How Much Does It Cost To Build A Fintech App Like Cleo?

Mohit Mittal

Jan 28, 2026

Money management has been revolutionized by personal finance applications powered by AI. Before, managing your finances meant using spreadsheets or expense tracking apps, and hoping you could stick to a budget or save for retirement. Today, because of the advancements in technology, consumers can expect real-time, tailored assistance from their financial institutions through these applications. Because there is a great demand for these types of services, many new start-ups or established enterprises have begun to research various AI-based solutions for assisting consumers with their finances.

One of the more successful AI-based services is Cleo. Cleo provides financial management to its users in the form of a chatbot, which uses an artificial intelligence program to provide personalized and interactive financial advice. As a result, there are many new entrepreneurs who are asking the same question: What is the cost of developing a fintech application similar to Cleo? When developing or creating a fintech app similar in functionality to Cleo, it's extremely important to understand the overall development costs involved, the potential features available for your fintech app, and the various factors that can affect the cost to develop your application. In this post, we will detail everything you need to know about the Cleo application, development challenges, and trends in the future. So let’s start.

What Is Cleo, and How Does It Work?

Cleo is a money management assistant powered by artificial intelligence. The Role Of Artificial Intelligence In Fintech is very crucial. It aims to simplify money management for users by providing a friendly and relatable chatbot experience instead of complicated financial dashboards. By connecting with a user's private banking and credit card accounts via a secure connection, Cleo can automatically review users’ transaction history, and automatically track their spending habits, and categorize where they are spending their money.

Using AI and machine learning technology, Cleo generates insights such as a weekly breakdown of spending habits and saving recommendations, and alerts users of any unusual transactions. Some of Cleo's features include:

-

AI chat-based conversation

-

Bank account data integration in real-time

-

Smart budget management algorithms

-

Financial forecasts based on real-time data

Due to its focus on AI, Cleo's development costs are significantly higher than those of an average finance app, yet it delivers superior levels of spending insight and automation, which makes it very appealing to both users and investors alike.

Why Invest in Building a Fintech App Like Cleo?

The global fintech market is expanding rapidly, and AI-driven personal finance apps are among the fastest-growing segments. Cleo is one of the most popular fintech apps. Investing in a Cleo-like solution offers several strong business advantages. Here are the reasons why you should invest in a Fintech app like Cleo.

1. High Market Demand

The expansion of user interest surrounding artificial intelligence-based budgeting and expense tracking services makes developing a Cleo-like mobile application a highly profitable investment with large adoption potential and substantial room to grow in the burgeoning Fintech Sector.

2. Recurring Revenue Opportunities

Sustained, consistent revenue will come from subscription-based plans, premium subscriptions that provide added features not available for free users, and personalized financial information & suggestions for budgeting & spending strategies. Therefore, it is likely that developers of AI-based fintech applications will quickly recoup the costs of developing those applications through ongoing subscription fees while generating enough income from their applications to ensure continued profitability over the long term.

3. AI-Powered Personalization

AI-based financial applications provide more custom-tailored solutions for individual users regarding budgeting, spending, and general financial advice, which results in increased user engagement and retention rates, as well as enhanced value for AI-based financial applications compared with traditional financial platforms.

4. Scalable Business Model

Once an AI-based fintech application has been created, it can scale rapidly to millions of users while incurring minimal additional operational expenses. This will result in maximizing return-on-investment and enabling rapid growth of the businesses that launched those applications.

5. Competitive Market Advantage

When businesses develop and launch AI-based fintech applications that use chatbot technology, they set themselves apart from their competitors by providing new, more innovative, and user-friendly experiences for users that meet the demands of the current digital banking environment.

Must-Have Features of a Fintech App Like Cleo

To accurately estimate the cost to build a fintech app like Cleo, you must first understand the essential features that define the app experience.

1. User Registration and Security

Secure sign-up with email, phone number, or social login is mandatory. Multi-factor authentication, biometric login, and encryption add to both security and personal finance app development cost.

2. Bank Account Integration

The app must connect securely with multiple banks using APIs. This real-time data synchronization significantly impacts the fintech app development cost.

3. AI Chatbot Interface

An important component of a Cleo-like application is the use of conversational chatbots to interact with the user. Therefore, developing NLP, intent recognition, and contextual responses will contribute significantly to the overall cost of building an AI Chatbot application.

4. Expense Tracking and Categorization

Another component of developing an early-stage AI-Chatbot is the provision of Automatic Transaction Categorisation utilising AI technology. This feature will assist customers in identifying their spending patterns and, therefore, forms an important consideration when budgeting app development cost like Cleo

5. Smart Budgeting Tools

AI-Based Budgeting Suggestions utilizing user activity and income history are critical for creating a true Clio-like experience.

6. Savings and Financial Insights

Predictive Analysis capabilities will enable customers to receive suggestions for how much they may potentially save and alerts for instances of potential overspending. Both of these additional AI capabilities will, in turn, add to the overall AI fintech app development cost.

7. Notifications and Alerts

Low balance notifications, unusual transaction alerts, and spending limit reminders all help to build engagement and strengthen trust.

8. Premium Features and Subscriptions

Included in the development of an AI-powered financial services application are tools for monetizing the service, such as premium plan offerings, credit-builder features, and personalized insights.

Cost Breakdown to Build a Fintech App Like Cleo

Let us now get into numbers. Several components affect the cost to build a Fintech app like Cleo. There is a different UI/UX Design Cost, Frontend Development Cost, Backend Development Cost, AI and Machine Learning Development Cost, and Third-Party API Integration.

Let us now break down the cost by the level of the app.

1. Basic Fintech-like App Cost

The basic Fintech app development cost ranges from $5,000 to $15,000, depending on the project requirements. It is an ideal choice for startups looking for an MVP or small and medium-sized businesses with a tight budget.

2. Mid-Level Fintech App Cost

A mid-level app costs range from $15,000 to $30,000, depending on the project requirements. It is an ideal choice for growing businesses or those that want to expand.

3. Advanced-Level Fintech App Cost

An advanced-level app costs range from $30,000 to $50,000, depending on the project requirements. It is a good choice for large enterprises who operates with full automation.

Factors That Affect Fintech App Development Cost

Factors That Affect Fintech App Development Cost. Here are some of them given below.

1. App Complexity

Simple budgeting applications have lower price tags than developing AI-based fintech applications due to the use of artificial intelligence (AI). However, other factors will influence how much it will cost to build an AI-based fintech application.

2. Technology Stack

AI in Finance sector has an important role to play. The use of advanced AI frameworks, cloud technology, real-time processing tools, and machine learning (ML) algorithms will raise the overall costs associated with creating an AI-based fintech application.

3. Development Team Location

Hiring a skilled fintech app development company from regions like India can significantly reduce costs without compromising quality.

4. Platform Choice

Developing for both iOS and Android increases the personal finance app development cost compared to a single platform.

5. Compliance and Security Requirements

More stringent regulations on compliance directly affect the price to build a fintech application.

Why Choose a Professional Fintech App Development Company?

Partnering with a professional AI development company ensures your app meets security, performance, and compliance standards. Here are the reasons to choose a professional Fintech app development company.

1. Expertise in Fintech Regulations

Companies that offer fintech app development services typically have extensive experience with legal issues and industry regulations. They can help ensure that your application will comply with the law and protect the personal financial information of users from outside threats.

2. Advanced Security Implementation

Companies with extensive experience can create sophisticated security systems, including encryption and secure API's, to protect both financial information and instill trust among users, which is integral to the long-term success of a fintech application.

3. Proven AI and Technology Skills

An experienced fintech app development company is also knowledgeable about the latest technologies, such as AI, machine learning, and data analytics, to provide intelligent, scalable, and high-performing fintech app solutions.

4. End-to-End Development Support

In addition to providing full-service development services for fintech apps, professional companies typically provide all elements in a single place through one reliable partner.

5. Faster Time-to-Market

The established processes and skilled developers at these companies enable them to speed up their development cycles and get your fintech app out into the marketplace much sooner than you could otherwise.

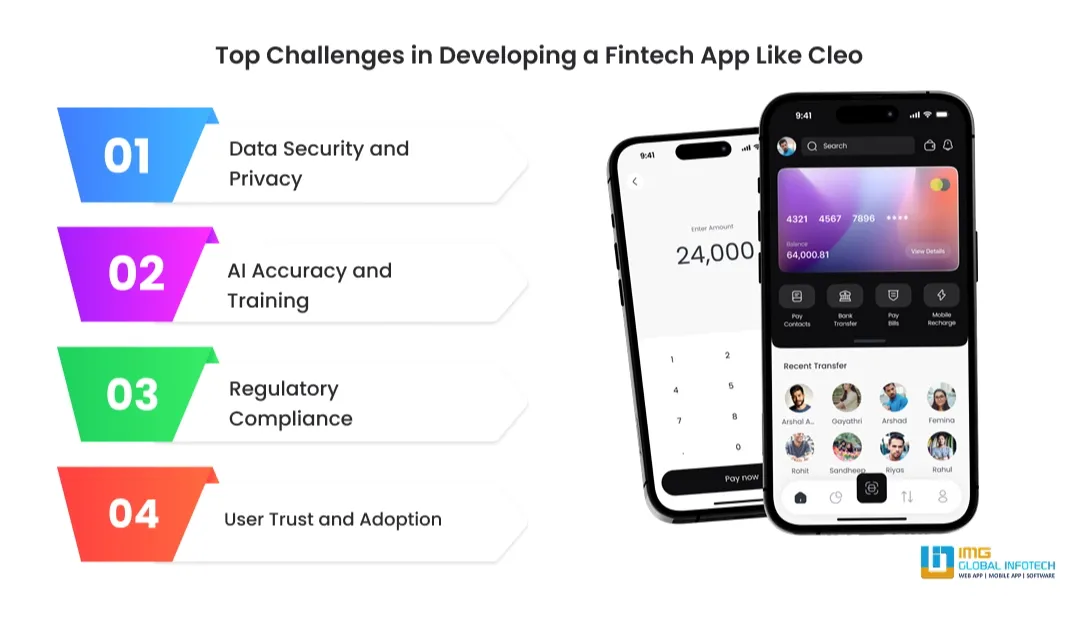

Challenges in Developing a Fintech App Like Cleo

Building a Cleo-like app is rewarding but challenging at the same time. With the use of AI in Banking and Finance sector, they have grown up many folds. But at the same time, they have to cope with the challenges that come along. Here are some of the challenges given below.

1. Data Security and Privacy

The creation of a Fintech App includes costs that increase due to the advanced encryption and compliance involved with handling Sensitive Financial Data.

2. AI Accuracy and Training

Developing an AI model that produces reliable financial advice requires training using a significant amount of data, requiring ongoing optimization, resulting in additional costs to develop an AI Fintech application.

3. Regulatory Compliance

Developing an overview of financial regulations in all regions is a resource-intensive and complicated task.

4. User Trust and Adoption

In order to encourage users to link their banks and use the app, it is necessary to ensure a robust User Experience and demonstrate transparency in the security practices used by the app.

Other Challenges are:-

-

Banking and third-party API integrations

-

Real-time financial data processing

-

Building user trust and adoption

-

Ongoing maintenance and feature updates

Future Trends in AI-Powered Fintech App Development

The future of AI-powered Fintech apps is looking good. Here are some of the future trends to see.

1. Hyper-Personalized Financial Advice

With AI, users can expect a highly personalised budget, saving and investing experience through real-time analysis of their behaviour, spending patterns and overall financial goals.

2. Conversational AI and Voice Assistants

The use of advanced chatbots and voice platforms will provide users with a natural, human experience when dealing with their financial management, creating a more intuitive, easy-to-use and engaging experience than ever before.

3. Predictive Financial Analytics

Advanced predictive models driven by AI will estimate cash flow, spending behaviours, and potential saving capabilities of users to provide a proactive means for achieving their financial goals and avoiding stress associated with financial planning.

4. Enhanced Fraud Detection Systems

Investment fraud will be minimal with the deployment of Machine Learning (ML) and Deep Learning Algorithms that will instantly identify potentially fraudulent activities and improve the overall levels of Trust, Security, and Compliance associated with FinTech.

5. Integration with Open Banking Ecosystems

We will shortly see FinTech applications powered by Artificial Intelligence (AI) capable of easily sharing data between users and open banking platforms for enhanced real-time financial insight, improved user experience and broader scope of financial products and services.

Other Future Trends are:-

-

Emotional AI for money behaviour analysis

-

AI-driven credit scoring models

-

Embedded finance solutions

-

Automated wealth management tools

-

Cross-platform AI fintech ecosystems

CONCLUSION

Developing a fintech application that utilizes artificial intelligence has become more than an innovation. It is becoming a strategic business decision. While it may seem that the cost of developing an app similar to Cleo is quite expensive at first glance, the expected long-term revenue, growth potential, and increasing user interest will make it an excellent investment.

In order to develop an accurate budget for developing your app, you can identify features, costs, challenges, and trends. Working with the right development team will ensure that your application will be secure, smart and customer-focused. Cleo is one of the Most Popular AI Apps at the moment. New businesses look to replicate the same model in their product. If you are ready to create a new fintech application similar to Cleo, now is the time to start implementing the AI-driven financial innovations to define the new era of efficient money management systems.

Mohit Mittal is the co-founder of a leading IT company with over a decade of experience in driving digital transformation and innovative tech solutions. With a strong background in software development, Mobile app development, E-commerce, business strategy, and team leadership, Mohit Mittal is passionate about helping businesses scale through technology. When not solving complex tech challenges, he enjoys sharing insights on emerging trends, entrepreneurship, and the future of IT.