How To Build An App Like Empower: A Complete Guide

Dipti Singhal

Feb 03, 2026

Managing money has been more stressful. Many people struggle to track their spending, save consistently, and deal with unexpected expenses before payday. If you've ever experienced low balances, overdraft fees, or confusion about where your money goes each month, you're not alone. This is precisely why financial wellness applications such as Empower are gaining popularity.

However, developing an app like Empower entails more than simply adding banking features. It's about understanding real-world user problems and providing simple, dependable solutions. Users want instant financial insights, smarter budgeting tools, and easy access to emergency funds, all in one secure location. They also expect an app that is simple, not complicated.

So, how do you create a financial app that people will trust and use on a daily basis? In this blog, we'll go over the key steps, essential features, technology choices, and planning required to create a powerful app like Empower that truly helps users with their finances.

What is the Empower app?

The Empower app enables users to obtain cash advances through their mobile devices. The application allows users to access funds instantly, which makes it suitable for emergency situations in Financial advisor app development. Empower Server functions as a budgeting tool that enables users to establish spending boundaries based on their income. The app becomes the user’s preferred option because of this feature.

If your business intends to create an Empower-like application, then you should hire a fintech application development company. The company develops secure, modern, user-friendly applications that meet your requirements and ensure an easy loan application experience.

How Does an App Like Empower Work?

The Empower application functions as an intelligent budget management solution that creates secure access to your banking details together with your credit card information and all your financial accounts. The application begins to monitor your financial activities after you establish connections with your bank accounts.

The system identifies your spending categories while providing a complete picture of your financial expenditures, which assists you in creating spending limits. Users can track their cash movement and savings development together with their complete financial situation through basic graphical displays.

The system provides users with features that deliver instant access to minor cash loans while enabling them to save money and receive notifications about their spending. The system uses current financial data to assist users in controlling their spending while they handle their bills and improve their financial decision-making abilities.

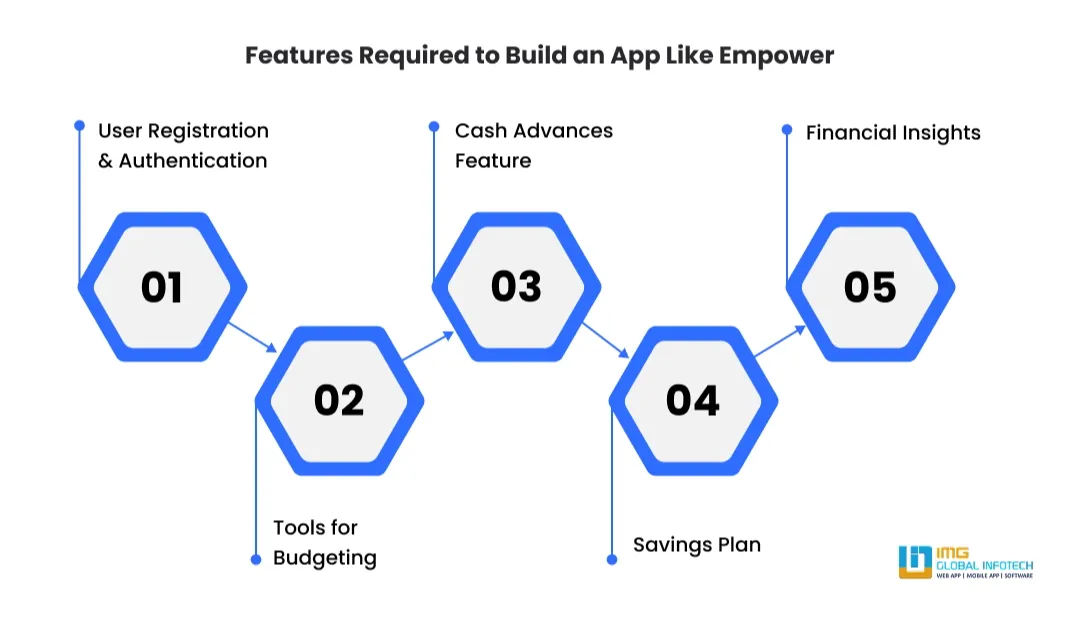

Core Features Required to Build an App Like Empower

It is essential to build a guide for developing an app like Empower, and it is also vital to incorporate features that can provide a seamless experience in every transaction for users through apps like empower cash advance. Let's take a closer look at these core features to develop an app like Empower as well:

User Registration & Authentication

The registration process would be easy and secure to bring users into the business. It can also provide options to sign up with a phone number, email, and social media profiles that can enhance the security level as well.

Tools for Budgeting

Empower offers multiple features yet its budgeting capabilities serve as its primary draw for users in app like empower cash advance. The design of these tools requires user-friendly operation while maintaining flexibility to meet different user needs.

Cash Advances Feature

It is also a notable aspect that can attract users to cash advance apps like Empower right away. This feature is especially valuable to users who have access to money for the loan application procedure as well.

Savings Plan

The application requires implementation of standard savings plans, which need to be used with Empower in the Stock trading app development. The savings plans enable users to save money automatically through features such as auto-debit, which transfers funds to their savings account or e-wallet.

Financial Insights

The most important thing is to ensure the users remain interested and engaged, which can best be done by presenting them with relevant information in the form of financial analysis.

The system needs to use artificial intelligence and machine learning technologies for analyzing user spending patterns to deliver recommendations that will improve financial performance.

Technology Stack for Financial Wellness App Development

To develop a cash advance app like Empower, you need a robust and scalable tech stack:

How Do You Build an App Like Empower Step by Step?

Here is the step-by-step guide that can help to build a cash advance app like Empower:

Market Research and Planning

Market research needs to begin first because it helps to identify the target audience while determining their requirements and assessing competing businesses to examine the Fintech app development cost. This process helps to develop a unique market position, which enables additional apps like Empower to enter the market.

Define the App’s Features and Functionality

The market analysis should identify essential features, which include cash advance and budgeting tools and P2P transfer capabilities to create a cash advance app like empower. Select features that deliver the highest benefits to users and that will assist your company in achieving its objectives.

Select the Appropriate Technology Platform

Select a technology stack that will enable system expansion while ensuring data security and maintaining performance efficiency in financial wellness app development . The frontend can use React Native, Node.js serves as the server solution, and PostgreSQL functions as the database system, which are popular technology options.

Design UI & UX

Create a user interface and user experience design that enables users to easily navigate and comprehend the system in order to empower personal finance app development. The design should create an inviting experience that assists users in finding their way through the application while using all available features.

Development Process

Architect the application with a secure design that protects against common security threats while supporting business expansion to Build a personal finance app like mint. The application needs basic third-party features, which include payment methods and extra AI capabilities for enhancement purposes.

Testing and Quality Assurance

The team will conduct unit and integration tests to identify bugs and security vulnerabilities and optimization issues in personalized finance app like empower. Software testing services will evaluate the system through functionality tests and usability assessments and security checks and output compatibility evaluations across various devices and operating systems.

Cost to Build an App Like Empower

The typical cost to build an app like Empower would be $5,000 to $15,000 or above. The major cost depends on several factors, app complexity, and the level of alteration of specific needs. Here is the table that can showcase the cost to build a cash advance app like Empower on different app complexity levels as well.

Future Trends in Financial Wellness & Cash Advance Apps

Financial wellness and cash advance apps are developing to address the increasing financial needs of modern users. New innovations and improved features are enabling users to manage their finances effectively, access money instantly, and develop better financial habits.

AI-Powered Financial Advice

Artificial intelligence is revolutionizing the way apps assist users. Rather than simple tracking, apps now use financial data analysis, such as spending habits, income, and financial behavior, to offer tailored advice in financial wellness app development. This enables users to make more informed decisions, manage their spending, save more, and get timely advice based on real-life financial situations.

Real-Time Income & Expense Tracking

Future apps will concentrate on real-time financial awareness. Automatic financial organization, real-time balance updates, and predictive spending alerts enable users to avoid overspending. These features will optimize budgeting, reduce financial stress, and ensure that users are aware of their spending before financial issues like overdrafts arise.

Smarter & More Flexible Cash Advances

Cash advance solutions are becoming smarter and more user-friendly. Cash advance amounts will depend on confirmed income and spending patterns, making lending more secure. Clear fee terms, flexible repayment options, and responsible lending practices will promote trust while enabling users to manage their short-term financial difficulties.

Integration of Financial Education

Apps will integrate financial education with financial services to Build cash advanced app like dave. Financial tutorials, savings challenges, and goal-oriented advice will enable users to develop long-term financial capabilities. This approach will transform apps from short-term financial tools to comprehensive financial wellness platforms that promote smarter financial habits and better financial planning.

Improved Security & Data Protection

With sensitive user data being processed by financial apps, improved security is a critical requirement. Biometric authentication, enhanced encryption, fraud protection systems, and rigorous compliance requirements will safeguard user data in empower clone app development. High security will promote trust, encouraging users to use these apps for their everyday financial needs.

How IMG Global Infotech Help You Build Your Cash Advance App?

To build a cash advance requires a strong security system along with a smooth user experience and smart financial features. Our development team helps you to turn concepts into scalable and user-friendly fintech solutions for your business.

Industry-Focused Fintech Expertise

Our developers can understand the financial technology landscape and compliance requirements for cash advance lending platforms. Our team can design solutions that can align with market trends along with regulatory standards and market trends.

Secure & Compliant App Development

Security is a vital component in cash advance apps that can manage the sensitive financial data in business. The advanced encryption with secure APIs and multi-factor authentication can also allow data protection practices for the right establishment in the business as well.

User-Centric UI/UX Design

A cash advance must be simple, easy, and fast. The clear interfaces with smooth onboarding and scalable dashboards are designed to help users track repayments and manage accounts seamlessly in money apps like empower. It can improve engagement with retention and overall customer satisfaction in diverse user engagement as well.

Smart Features & Integrations

The application provides essential functions, which include instant loan approval workflows and automated eligibility checks, credit scoring integration, payment gateway setup and bank API connectivity, and real-time notifications.

Scalable & High-Performance Architecture

The backend system delivers strong capacity in empower app development. Your platform maintains performance during increasing user demand because of this robust backend structure.

Post-Launch Support & Upgrades

Development does not end at launch to build an app like empower. The app maintains its competitive edge through ongoing monitoring, which includes performance optimization, bug fixing, feature improvement, and security patching.

Final Thoughts

The process of developing Empower applications presents both challenging obstacles and multiple potential benefits for developers in the Fintech app development. The creation of this application requires extensive planning together with technical knowledge and compliance with specific financial regulations, yet the obvious advantages of the project remain.

The increasing need for online financial solutions demonstrates a dynamic market that is ready to accept new offerings. Fintech app development services combined with established development processes will enable you to create an application that makes a significant impact on users while distinguishing itself from other financial technology products as well.

Dipti Singhal is a skilled Content Writing Specialist at IMG Global Infotech, with strong expertise in creating engaging, SEO-optimized content for various industries. She focuses on blending storytelling with effective keyword strategies to help businesses connect with their audience and improve their online visibility. Passionate about delivering high-quality content that drives real results, Dipti plays an essential role in strengthening the company’s digital presence.