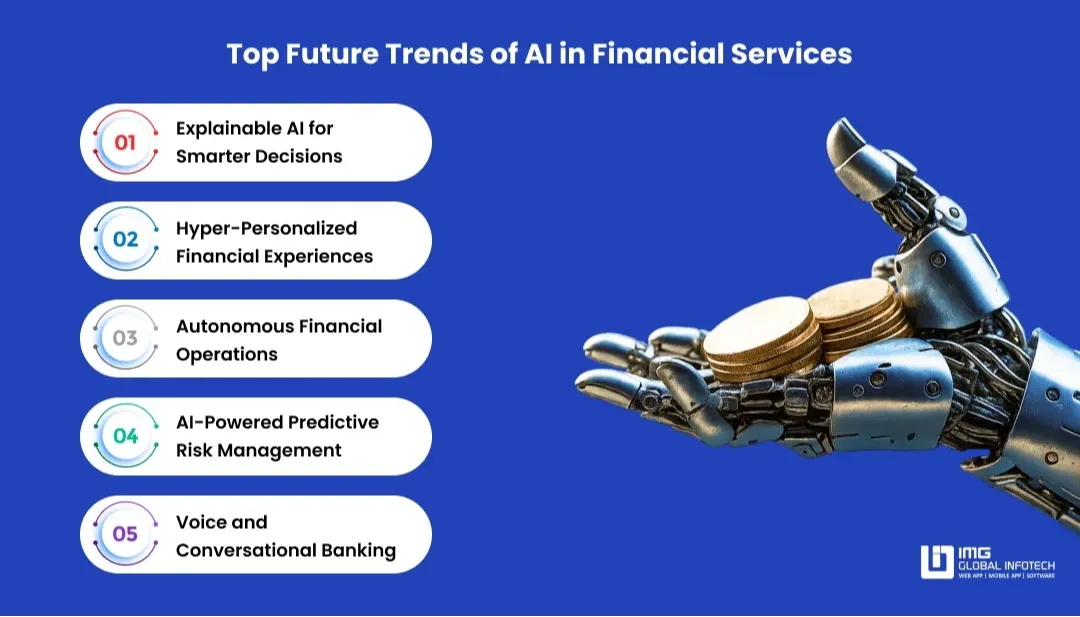

Future Trends of AI in Financial Services

The future of AI in lending and fintech looks incredibly promising. A professional AI Software development Company follows these trends to give a future-ready product. Here are some of the future trends to see.

1. Explainable AI for Smarter Decisions

Financial institutions are starting to use explanatory AI models that can provide transparency in their decisions while also complying with industry standards and regulations and thus creating trust with customers

2. Hyper-Personalized Financial Experiences

Personalized banking, credit, and investment services will all be powered by AI systems that will measure real-time activity, goals, and preferences rather than using generic customer segments

3. Autonomous Financial Operations

AI systems will take care of the entire process from beginning to end, from numbering customers to managing risk, reducing the need for human interaction while increasing speed, accuracy, and operational efficiency

4. AI-Powered Predictive Risk Management

Future AI models will be able to predict credit, fraud, and market risks before they occur, enabling financial institutions to be proactive rather than reactive regarding losses

5. Voice and Conversational Banking

Using voice-enabled AI assistants will create a more natural way for users to interact with their finances, manage their accounts, invest, and make payments by simply speaking to the assistant.

How Businesses Can Leverage AI for Fintech Innovation?

To stay competitive, businesses must go beyond experimentation. Here is how businesses can leverage AI for fintech innovation.

1. Identify High-Impact AI Use Cases

Companies must develop AI-enabled solutions that tackle actual problems, such as detecting fraud, scoring credit, or providing customer service, which will ensure that these solutions are adopted quickly.

2. Use Data as a Strategic Asset

The availability of clean and well-structured data is critical for the effective use of AI technologies. Therefore, companies need to invest in data quality, integration, and governance in order to access accurate insights and use those insights to make smarter decisions.

3. Automate Core Financial Processes

Automation through AI in the area of onboarding, compliance, lending, and reporting reduces the manual effort involved in performing these tasks, increases their accuracy, and frees up teams to focus more on growing their businesses and innovating.

4. Partner with Experienced AI Experts

By working with experienced AI and FinTech development organizations, companies can create scalable, secure, and compliant solutions without having to go through the complex technical aspects of creating those solutions themselves.

5. Start Small and Scale Smartly

Using pilot programs to implement AI initiatives allows a company to test, learn, and improve on their AI models before fully implementing these ideas, thereby reducing the likelihood of failure and increasing the potential for long term success in Fintech innovation.

CONCLUSION

Actually, artificial intelligence is not something that will happen someday—it’s here, and it is changing the way we make lending decisions, how banks operate, and how we invest money.

AI is changing how we create and deliver financial value, with smarter lending and more efficient online banking solutions, as well as making data-driven decisions in investment management. If you embrace this change, your business will benefit from improved speed, accuracy, and trust from customers; conversely, if you resist this change, your company will quickly lose ground to those who have embraced it.

Smartest financial institutions will treat AI as a strategic partner instead of merely a tool, and the process is already underway, and the intelligence gained will continue to increase.

-

How to Develop a Trading Platform Like Robinhood? A Complete Guide

How to Develop a Trading Platform Like Robinhood? A Complete Guide

-

Hire Gold Investment App Developers: Cost, Skills & Benefits

Hire Gold Investment App Developers: Cost, Skills & Benefits

-

Thinking of Building a Fintech App? A Complete Guide to Features, Costs, and Success

Thinking of Building a Fintech App? A Complete Guide to Features, Costs, and Success

-

Top 10 Logistics Software Development Companies to Hire in 2026

Top 10 Logistics Software Development Companies to Hire in 2026

-

Top Fintech Apps in India in 2026

Top Fintech Apps in India in 2026

-

Top Fintech Trends to Accelerate Business in 2026

Top Fintech Trends to Accelerate Business in 2026

Lokesh Kumar is the Digital Marketing Manager & SEO Content Strategist at IMG Global Infotech, a top-rated Web & Mobile App Development Company. With extensive experience in digital marketing, SEO, and content strategy, he specializes in boosting online visibility and driving organic growth for startups, SMEs, and global brands. Lokesh is passionate about creating SEO-friendly, user-centric content that not only ranks but also converts. His deep understanding of digital trends and search algorithms helps businesses thrive in a competitive online space.