Future Of Digital Gold Investment Apps: Key Trends To Watch In 2026

Neeraj Rajput

Jan 24, 2026

The price of gold is rapidly increasing day-by-day in the market. In earlier times, gold was considered precious. In today's time, when everything is evolving into digital form, why is gold also falling behind in this race and these valuable assets also being transformed into digital gold investment apps? We know that you know this statement and also you invested in various applications, but the main thing is, do you know about the upcoming trends and the future of the digital gold investment app in 2026 or further?

Well, if you don't know, no worries there; the purpose of this blog is to explore the emerging trends, benefits, and challenges of investing in a digital gold app along with the scalability of your business in the future of digital gold apps. Through this blog we will also discuss the other major topics in this guide, but first let's do a discussion on the market overview of digital gold investment apps as well.

Market Overview of Digital Gold Investment Apps

Investing in digital gold used to be something that only a few countries or a small group of investors were involved in the digital gold investment trends 2026. Now, it is quickly turning into a worldwide fintech trend that is being facilitated by digital payments, the adoption of smartphones, and the craving for gold investment alternatives that are easy and affordable.

The market for precious metals worldwide, among which gold is the major component, was worth roughly $513.3 billion in 2024, and it is anticipated to reach about $865.3 billion by 2030; thus, the market will grow at a compound annual growth rate (CAGR) of around 9.1% between 2026 and 2030. The bulk of this growth comes from the mounting investors' fascination with digital asset classes, especially when the global economy is uncertain.

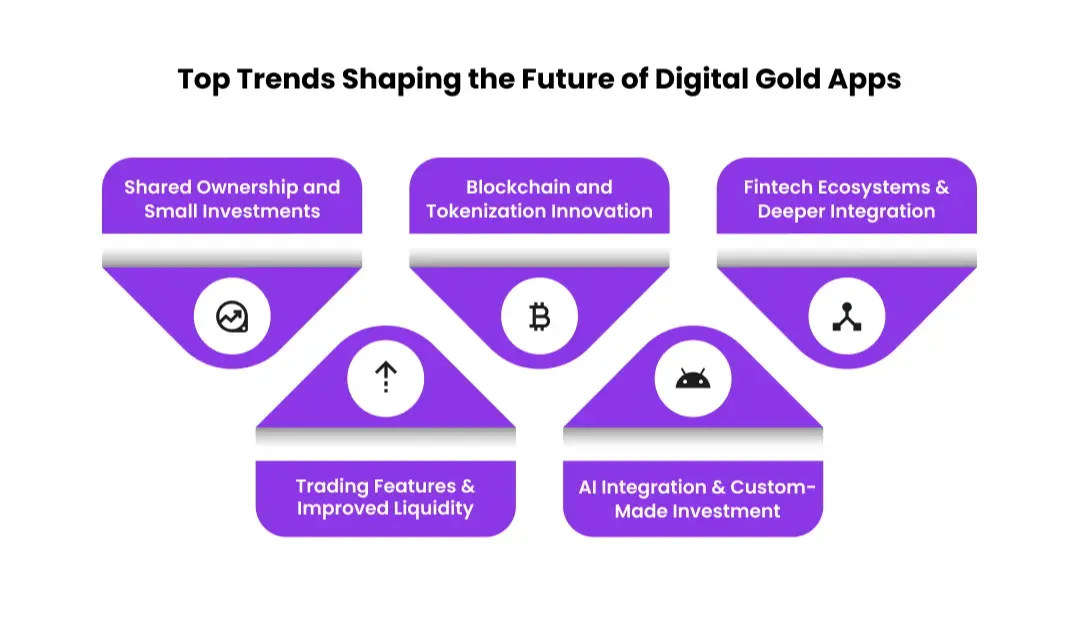

Top Trends Shaping the Future of Digital Gold Apps

As we move forward into 2026 and beyond, we are also based on several key trends that can reshape how digital gold investment apps evolve according to the market trends as well:

Shared Ownership and Small Investments

One of the most transformational trends is the capability to buy digital amounts of gold—that means investors can buy small portions of a gram instead of being forced to buy full coins or bars to find the Fintech app development cost. It mainly includes inclusivity that opens an opportunity for varying incomes to start the investment in early stages with very small amounts as well.

Blockchain and Tokenization Innovation

The emerging technology trends like blockchain and tokenization can start to play a different role than how digital gold is tracked and traded in the digital gold app development trends. The tokenization develops a verifiable digital record of ownership for a secure ledger that can help address trust and transparency issues around the storage and authenticity as well.

Fintech Ecosystems & Deeper Integration

Previously, digital gold was a single product offering. However, nowadays, it is commonly integrated within diverse fintech platforms in the gold investment platform trends. Various applications like payment apps, wealth management tools, and digital wallets are combining gold investment with other financial activities, for instance, savings plans, SIPs (Systematic Investment Plans), and payment rewards in the AI app development. This holistic approach not only makes investment easier but also turns gold into a component of daily financial exercises.

Trading Features & Improved Liquidity

As digital gold turns out to be more familiar, the main goal of apps will be to facilitate liquidity i.e. making it easy for the customer to buy and sell without a big difference between the buy and sell prices. In addition, some platforms might venture into secondary markets or introduce features whereby users can leverage their gold holdings as collateral for getting loans or as a way to other financial products.

AI Integration & Custom-Made Investment

Artificial intelligence (AI) is changing the way users decide on investments. It is estimated that future digital gold apps will use AI to give personalized advice for example, telling users the best times to buy or how much they should save based on their risk profiles and goals in AI in gold investment apps. These kinds of investment tools not only make the experience more enjoyable but also help users make smarter choices backed by data.

Challenges in Scaling Digital Gold Investment Platforms

Digital gold investment platforms confront a number of difficulties despite their quick expansion and fascinating trends:

Transparency & Verification Issues

The platforms can promise the secure vault storage, but users rarely have direct insight into where, how, or by whom the gold is held. This can create a lack of transparency that can undermine trust that uses third-party partners for differing standards. The blockchain and tokenization are reliable solutions that can be adopted and standardized as well.

Education in Misconceptions

Many investors still have misconceptions about digital gold; some see it as a risk-free way to create wealth without knowing about spreads, fees, or redemption restrictions from the Fintech app development company. Users still need to be informed that although digital gold makes access easier, it might not always provide the same returns or legal protections as other regulated gold investments (such as ETFs or Sovereign Gold Bonds).

Operational Risks in Cybersecurity

The digital platforms are basic targets for cyberattacks from hackers. A breach can be dangerous and risky for financial loss and it can also erode trust, especially for an asset like gold that is associated with security and stability in the future technology for digital gold investment app. It is important to ensure robust cybersecurity along with frequent auditing to sustain growth as well.

Regulatory Uncertainty for Investor Protection

A significant problem is that digital gold is often not subject to regulations applicable to traditional securities or commodities. Take the case of India, where the Securities and Exchange Board of India (SEBI) has on several occasions cautioned the public about the risks associated with the digital gold platforms that are not regulated in the digital gold app trends. It was based on the assumption that such products may not have the safety features for investors as well as the legal protections that usually accompany the regulated investment options.

Opportunities for Fintech Startups & Investors

Investing in digital gold is still a relatively new but exciting industry, particularly in rapidly expanding markets worldwide. Here are a few chances:

Product Innovation

Start-ups can develop novel products by merging digital gold with savings plans, insurance, gaming rewards, loyalty benefits, or even financial planning tools to examine the Cost to build gold investment app. This approach is not only user-friendly but also helpful in achieving a deeper engagement with the users.

Regulatory Partnerships

Working with regulators on the issuance of clear, unified digital gold products could well be the way to setting new industry standards. More attraction to the project might be created by the involvement of tokenized gold with clear audit trails and custodial oversight, which would bring about institutional interest and even more trust from investors.

Cross-Border and Global Expansion

A lot of the digital gold apps are catered mainly to a local audience. By providing the capability of hassle-free cross-border transactions, it would be possible for the entire world to invest in gold—users from various countries would be able to buy and sell gold digitally.

Financial Inclusion and Education Initiatives

Reaching out to newbies in investment from the neglected areas through user-friendly interfaces along with financial literacy programs can potentially increase the number of users by a large margin from digital gold investment app development companies in india. The "digital gold as part of a diversified portfolio" message can be the key to customer retention in the long run.

Why Partnering with a Gold Investment App Development Company Matters?

]Developing a digital gold investment app needs deep fintech expertise, regulatory understanding, and strong security frameworks. When you partner with an experienced gold investment app development company that can ensure faster development along with compliance readiness for a scalable, user-centric solution as well.

Proven Fintech & Domain Expertise

A company that devotes itself to the development of a dedicated gold investment application knows all about the workflows in fintech, digital gold mechanisms, vault integration, pricing APIs, and the associated compliance from Best digital gold investment apps. Their grip on the domain cuts down technical risks, sparing the company from losing money through mistakes and assuring that the setup is at par with the industry and investor expectations.

Faster Time-to-Market

Development partners with experience make use of pre-built modules, tried and tested architectures, and agile methodologies to speed up the process. The result is that you get to bring your gold investment app to the market quicker, thereby getting the chance to seize the market opportunities that come early and remaining the frontrunner in the constantly changing fintech scene.

Robust Security & Data Protection

The financial data and transactions of gold investment apps are highly sensitive and need to be well protected. A reputable development firm makes use of security measures that are at par with banks, data encryption, secure APIs, and the implementation of fraud prevention methods thus guaranteeing the trust of the users, the reliability of the platform, and the non-occurrence of threats by hackers.

Regulatory & Compliance Readiness

The digital gold platforms are required to conform to the financial regulations, KYC, AML, and data protection laws in Gold investment app features. A reliable development partner creates the app on a compliance-ready foundation, thereby making it easy for you to conform to the different regional regulations and keeping legal and operational risks to a minimum.

Scalable & Future-Ready Architecture

An establishment that is trusted to lead the development manages to network a foundation that can be expanded and supports, along with it, more users, transactions, and features. This architecture that is ready for the future opens the door for upgrades, integration with other parties, and market extension without affecting the current performance of the platform.

Ongoing Support & Technical Maintenance

Long-term technical support, performance optimization, and feature improvements are guaranteed when you work with a reputable app development company. As market trends and user expectations change, ongoing maintenance keeps your gold investment app safe, current, and competitive.

Closing Statement

Digital gold investment applications are changing the way people get to and invest in gold. The increase of these apps is a signal that convenience, low entry barriers, and mobile-first experiences are the new things the fintech world is investing in through a reliable Digital gold investment app development company. By 2026, these platforms will be experiencing further growth, thanks to the tight integration of fintech innovations and technologies and the shifting of the customer base from the large cities to the smaller towns.

Digital gold, however, faces the issues of regulation, transparency, and investor protection that need to be fixed before it can get to its full potential. Start-ups will find this area very attractive since they will be able to innovate and be part of the building process of wealth creation in the future. The investors need to be aware of the possibilities and risks since this is the only way to make the right financial decisions.

How to Choose the Best Ecommerce Website Development Company for Your Business?

How to Choose the Best Ecommerce Website Development Company for Your Business? AI in Banking & Finance: Key Use Cases, Benefits & ROI (2026)

AI in Banking & Finance: Key Use Cases, Benefits & ROI (2026) How to Choose the Right Gold Investment App Development Company?

How to Choose the Right Gold Investment App Development Company? Must-Have Features for a High-Performance Digital Gold Investment App

Must-Have Features for a High-Performance Digital Gold Investment App Top Features Every Mobile App Development Company Should Offer

Top Features Every Mobile App Development Company Should Offer

Neeraj Rajput is the co-founder of a leading IT company with over a decade of experience in technology consulting, product development, and digital transformation. With a passion for solving complex business challenges through smart tech solutions, he shares insights on innovation, leadership, and the evolving IT landscape