Fintech App Development Cost: Complete Guide

Neeraj Rajput

Oct 10, 2025

When everything is going smarter, then why does the fintech industry remain behind? We know that the fintech industry is already adapting mobile app technology for types, but do you think it is worth it to invest in developing a fintech app for your business? Well, the answer is, of course. No matter which kind of app you want, like banking, stock, or Bitcoin apps, the cost may differ, but the advantage would be the same as well.

The fintech app not only offers a great range of features but also enhances the brand visibility of your business in the finance sector. It's time to stay ahead in this competition with a reliable fintech app for your business, but the main thing is, is it possible? Well, in this blog we shall discuss the fintech app development cost. We will also discuss several elements that are essential for the cost to build a fintech app in this blog, but first let's understand the types of fintech apps as well.

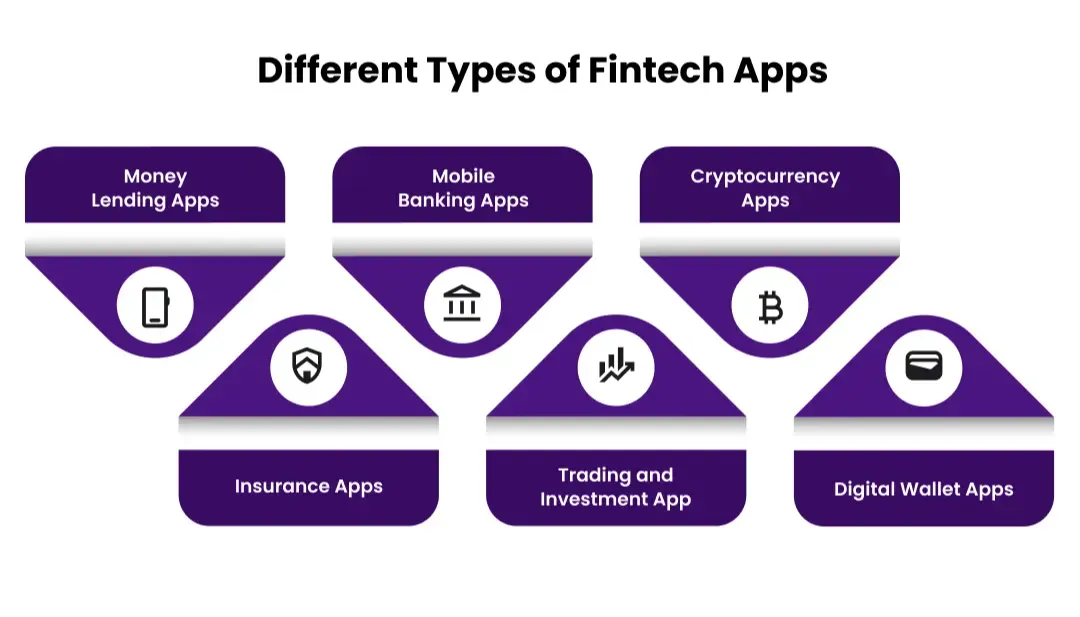

Types of Fintech Apps

Let's take a closer look at the common fintech apps for your business as well:

Money Lending Apps

Money lending apps that can connect with users who are seeking money. The repayment schemes for money lending are based on various conditions. It can also help you to examine your competitors' strategy, which is helpful for your business as well.

Mobile Banking Apps

Mobile banking apps provide complete banking assistance to the customers. From quick money transfers to expense trackers, everything will be managed by a single click through the customers in mobile banking apps. It provides convenience to customers to skip waiting in queues in the bank for any kind of service as well.

Cryptocurrency Apps

With the heavy demand of blockchain, mostly financial companies are now investing in cryptocurrency technologies to gain higher profit in their businesses. Developing a cryptocurrency app can be a game changer due to the increasing adoption of Bitcoin and other digital assets. Bitcoin apps like Relai simplify Bitcoin investing by allowing users to buy BTC directly without complex intermediaries, making cryptocurrency apps more accessible, compliant, and user-friendly for modern fintech audiences.

Insurance Apps

The digital insurance app offers InsurTech solutions, which would be integrated with modern technologies as well. These insurance apps can engage more customer in your business by offering various kinds of schemes on insurance that can also speed the commission process and also eliminate the deceptive activities as well.

Trading and Investment App

With the help of these apps, you can trade and invest straight from your phone without using brokers or other middlemen. Typically, this FinTech app operates on stocks, forex, and capital markets.

Digital Wallet Apps

A digital wallet is a phone app that enables you to send and receive money, store money online, and send money to others. Samsung Wallet is a well-known example of an eWallet app development solution.

Estimated Cost to Build Fintech Apps

The cost to develop fintech app is mainly related to several elements. It includes the set of features, app complexity, custom UI/UX, customization, development team expertise, location, size, and hourly charges. Here is an average cost breakdown to develop the fintech app development costs for your business.

Factors Affecting the Cost to Build a Fintech App

Establishing a fintech application contains numerous cost-driven variables that form the bottom line for cost factors of fintech app development.

App Difficulty

The greater the number of features on your application, the more you pay for it in Mobile app development cost. Simplified apps with basic transactions are affordable, while advanced functionalities such as AI-driven investment solutions, blockchain solutions, and real-time analytics are expensive.

Platform Suitability

It is cheaper to create a fintech application for one platform (iOS or Android) than it is for both, which makes cross-platform application-creating frameworks such as React Native or Flutter cut costs using a common codebase.

Design Complexity

It requires a simple UI/UX for user experience for a fintech app. Ready-to-use templates with general UI widgets are less expensive, but templates with captivating animation effects and custom experiences are pricier for dev time and increase expenses.

Security Measures

The The fintech apps deal with highly sensitive financial information, so security takes center stage in fintech app development cost india. Fundamentally, simple security such as data encryption and password-protected login is affordable, but multi-factor authentication, facial recognition, and AI-powered anti-fraud protection modules increase development costs tremendously.

Development Team Experience

It is the experience of your fintech programming team that is behind the expense in fintech mobile app development cost. For senior fintech programmers, compliance, security, and success go without saying, but at a higher expense than for junior programmers.

Regulatory Health Checks

The fintech solutions must conform to financial regulations such as GDPR, PCI-DSS, and KYC/AML policies, which attract additional legal and security audits at a financial expense.

Maintenance and Upgrades

Maintenance Continuous updates, bug fixes, and security support are recurring costs that keep the app running, secured, and up to industry standard in the average cost to build a fintech app.

Significant Technology Stack to Develop a Fintech App

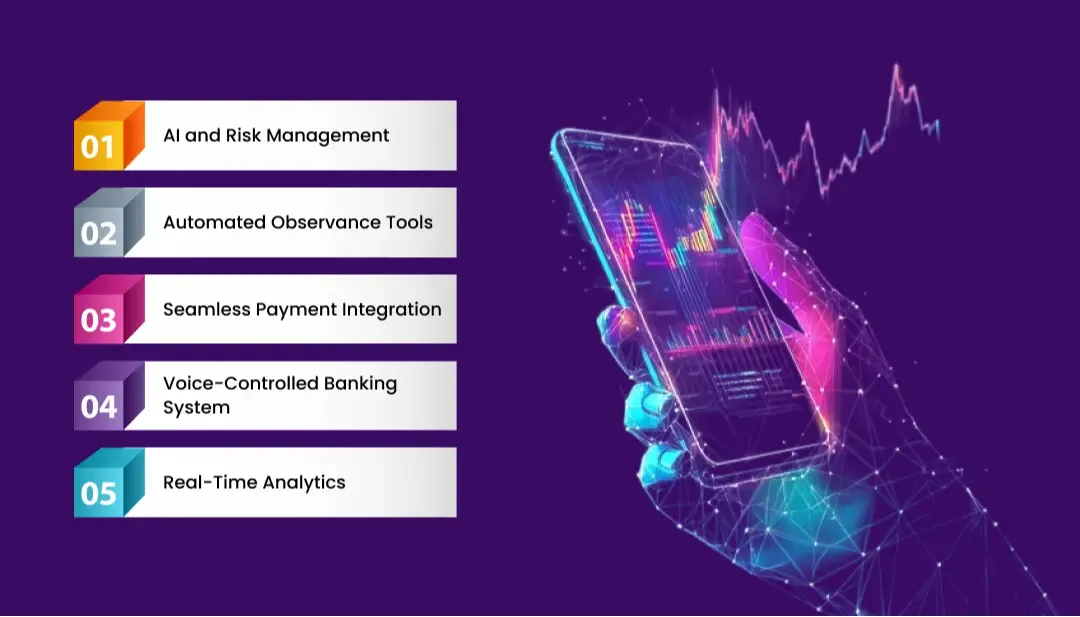

Essential Features of Fintech Apps

Using fintech apps to handle contemporary financial services has become the new standard. These solutions are quick, scalable, and safe in Cost to build app like cash app. Let's examine the essential components that each fintech app ought to have:

AI and Risk Management

There is a massive role of AI in fintech that can integrate with machine learning algorithms that can eliminate risks in your business. It can also help in detecting fraud and predicting market trends. It also offers personalized experiences, which can improve the user acquisition in your business as well.

Automated Observance Tools

Fintech software is appointed with automated compliance tools that can help businesses with financial regulations like AML and KYC. The integration of these tools is significant in that it reduces manual efforts while aligning with a better regulatory environment.

Seamless Payment Integration

Multiple payment methods are supported by secure payment processing systems found in fintech apps in app development cost for banking & finance. Digital wallets, credit/debit cards, and even cryptocurrencies are some of these ways. A seamless and safe payment environment is offered by the integration with multiple payment gateways.

Voice-Controlled Banking System

One particularly notable feature of a fintech app is voice control. It enhances user experience and security, which leads to improved functionality. The availability of multiple voice-activated virtual assistants facilitates fintech transactions for users. Providing seamless customer service is made easier by this feature.

Real-Time Analytics

Tracking investments, expenses, and other financial activities requires real-time analytics and reporting, which fintech software provides. These features support consumers' and businesses' decision-making and keep them informed.

Read Also: The Rise of Green Fintech: Powering the Future of Sustainable Finance

How to Choose the Best Fintech App Development Company

The primary nature of the development of fintech applications is collaborations with the appropriate application development company. Do your research on the crucial areas for identifying and choosing the top fintech application development company for you to work with.

List of Skills

The firm you wish to join should have experience in many app construction techniques, like programming, designing, project management, and a lot more in mobile banking app development cost.

Visiting the project list of a specific app-building firm allows you to view their experience and capabilities within app building for the financial services sector.

Certified Mobile Developers

The firm that you wish to join should have experienced application developers who have knowledge in the field and technological experience, primarily for the fintech sector in Mobile app development. To get world-class software for your own fintech company, the team ought to learn the art of developing protected, dependable, and advanced Fintech products.

Team Size

The fintech app development firm should be large enough for you to attain your business objectives. Assure the team you desire to work with is comprised of the specialists you need at various points throughout the developmental course of action, e.g., application developers, UI UX experts, project managers, marketers, and other experts needed based on what you need for the project and its needs.

App Security

An integral aspect of choosing the ideal company is considering its experience in providing a safe haven for users of fintech to Build fintech app like wise. The fintech sector needs high accuracy and security when it comes to business information and business activities.

Financial solutions help businesses improve employee performance, customer experience, and business performance by working with reliable fintech app development companies on the venture.

Risk Mitigation Strategy

Risk management is also a very crucial aspect of creating a fintech application. Financial solutions can be utilized by business entities to optimize business performance, employee efficiency, and customers when collaborating with reputable fintech application developing companies for their business.

Conclusion

Through this blog, we have discussed the fintech app development cost guide. We have also talked about several elements, like types of fintech apps, average cost, cost-influencing factors, core features, and how you can select the best fintech app development company.

As a leading Fintech app development company, we are always here to build a custom fintech app for your business. IMG Global Infotech is always here to build custom solutions for your business in terms of mobile apps, websites, and software as well.

-

How to Build a Jewelry E-commerce Website Like CaratLane?

How to Build a Jewelry E-commerce Website Like CaratLane?

-

Porter-Like Logistics App Development Cost in 2026

Porter-Like Logistics App Development Cost in 2026

-

Top AI Features Every Successful Astrology App Must Have

Top AI Features Every Successful Astrology App Must Have

-

What Are the Top Ecommerce Development Trends to Watch in 2026?

What Are the Top Ecommerce Development Trends to Watch in 2026?

-

How Much Does AI Astrology App Development Cost in 2026?

How Much Does AI Astrology App Development Cost in 2026?

-

How to Choose the Right AI Consulting Company in the USA?

How to Choose the Right AI Consulting Company in the USA?

Neeraj Rajput is the co-founder of a leading IT company with over a decade of experience in technology consulting, product development, and digital transformation. With a passion for solving complex business challenges through smart tech solutions, he shares insights on innovation, leadership, and the evolving IT landscape