AI In Banking & Finance: Key Use Cases, Benefits & ROI (2026)

Mohit Mittal

Jan 23, 2026

The global financial ecosystem is experiencing tremendous disruption due to a shift towards digital technology. At the heart of this disruption is the use of AI within Banking & Finance. With the ability to provide enhanced decision-making capabilities and the ability to provide hyper-personalized experiences for customers, AI is changing the way banks and financial Institutions do business, compete, and grow. By the year 2026, Banks will no longer be in a position to debate whether they should implement an AI strategy. They will be focusing on the question of how quickly they can securely and profitably scale their AI strategy. The increase in customer expectations, regulatory scrutiny, and aggressive competition with digital-first companies has made AI a strategic imperative rather than simply a technology enhancement.

This blog will review how AI in Banking & Finance is used, the various significant Use Cases for AI, the ROI that can be measured from using AI, challenges in implementing AI, and what the future may hold for AI in Banking & Finance after 2026. All of the above information is delivered in simple, conversational terms. So let’s begin.

Why AI Adoption Is Accelerating in Banking?

The rapid rise of AI in Banking & Finance is driven by a mix of business urgency, technological maturity, and evolving customer behavior. Here are the reasons why AI adoption is accelerating.

1. Growing Demand for Personalized Customer Experiences

AI is being utilized by banks for the purpose of providing personalized services to customers in real time. Using AI, banks analyze customer behavior, transaction history, and preferences to provide recommendations tailored to the customer, faster assistance to customers via chatbots, and a seamless omnichannel banking experience.

2. Rising Fraud and Security Threats

Due to the rise in digital transactions, fraud risk has become significantly more complex. AI-enabled systems detect anomalies instantaneously and are able to identify patterns that are indicative of fraudulent activity. They enable banks to detect and combat fraud in real time, creating a safer and more reliable banking system.

3. Need for Operational Efficiency and Cost Reduction

In addition to protecting the customer from fraud, the application of AI technology also allows banks to reduce operational costs by automating traditional tasks such as data entry, customer queries, and regulatory compliance. AI helps banks automate many of their low-value transaction-processing activities, allowing staff more time to focus on high-value and strategic activities that add value to the organization.

4. Data-Driven Decision Making and Risk Management

The volume of data generated by banks daily is overwhelming and presents banks with the additional challenge of effectively processing this data into usable formats. Because of the speed and accuracy with which AI can convert data into actionable insights, AI provides banks with a competitive advantage.

How AI Works in Banking & Financial Services

To understand the impact, it’s important to know how it actually works behind the scenes. The AI software development companies can help you properly in this regard.

1. Data Collection and Processing

AI technology collects vast amounts of both structured and unstructured data from market sources, consumer interactions, mobile apps, and transactions for analysis and reliable outputs, which ultimately requires data to be cleansed, structured, and processed before being analyzed.

2. Machine Learning Model Training

Machine Learning is then trained using historical Banking and Financial data to discover relationships, trends, and patterns within this data. These algorithmic models will continue to learn as they receive additional data over time, which allows for improved predictions related to credit risk, fraud, and consumer behaviour.

3. Real-Time Analysis and Decision Making

Using AI to process live data enables immediate access to insights and automated decision-making. Financial Institutions can respond rapidly to identify fraud, authorise loans, provide tailored services, and respond to customer inquiries in a timely manner.

4. Integration with Banking Systems

AI-enabled solutions are typically connected with a Financial Institution's core banking platform, CRM System, and Compliance Tools, all of which support workflow automations, operating efficiencies, and regulatory compliance associated with providing financial services safely and securely.

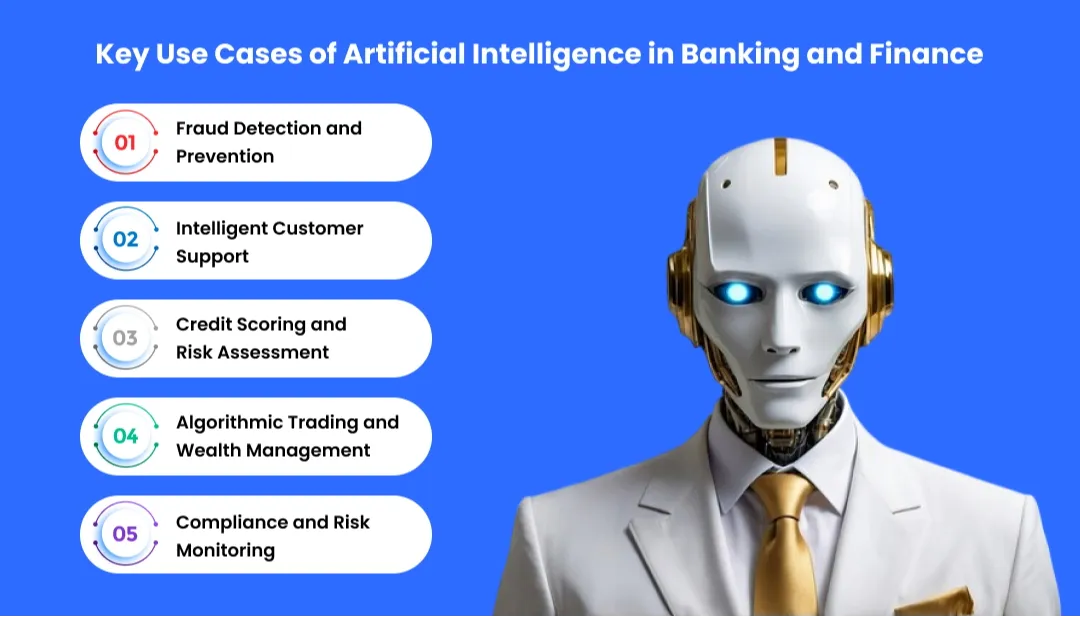

Key Use Cases of AI in Banking & Finance

The real power of AI and Fintech apps lies in their wide range of practical, high-impact use cases. Here are some of them given below.

1. Fraud Detection and Prevention

AI-driven fraud detection in banking uses real-time behavioral analysis to detect potential fraud by analyzing a customer's behavior to uncover suspicious transaction activity. This method reduces the number of false positives produced, which prevents losses to the bank.

2. Intelligent Customer Support

Chatbots and virtual assistants enable an AI-powered customer experience in finance. It offers clients instant support, responding to inquiries with a customized response and providing support to clients whenever they require help via digital channels.

3. Credit Scoring and Risk Assessment

AI use cases in banking also include an advanced credit scoring model that utilizes alternative data points to develop faster and fairer lending solutions.

4. Algorithmic Trading and Wealth Management

AI applications in finance include robo-advisors, automated trading, and portfolio management based on risk and market trends.

5. Compliance and Risk Monitoring

Implementing AI Compliance and Risk Management in banking allows companies to streamline compliance processes and monitor risks efficiently with the best compliance management software.

All of the AI applications listed above demonstrate how AI in finance industry operations will soon become intelligent, proactive, and resilient with the advent of AI.

Benefits of AI in Banking & Finance

Several advantages go far beyond automation. They directly impact profitability, customer loyalty, and long-term competitiveness. Here are some of the benefits given below.

1. Enhanced Customer Experience

Artificial Intelligence brings more personalization and immediacy to service and support interactions, both in digital and traditional Banking experiences. Consumers receive a higher level of customer satisfaction and engagement due to being a part of a personalized experience that drives loyalty.

2. Improved Fraud Detection and Security

Leveraging AI can help Financial Institutions gather data about real-time transaction activity to spot abnormal patterns that may identify fraud activity.

3. Operational Efficiency and Cost Reduction

With AI, Banks benefit from automating labour-intensive tasks and workflows, leading to lower operating expenses, reduced processing time, and increased accuracy.

4. Smart Risk Management and Compliance

Analytics, powered by AI, will allow Banks to access information on evaluating Credit Risk, Compliance, Irregular Behavior, and Compliance With Regulatory Standards.

5. Data-Driven Decision Making

Through the use of AI, Financial Institutions can process and convert much larger amounts of Financial Data into Actionable Insights to facilitate the speed and quality of decisions regarding lending and strategic planning.

ROI of AI in Banking: Business Impact & Metrics

The ROI of AI in banking is measured across multiple dimensions. Here are some of them given below.

1. Reduction in Fraud Losses

Fraud detection powered by AI provides a means to detect suspicious transactions in real-time, thereby reducing chargebacks and other costs associated with investigating transactions and increasing the security of all other transactions processed.

2. Lower Operational Costs

Automation of customer support operations, compliance checking, and other back-office processes reduces the amount of manpower needed and the chance of making errors. For example, businesses often achieve these savings by implementing the best business expense tracker to automate receipt scanning and reconciliation, providing an overall reduction in administrative costs.

3. Faster Loan Processing and Approvals

Using AI for credit decisioning allows lenders to approve loans faster and with less manual intervention, increasing the chances of converting prospects into paying customers and therefore adding revenue and enhancing customer experience.

4. Improved Customer Retention and Lifetime Value

AI creates a personalized experience through predictive analytics that allows lenders to build relationships with borrowers, leading to increased trust and retention, while also creating opportunities for more cross-selling of additional products or services, creating lifetime value over time.

5. Better Compliance and Risk Metrics

AI allows for greater accuracy in reporting to regulatory agencies; with better reporting comes lower penalties and more robust risk management, ultimately delivering ROI from improved governance and a reduction in compliance-related costs.

Banks leveraging AI-powered banking systems often report ROI within 12–18 months, especially in fraud detection, customer support, and risk management.

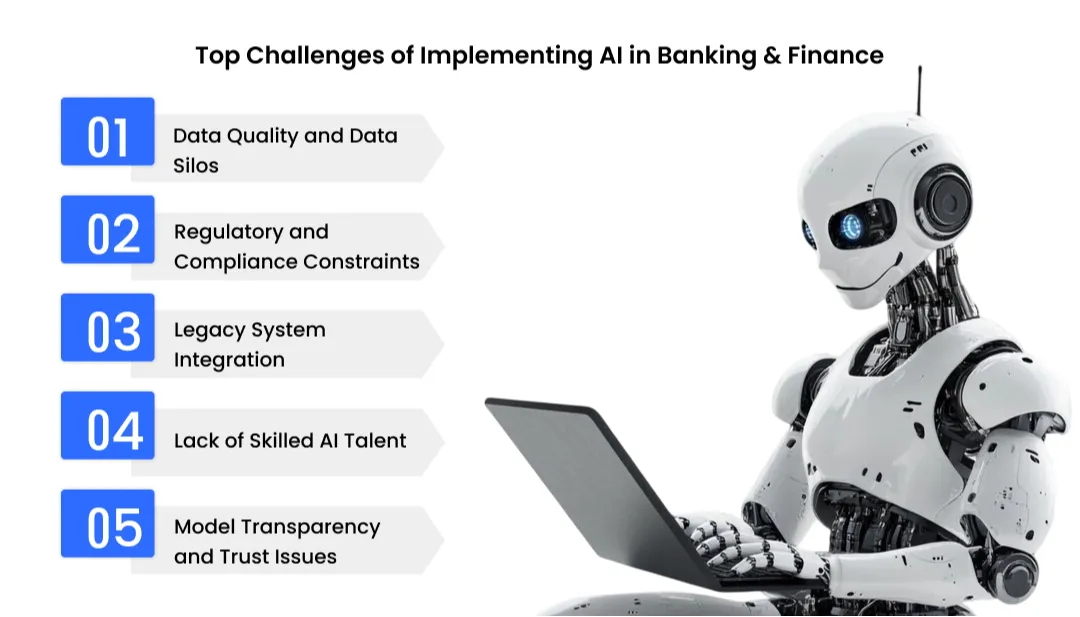

Challenges of Implementing AI in Banking & Finance

Despite its benefits, implementing AI in Banking & Finance is not without challenges. Some of the challenges are:-

1. Data Quality and Data Silos

Data quality issues, inconsistency, and fragmentation caused by the legacy systems of banks make developed accurate predictive models and provide reliable data-driven insights very challenging.

2. Regulatory and Compliance Constraints

Bank regulation is very complex, and AI model implementations are subject to very strict compliance, auditing, and transparency regulations. The ability to provide an explainable AI solution in a changing regulatory environment presents particularly significant regulatory and operational challenges to a banking organization.

3. Legacy System Integration

Many banks operate on outdated core banking platforms, making the integration of innovative AI solutions into these legacy bank core systems difficult, labor-intensive, and costly.

4. Lack of Skilled AI Talent

In order for banks to successfully implement and operate an AI solution, the organization must develop resources in data science, machine learning, and regulatory compliance. This demand for people with these specialized skills will create limitations regarding the speed of adoption and the ability to scale AI solutions within banks.

5. Model Transparency and Trust Issues

Black-box AI models create issues of lack of trust and accountability among regulatory agencies and other banking stakeholders. Banks will need to ensure AI-driven decisions are made in an explainable and unbiased way to maintain long-term acceptance of AI solutions.

Successful AI implementation in banking requires a clear strategy, strong governance, and close collaboration between technology, compliance, and business teams

Best Practices for Successful AI Implementation in Banking

To maximize the value, banks should follow proven best practices. Here are some of the best practices given below.

1. Start with Clear Business Objectives

To guarantee measurable effect and quicker return on investment from AI, banks should align their AI projects to their very specific business objectives, including decreasing fraud, optimising costs, and enhancing customer experience.

2. Build a Strong Foundation

Data of high quality that is governed properly will guarantee that AI is successful. Banks need to make large investments in their data infrastructure, including integration, cleansing, securing, governing, and other related technologies, which will facilitate the development of accurate and dependable AI systems.

3. Ensure Regulatory Compliance and Explainability

AI systems need to be completely transparent and accountable for their actions. By implementing explainable artificial intelligence, banks can not only fulfil their regulatory obligations but also create an environment of trust in AI and establish a sound basis for making responsible, fair, and impartial judgements.

4. Partner with Experienced AI Experts

Working with knowledgeable, experienced partners on AI system development and consultation allows banks to accelerate their implementation, lessen their risk exposure, and enable the development of a best practices-based solution that is geared specifically toward the banking and financial services industry.

Many institutions also rely on AI consulting for banking and finance to align AI initiatives with regulatory requirements and long-term business objectives.

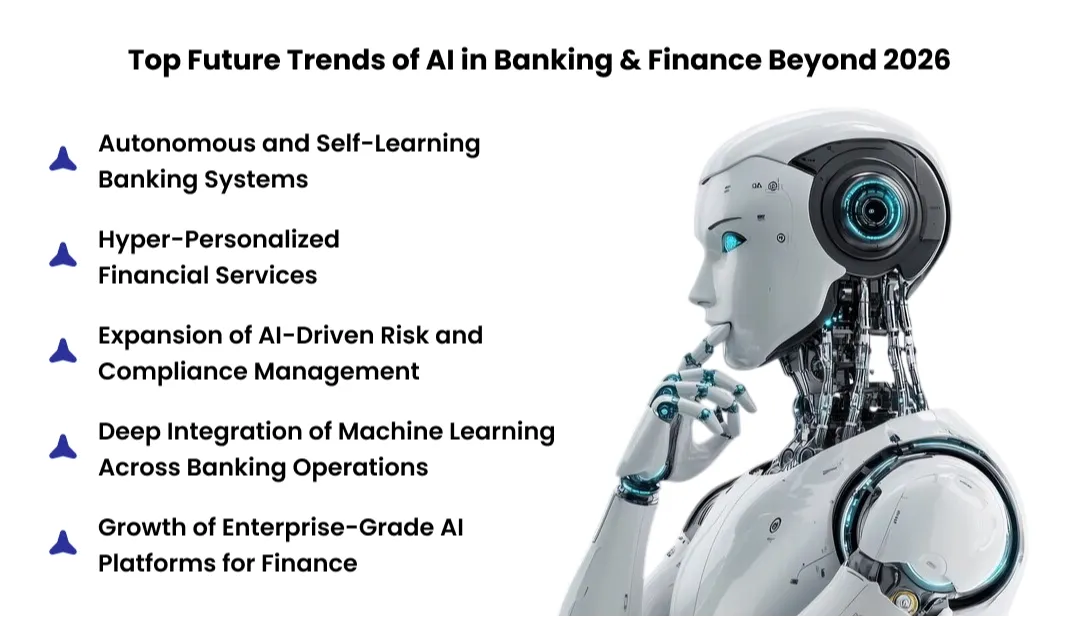

Future Trends of AI in Banking & Finance Beyond 2026

Beyond 2026, we can expect even deeper integration of AI across the financial ecosystem. The AI development company must be aware of these trends. Here are some of the key trends to watch.

1. Autonomous and Self-Learning Banking Systems

The use of AI in banking will transition toward systems that autonomously learn from real-time data, automate decision-making processes, and optimize operations with little to no human involvement within core banking functions.

2. Hyper-Personalized Financial Services

With more powerful AI models within finance, it is possible to provide real-time product recommendations as well as pricing and financial advice tailored specifically to a customer's individual needs, wants, and lifestyles based on their behaviors, goals, and life events.

3. Expansion of AI-Driven Risk and Compliance Management

Due to increased regulations, the use of Artificial Intelligence within banking will become increasingly important in predictive risk analysis, compliance monitoring, and identifying early instances of non-compliance with regulations.

4. Deep Integration of Machine Learning Across Banking Operations

Within the banking sector, machine learning will play an important role in lending, fraud detection, treasury management, and the investment process, providing predictive information to make faster, more accurate decisions and continuously improve performance.

5. Growth of Enterprise-Grade AI Platforms for Finance

Enterprise AI solutions for finance will become increasingly popular with large financial institutions as they enable the consolidation of financial-related data for storage and the deployment of AI capabilities to increase the scale and accessibility of AI solutions throughout a large, complex, and global banking and finance organisation.

As innovation accelerates, how AI is used in banking and finance will continue to evolve—shaping the future of money, trust, and financial inclusion.

How to Choose the Right AI Development Partner for Banking?

Selecting the right partner is critical for successful AI development for banking and finance. Doing so will help in a smooth functioning, avoid rework, and reduce overall costs. One wrong foot forward will lead to a negative impact on the whole development process. Here are some of the things to look at.

-

Proven experience in regulated financial environments

-

Strong data security and compliance frameworks

-

Expertise in AI solutions for banking at scale

-

Ability to deliver Custom AI solutions for financial institutions

-

Long-term support and optimization capabilities

A fintech software development company must be trusted and professional. They should meet the above-given standards.

CONCLUSION

Leading banks often collaborate with a trusted fintech software development company or specialized AI development company to accelerate innovation while minimizing risk.

By 2026, AI will have become a standard operating procedure in banking and finance and not just an asset for improved competition. Banks now employ Artificial Intelligence in their fraud prevention measures, compliance procedures, enhancement of customer experience, and revenue generation. Banks that strategically integrate AI Banking solutions, responsibly modernize, and partner with technology experts will put themselves in the best position to survive and prosper in an increasingly digital and data-driven world. The future of banking will have a heavy AI influence. It will be smart, fully automated, and centered around the customer.Artificial Intelligence in Fintech is a must, and whoever understands it early will get the competitive edge.

-

Mental Health Chatbot Development: Step-by-Step Guide

Mental Health Chatbot Development: Step-by-Step Guide

-

How AI and Chatbots Are Transforming Doctor On-Demand Apps

How AI and Chatbots Are Transforming Doctor On-Demand Apps

-

How to Build a Telehealth App Like MDLive?

How to Build a Telehealth App Like MDLive?

-

Top Truck Booking App Development Company for Logistics Businesses

Top Truck Booking App Development Company for Logistics Businesses

-

How Much Does It Cost to Hire Hybrid App Developers in 2026?

How Much Does It Cost to Hire Hybrid App Developers in 2026?

-

How Much Does Truck Booking App Development Cost in 2026?

How Much Does Truck Booking App Development Cost in 2026?

Mohit Mittal is the co-founder of a leading IT company with over a decade of experience in driving digital transformation and innovative tech solutions. With a strong background in software development, Mobile app development, E-commerce, business strategy, and team leadership, Mohit Mittal is passionate about helping businesses scale through technology. When not solving complex tech challenges, he enjoys sharing insights on emerging trends, entrepreneurship, and the future of IT.