The Rise Of Green Fintech: Powering The Future Of Sustainable Finance

Mohit Mittal

Oct 06, 2025

Green Fintech signifies an important change in the financial services sector where technology and sustainability intersect to achieve environmental solutions. As concern over climate change increases and ESG (Environmental, Social and Governance) objectives gain traction, financial institutions are utilizing new digital tools to leverage responsible investment, carbon accounting, and sustainable finance. Additionally, Green Fintech encompasses the use of technologies such as artificial intelligence, distributed ledger (blockchain) and big data analytics, that facilitate sustainable banking, and the development of transparent green bonds and carbon-neutral transactions.

The latest reports indicate that the global market for sustainable finance could exceed $22 trillion by 2031, indicating tremendous growth potential. From climate-smart start-ups to large financial services organizations, businesses in the financial sector are designing and executing a new approach to their current ways of doing business through the lens of sustainability.

This blog will highlight how Green Fintech is transforming the financial industry, establishing responsible investment practices, and shaping a resilient low-carbon economy.

What Is Green Finance?

Green finance encompasses financial activities and investments that benefit environmentally sustainable projects and activities. Green finance focuses on finance app solutions that address climate change, provide funding for renewable energy, reduce carbon emissions, and promote the sustainable management of resources.

Examples of green finance funding opportunities include, but are not limited to green bonds, sustainable loans, ESG investments, and climate-focused funds. By coupling financial growth with environmental responsibility, green finance seeks to enable governments and businesses to transition to a low-carbon economy. Green Fintech is pivotal in the pursuit of global sustainability objectives, advancing the modification of practices toward environmentally sustainable economic development.

Significance of Green Fintech

Now the time has come when you must know about the benefits of green finance for businesses. So are you ready? Let's get it started.

1. Stimulates Sustainable Investments

Green Fintech directs capital toward projects with environmentally-friendly practices, focusing on generation of renewable energy or clean technology, equitable sustainable infrastructures, etc. The benefits of green finance for businesses enables investors to many opportunities by fiscally aligning their investments with a sustainability/ESG strategy. which can support a broader, more global transition to a low-carbon economy.

2. Increases Financial Transparency

Fintech and green finance can offer auditing and reporting through the advancement of deploying technologies towards transparency in "green" investments, utilizing systems such as blockchain and AI. These innovations create trust for the investor and lessen the likelihood of greenwashing by reporting the effective use of funds.

3. Creates Climate-Conscious Banking

Green fintech-digital solutions inform banks and financial institutions offering products to consumers that inspire climate-conscious banking methods in the form of products like green loans, a carbon-neutral credit card, a climate savings account, etc. These types of products are meant to challenge customers to engage in eco-friendly practices both personally, and financially.

4. Creates Innovation in Financial Services

Green world fintech service supports innovation in the FS industry by merging digital and technology with sustainable practices, creating products aimed at maintaining profit while preserving purpose. Examples include carbon credit trading platforms, and AI-ESG analytics tools.

5. Drives Global Ambitions to "Green" Climate Standards

Green Fintech is charged with pursuing the UN Sustainable Development Goal's (SDG) approach, and managing investments as set forth in the Paris Accords, to initiate projects supporting reductions in the economy's carbon footprint (harmful emissions), and growing "green" sources of growth-creating jobs/employment opportunities aligned with sustainable practices. The rise of green finance strategies continue to drive alignment of the finance and economic needs with valid sustainability behavior, while assuring long-term resiliency within the economy to ensure balance (for preventative measures) existed practices, environments, and society stably.

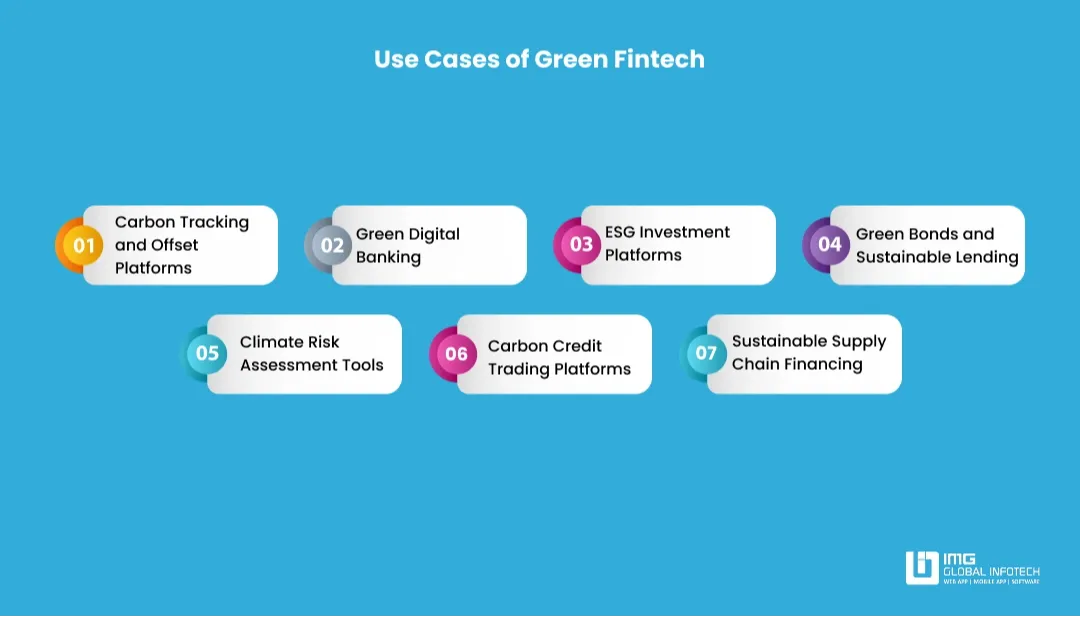

Green Fintech Use Cases

Here is the role of green finance in sustainable development that everyone should know if you want to invest in it.

1. Carbon Tracking and Offset Platforms

This is one of the major benefits of green finance for businesses assisting individuals and businesses in tracking and managing their carbon footprint in real-time. Users connect their financial information to apps that allow them to measure their emissions based on their spending and provide recommendations on how they can offset those emissions through options, like tree planting or renewable energy fuel projects. Examples are Doconomy and Almond, which enable users to use their financial information to become more sustainable in what they are spending their money on.

2. Green Digital Banking

Green digital banks, such as Aspiration and Tomorrow, are focused on eco-friendly banking, which includes products that are carbon-neutral debit cards, green loans, or investment portfolios that do not contain fossil fuel exposure. In addition to the aforementioned, these banks typically donate a portion of their profits to environmental causes, and their apps guide eco-friendly behavioral change related to economics.

3. ESG Investment Platforms

Fintech platforms, such as Clim8 and Swell, enable you to invest in companies that rate high in Environmental, Sustainability, and Governance (ESG). Role of green finance in sustainable development helps such as these request an individual to invest in companies whose operational impact is further evaluated by AI, and, whose portfolio allocations, relative to the company's impact as it adheres to ESG company performance.

4. Green Bonds and Sustainable Lending

Fintech green finance platforms utilizing block-chain technology help facilitate the issuance of green bonds and sustainability energy lending by tracking the bonds and their usage by use of technology. Green Fintech platforms also allow for having a record of green bond sales, and what happens to the funds, and allow for bots to sell bonds in both a private placement of funds investment bank as well as public sustainability-investment bank owned by government and/or public funds. Further these firms can issue a green bond in order to fund energy sustainability, waste management or sustainable infrastructure per ESG standards.

5. Climate Risk Assessment Tools

The use of advanced analytics along with AI tools helps to evaluate the risks associated with the climate that are part of financial portfolios. This information allows the investors and the institutions to uncover the possible threats that may arise due to environmental changes which, in turn, will be the reason for a smarter and more resilient financial planning that will correspond to sustainability goals.

6. Carbon Credit Trading Platforms

The blockchain-empowered market places allow for carbon credits transactions that are both secure and transparent. Such trading enables the companies to support the environment with the portion of emissions and, at the same time, set their sustainability targets. These fintech green finance become an aid to the carbon market through ensuring easy access, tracking, and high standards of integrity.

7. Sustainable Supply Chain Financing

Green Fintech is a supporter of the supply chain where it is required through the provision of loans and the issuing of incentives to the companies that choose the way of the environment as their business practice. A green finance fintech platform evaluates suppliers' eco-friendliness and credits those who contribute to the reduction of carbon footprints or utilize renewables.

Challenges in Green Finance Adoption

1. Lack of Standardization

Green finance's most significant obstacle might be the absence of globally agreed standards and definitions regarding what constitutes a "green" investment. The inconsistency in green finance standards leads to a variety of problems such as confusion among the stakeholders, difficulty in acquiring their trust and increasing the risk of greenwashing which is the practice of companies in claiming to be sustainable whilst they are not.

2. Limited Awareness and Expertise

There is a lack of knowledge and skills of green project evaluation amongst investors, businesses, and financial institutions. The shortage of professionals and of the awareness of such issues slow down the adoption process and limit decision-making that is based on knowledge.

3. Measurement and Data Issues

The true environmental impact measurement is still a big issue due to the lack of data and different reporting frameworks used. Without reliable metrics, it is very difficult to evaluate the risks, returns, and the real outcomes of sustainability.

4. The Problem of High Initial Costs

Green digital finance projects typically come with a high initial investment and long payback periods. Financial institutions may be reluctant to provide loans for these projects due to the perceived risks and lower short-term profits as compared to traditional ones.

5. Policy and Regulatory Gaps

In most areas, policies and incentives that are favorable to green finance are still in the process of being established. The absence of explicit regulatory frameworks and government support leads to less large-scale participation and slower market growth.

The Role of Emerging Technology in Green Finance

1. Artificial Intelligence (AI)

Artificial Intelligence contributes to eco-friendly financial solutions in multiple ways such as automating the data collection process for ESG, discovering new opportunities for sustainable investment, and forecasting climate risks. Additionally, AI development equips financial institutions with the ability to base their decisions on tangible data through which both the transparency and the risk management of the concerned projects are enhanced.

2. Blockchain Technology

Blockchain creates the transparency and traceability required for green finance by recording transactions such as green bonds or carbon credit trades in a secure and immutable fashion. Blockchain development also helps to lower the risk of greenwashing by providing proof that the money in question is used for genuine environmental projects.

3. Big Data Analytics

Big data offers a detailed picture of environmental performance, carbon footprints, and the risks associated with climate change. By collecting and scrutinizing various sustainability metrics, it provides for the exactness of the emission report, the reporting of the impact on nature, and the better deployment of the green capital.

4. The Internet of Things (IoT)

IoT devices continuously collect and report environmental data, for example, on the consumption of energy, emissions, and the use of resources, providing support to the sustainability assessment process and green loan validations for the projects that are eco-friendly.

5. Cloud Computing

Cloud computing is fundamentally the resource behind the renewable energy financing platforms that are both scalable and cost-effective which, in turn, makes it possible for data sharing and collaboration to be carried out on a global level. This technology is essential for ESG reporting tools and the sustainable finance marketplaces to function efficiently and to be accessible.

Conclusion

Green Fintech's adoption is one of the most potent examples of technology working hand-in-hand with sustainability as it tends to overhaul the global financial landscape. Green Fintech makes use of AI, blockchain, and big data not only to create a more transparent financial environment but also to finance projects that are eco-friendly and to undertake a responsible mode of investing. The rise of green finance of standardization and the existence of data gaps, among other problems, still linger in the background; however, it would be a mistake not to acknowledge the extent of its potential to expedite climate-related actions and to bring about the attainment of ESG objectives. Once businesses, investors, and consumers all turn towards greener financial solutions, green banking is going to find itself at the very core of building the resilient, inclusive, and low-carbon economy, therefore, it will not only be a step towards the sustainable financial future, it will actually be paving the way further on.

-

D2C Ecommerce Website: Complete Development Guide for Startups

D2C Ecommerce Website: Complete Development Guide for Startups

-

How to Build a Custom Fintech App Like Zerodha

How to Build a Custom Fintech App Like Zerodha

-

How to Start Mobile App Development in 2026

How to Start Mobile App Development in 2026

-

How Much Does It Cost to Develop Fintech App Like Revolut in 2026?

How Much Does It Cost to Develop Fintech App Like Revolut in 2026?

-

Duolingo-Like App Development: A Complete Guide

Duolingo-Like App Development: A Complete Guide

-

How Much Does It Cost to Hire Ecommerce Web Developers in India?

How Much Does It Cost to Hire Ecommerce Web Developers in India?

Mohit Mittal is the co-founder of a leading IT company with over a decade of experience in driving digital transformation and innovative tech solutions. With a strong background in software development, Mobile app development, E-commerce, business strategy, and team leadership, Mohit Mittal is passionate about helping businesses scale through technology. When not solving complex tech challenges, he enjoys sharing insights on emerging trends, entrepreneurship, and the future of IT.