Top Fintech Trends To Accelerate Business In 2026

Mohit Mittal

Feb 04, 2026

It’s a quiet evening, and you unlock your phone to pay a bill, transfer money, or check your credit score—all within seconds. No queues. No paperwork. No bank visits. Moments like these don’t feel agitator anymore, yet they represent one of the biggest financial transformations in modern history. This is fintech in action.

What once sounded futuristic AI approving loans, apps detecting fraud instantly, and digital wallets replacing physical cards are now woven into everyday life. But here’s the turning point: fintech is moving beyond convenience. It’s evolving into an intelligent, predictive, and deeply personalized financial ecosystem.

So here’s the bigger question: as technology accelerates and consumer expectations rise, who will shape the next phase of financial innovation? The industry is entering an era where automation meets trust, data meets regulation, and speed must coexist with security.

Let’s step behind the curtain of 2026’s fintech landscape and explore the trends, technologies, and strategic shifts redefining how money moves, how risks are managed, and how businesses must prepare to stay ahead.

Global Financial Market Landscape

As per the report of Fortune Business Insights, the global fintech market was valued at $394.88 billion in 2025. The market is projected to be worth $460.76 billion in 2026 and it would reach $1.18 trillion by 2034 with a CAGR of 18.20% during the forecast period of 2027 to 2034.

Key Market Trends & Insights:

-

North America dominated the fintech-as-a-service market in 2026 and accounted for a revenue share of over 34%

-

Asia Pacific is expected to grow at the highest CAGR over the forecast period.

-

Based on type, the payment segment dominated the market in 2026 and accounted for a revenue share of more than 40%

-

Based on technology, the blockchain segment dominated the market in 2026 and accounted for a revenue share of more than 40%

-

Based on application, the compliance and regulatory support segment dominated the market in 2026 and accounted for over 31% of the global revenue.

20 Fintech Trends to Watch in 2026

Here is a list of 20 Fintech Trends to watch in 2026.

-

Embedded Finance

The embedded finance integrates the financial services that are directly connected with non-financial platforms to examine the fintech app development cost. For instance, the ride-sharing apps can offer the insurance at checkout or e-commerce platforms can provide the buy-now-pay-later (BNPL) options. In 2026 it can expand deeply into sectors like education, travel, and healthcare as well.

-

AI-Driven Financial Services

Artificial intelligence serves as the fundamental technology driving financial technology development. The use of AI in 2026 extends beyond being an industry trend because it powers intelligent decision systems that operate throughout underwriting processes and predictive analytics and customer service chatbots and fraud detection systems and wealth management solutions and personalized recommendation services in trends in fintech. AI systems process extensive data sets to discover hidden patterns, which allow organizations to make quicker decisions based on validated information.

-

API Ecosystems in Open Banking

The APIs can allow banks and fintech to securely share customer data with consent to build the innovative products. The open banking can enable the competitive ecosystem and the customer to benefit from the customized financial solutions to enhance the transparency as well.

-

Web3 Integration with Decentralized Finance

In 2026, DeFi is still developing and providing decentralized lending, borrowing, and trading without the need for conventional middlemen in trends in the fintech industry. Web3 experiences and blockchain-based platforms are merging, allowing for programmable money, true ownership of digital assets, and new kinds of economic coordination.

-

Smarter Compliance & RegTech

The regulations can tighten rules and data usage along with anti-money laundering (AML) and know-your-customer (KYC) requirements along with regulatory technology (RegTech) solutions that can use automation and machine learning to help companies to stay compliant with less manual effort as well.

-

Biometric and Behavioral Security

Biometric authentication, which includes face ID and fingerprints, together with behavioral analytics, which uses typing patterns and device usage patterns, has become the primary security method that organizations use instead of traditional passwords to protect against fraud and secure their transactions.

-

Next-Generation Payments

The instant payments have become table stakes in current trends in fintech. In 2026 the cross-border transactions are faster and cheaper for the blockchain innovations with digital currencies and global payment networks for both commerce and remittances as well.

-

The Buy-Now-Pay-Later (BNPL)

The medical and travel system has developed into an advanced payment method that provides educational, medical, travel, and business-to-business invoice payment solutions. The use of AI technology for credit evaluations helps lenders become more accurate in their risk assessments.

-

Sustainable and ESG-Aligned Finance

The investment platforms and lending criteria now include environmental and social and governance (ESG) metrics as standard requirements from the best fintech apps. Investors can use fintech solutions to allocate funds to green projects while monitoring their environmental effects.

-

Tokenization of Assets

The tokenization of traditional assets is facilitated by blockchain platforms, enabling individuals to acquire fractional ownership in various asset classes, including real estate, artwork, and equity investments. This innovative approach democratizes access to investments that were previously limited to affluent investors.

-

Quantum Computing

Quantum Computing is not a new trend but is still emerging; quantum Computing includes risks and opportunities for super-fast credit risk analysis. The fintech companies are exploring the quantum-safe encryption for the next level of optimization to integrate the algorithms in systems as well.

-

Digital Identity Platforms

Secure digital identity systems streamline the KYC process, effectively eliminating fraud while providing seamless access to a wide range of financial services, significantly reducing the need for individuals to repeatedly submit documentation for verification as well.

-

Smart Contracts & Automated Compliance

The system executes contracts automatically when their specific conditions have been established in fintech marketing trends every advisor should watch, which results in fewer manual operations for processing loans and insurance claims and supplier payments and additional operations.

-

InsurTech Growth

The insurance industry experiences disruption through technological advancements that enable real-time risk assessment and usage-based insurance models and automated claims processing to decrease operational expenses while enhancing customer satisfaction.

-

Financial Inclusion by Mobile Banking

Mobile banking services have achieved success in bringing millions of people into formal financial systems across emerging markets by providing digital savings and credit options and insurance products and merchant services that were not accessible before.

-

AI-Driven Wealth Tech

The digital wealth platforms leverage advanced machine learning algorithms to customize investment portfolios effectively from the AI in finance. They automatically rebalance these portfolios, ensuring that financial planning is personalized according to individual goals and preferences, while also taking into account varying levels of risk tolerance.

-

Cybersecurity Management

Cybersecurity is essential for digital transactions with cybersecurity innovations. It mainly includes zero-trust architectures, encryption processes, and secure multiparty computation that are vital to protect the sensitive and financial data with customer trust as well.

-

Subscription-Based Banking

The BaaS (Banking as a Service) system, together with subscription services, provides customers with access to advanced features to discover financial services fintech trends 2026, which include analytics tools and customized financial guidance and increased transaction limits.

-

Conversational Banking and Voice Interfaces

AI-powered voice systems together with conversational interfaces enable users to interact with financial applications, which results in easier access to financial services for people who belong to underprivileged communities.

-

Adaptive Risk Scoring Models

Lenders use traditional credit scoring methods with additional data from mobile phone usage and online shopping patterns and social status information to evaluate a person's creditworthiness and extend lending options.

What are the Emerging Technologies in Fintech Industry in 2026?

The ongoing evolution of fintech advances through the combination of innovative technologies, which enhance both backend operations and customer-facing systems. The most transformative technologies in 2026 include:

Artificial Intelligence and Machine Learning

AI drives personalization, risk assessment, fraud detection, and predictive analytics. The machine learning models in fintech achieve success through their ability to enhance accuracy by learning from new data.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain technology delivers two crucial benefits by creating transaction records that remain accessible to everyone and cannot be altered by anyone to Build a fintech app like wise. The system allows decentralized finance (DeFi) operations and digital asset tokenization together with smart contracts that execute business rules without the need for intermediaries.

Cloud Computing and Edge Infrastructure

Cloud platforms provide scalable resources at reduced initial expenses, which permit fintech startups to launch their services in a secure manner in fintech marketing trends for advisors. Edge computing improves the efficiency of processing real-time transactions.

Quantum-Resistant Cryptography

The rise of quantum computing creates a threat to current cryptography systems, but quantum-resistant algorithms will protect financial information from upcoming security threats.

Natural Language Processing (NLP)

NLP creates more advanced chatbots and voice interfaces, which let customers use financial platforms through natural language for assistance, information retrieval, and transaction processing.

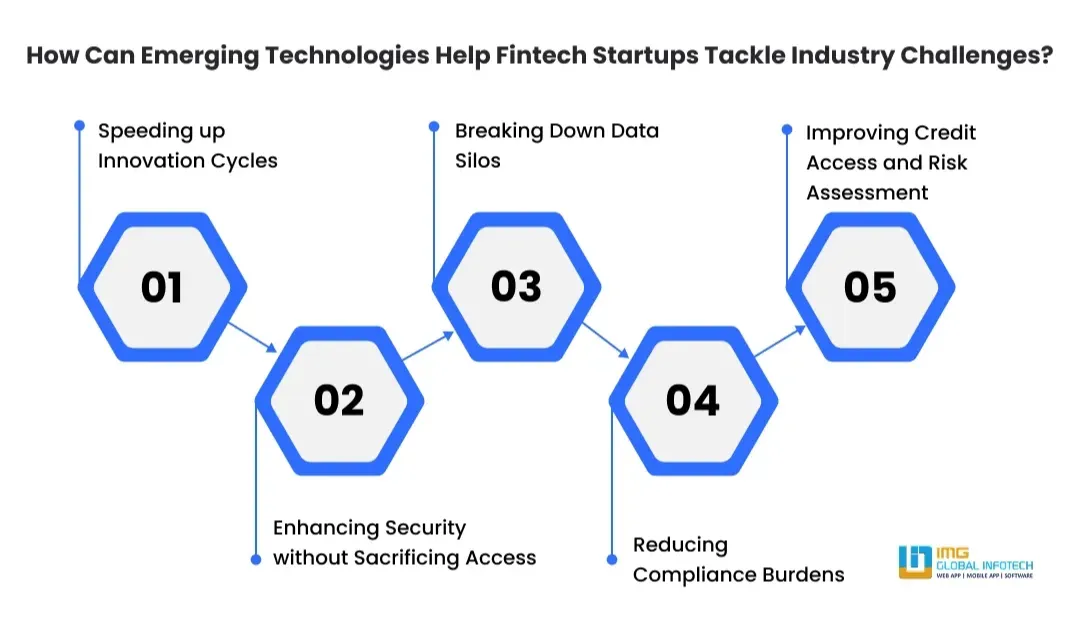

How Emerging Technologies are Helping Fintech Startups Overcome Challenges?

Speeding up Innovation Cycles

The cloud platforms and modular APIs that can allow startups to build, test, and launch products faster than ever in the most relevant fintech market trends 2026. These kinds of technologies eliminate the legacy of infrastructure of constraints to accelerate go-to-market execution in the business as well.

Enhancing Security without Sacrificing Access

The advanced encryption with biometric authentication along with anomaly detection helps balance security with seamless access to the Cost to build a fintech app like cleo. The startups can offer the touchless onboarding that can protect transactions against fraud and scam policies as well.

Breaking Down Data Silos

Artificial intelligence and machine learning technologies enable businesses to examine customer patterns through their platform data examination in fintech technology trends. The data intelligence system enhances both customer retention and operational performance.

Reducing Compliance Burdens

RegTech automates compliance checks together with KYC/AML processes and reporting, which results in time savings, reduced errors, and decreased regulatory risk. Startups can scale without incurring additional compliance expenses.

Improving Credit Access and Risk Assessment

Alternative data analytics enable underserved communities to obtain credit through non-traditional scoring systems in the future trends in fintech. This expansion of customer bases leads to increased financial access for various groups.

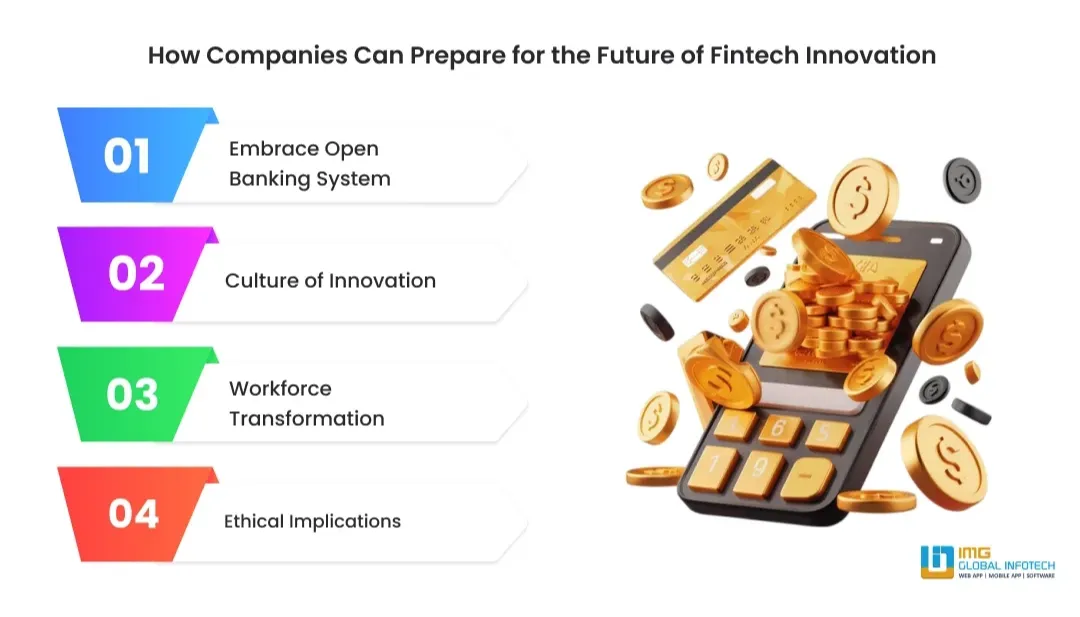

How Businesses can Prepare for Future Fintech Trends

The fintech trends won't just impact the tech startups; they can affect the traditional banks with enterprises with investors and policymakers in the financial technology trends. Here is how businesses can prepare:

Embrace Open Banking System

To participate in the open banking ecosystem, the companies can provide improved services that leverage the third-party innovation and deepen customer engagement as well.

Culture of Innovation

Foster a culture that promotes experimentation, encourages collaboration across various functions, and embraces rapid prototyping in banking fintech trends. Establish innovation labs, form partnerships with startups, and organize hackathons to enhance organizational agility and responsiveness.

Workforce Transformation

Help employees gain skills in data science, cybersecurity, AI governance, and digital product management in the fintech technologies market trends. Upskilling your staff will get them ready for a tech-enabled finance environment.

Ethical Implications

Work together with fintech companies, technology providers, and industrial/sectoral consortia. Collaborations can speed up the process of innovating and create new opportunities in the market.

Conclusion

By 2026, the fintech industry landscape will be marked by creativity, combination, and change. Artificial intelligence, blockchain, and big data, among others, are examples of technologies transforming every aspect of the financial services industry: their delivery, the customer experience, and regulation are recent trends in financial sector. At the same time, consumer expectations, regulatory frameworks, and competitive pressures keep on changing at such a high pace that it is hardly possible to keep up.

No matter if you are a startup founder, a corporate executive, a financial professional, or just a reader interested in the topic, it is indispensable to understand these trends if you want to successfully navigate the future of finance from the Fintech software development company. Through responsible technology adoption, innovation, and strategic preparation for change, companies will manage not only to adjust but also to prosper in a fintech world characterized by speed, personalization, security, and global connectivity.

There is a great deal of potential along the way, and those who remain well informed and flexible will be the first to open up new phases of financial transformation.

Mohit Mittal is the co-founder of a leading IT company with over a decade of experience in driving digital transformation and innovative tech solutions. With a strong background in software development, Mobile app development, E-commerce, business strategy, and team leadership, Mohit Mittal is passionate about helping businesses scale through technology. When not solving complex tech challenges, he enjoys sharing insights on emerging trends, entrepreneurship, and the future of IT.