Innovative AI Banking Solutions Shaping the Future

With AI banking solutions that automate analysis and customize customer journeys, you can unlock growth.

Progressive Banking Solutions Powered by Intelligent AI Services

Innovative AI Solutions in Banking: Quantifying Market Influence

Market Size

Cost Savings

Customer Support

Adoption Rate

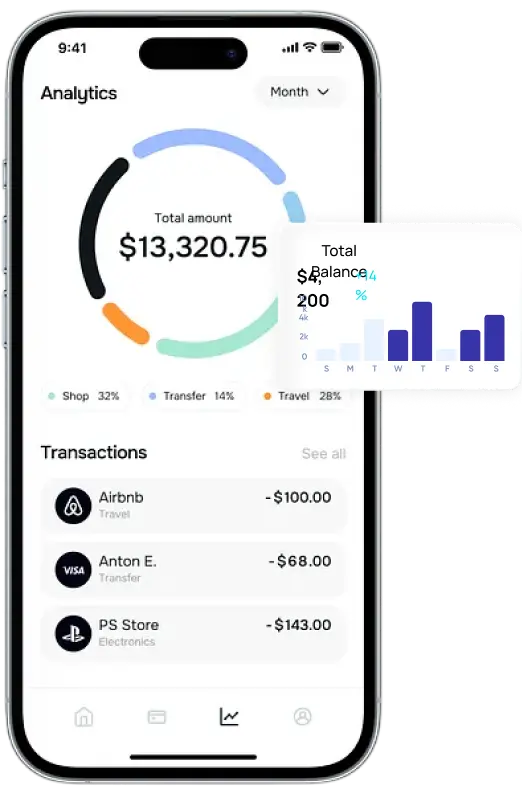

Customized AI Solutions for Banking Services to Meet Every Requirement

Innovative AI Solutions Tailored for All Your Banking Statements

Retail Banking

Private Banking

Digital Banking

Commercial Banking

Investment Banking

Microfinance

Our AI in Baking Development Process

Discover Innovative Banking Solutions Powered by Cutting-Edge Technologies

Chatgpt

Meta

Google AI

Grok

Mistral AI

Drant

Pinecone

LangChain

html5

CSS3

Angular js

React js

Vue.js

Next.js

Meteor

JavaScript

Ember

.NET

Java

Python

PHP

node js

Golang

Docker

Kubernet

Digital Ocean

Saltstack

SQL Server

Terraform

Ansible

Google Cloud

AWS

Azure

Innovative Technologies Driving the Future of AI Banking Solutions

Natural Language Processing

Predictive Analytics

Generative AI

Machine Learning Algorithms

RPA with AI

Computer Vision

Core Benefits of Artificial Intelligence in Banking

By improving customer engagement, streamlining operations, and fortifying risk and compliance frameworks across all banking services, artificial intelligence in banking creates real business value.

Why Choose IMG Global Infotech for AI Banking Software Development?

Domain-Specific Expertise

We create specialized banking AI software solutions that are in line with user expectations and financial regulations because we comprehend the banking industry.

End-to-End Development

We quickly, accurately, and transparently manage every stage of your AI banking software development, from conception to implementation.

Regulatory Compliance Ready

Legal peace of mind is ensured by the fundamental GDPR, PCI-DSS, and RBI compliance of our AI banking solutions.

Agile Delivery Process

We quickly deliver and iterate high-quality AI-driven banking solutions by using agile and DevOps methodologies.