Must-Have Features For A High-Performance Digital Gold Investment App

Neeraj Rajput

Jan 22, 2026

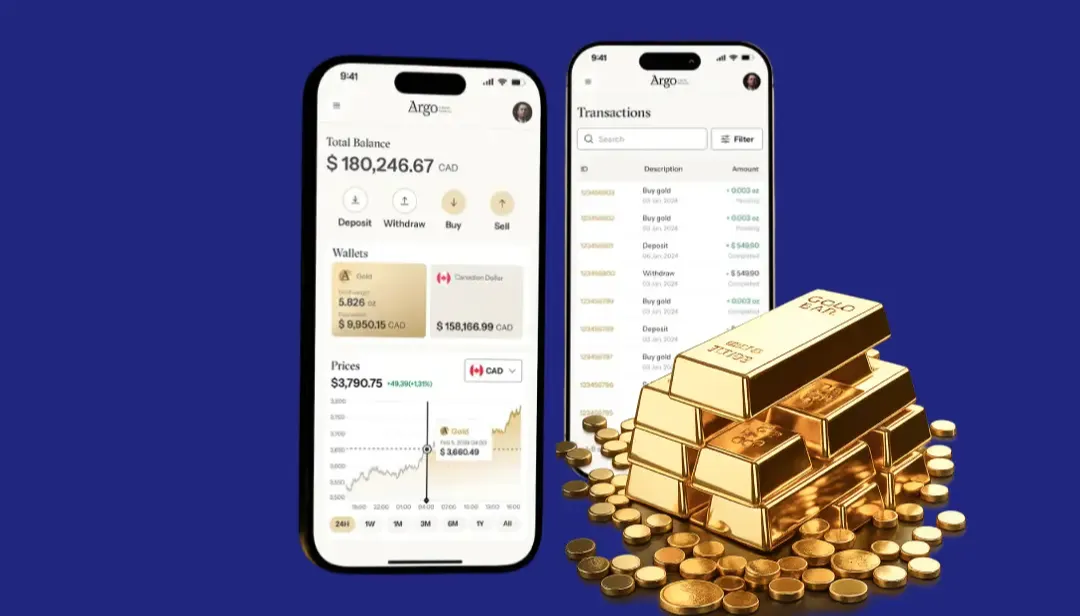

The quick adoption of fintech solutions has changed how people invest, save, and manage their money in digital gold investment app features. As a result of the various modern investment avenues, digital gold investment apps are seen as a great way to attract first-time as well as seasoned investors. Such apps give users the option to purchase, sell, keep, and monitor gold digitally without the inconveniences of physical storage, purity verification, or liquidity problems.

Due to the increase in smartphone users, growth in financial literacy, and more confidence in digital platforms, the digital gold market is growing very fast. But, when competition gets tougher, it is not enough to just launch any basic digital gold app with digital gold platform features. To be different and get users' trust, companies need to emphasize the features that not only ensure security, transparency, and a seamless user experience but also provide scalable ways of monetization.

This blog presents a list of features that are essential for a high-performance digital gold investment app for gold investment mobile app features. It not only talks about the basic features but also discusses the advanced ones, ways to monetize, and the aspects to consider when selecting a fintech development partner.

Core Features Every Digital Gold App Must Have

A reliable digital gold app mainly depends on digital gold app features. These kinds of features can ensure reliability along with regulatory compliance and smooth user onboarding as well.

1. KYC & Regulatory Compliance

Digital gold platforms must comply with Know Your Customer (KYC) regulations. Paperless KYC verification should be supported by the app, enabling users to upload documents like passports, PANs, and Aadhaar in the custom features of digital gold app. Onboarding time can be shortened and the verification process streamlined by integrating with government-approved KYC APIs.

By upholding transparency and authenticity, automated KYC guarantees regulatory compliance, stops fraud, and fosters user confidence.

2. Secure Gold Storage and Insurance

It is one of the main features of a digital gold app for secure storage. The app can clearly communicate that purchased gold is stored in insured vaults that are managed by trusted partners from a reliable Fintech app development company. The transparency can also be around vault partners, along with storage location and insurance coverage that reassures about their investment as well.

3. Secure Payment Gateway

Smooth and secure payment processing should be these apps' essential feature. These are some of the payment methods that digital gold apps must support in the gold investment app features: UPI, debit/credit cards, net banking, and digital wallets.

By integrating with trustworthy and PCI, DSS, compliant payment gateways, it is possible to ensure fast transactions, fewer failures, and a seamless user experience.

4. Redeem Digital Gold

It is core functionality for any digital gold app with the capability to buy, sell, and redeem gold flawlessly. The users can also enable the purchase of gold in small portions or even starting from minimal investment values. Real-time gold prices are also based on market rates that can ensure transparency.

On the other hand, the users should also have the option to redeem their digital gold in physical gold coins, bars, or cash that is transferred to their bank accounts as well.

5. Secure Authentication

Having a registration process that is both smooth and secure plays a crucial role in attracting and keeping users. Digital gold apps must provide consumers with different ways to get onboard, such as registering with an email, signing up with a mobile number, and logging in with a social media account to examine the Digital Gold Investment App Development Cost. In addition to that, there should be a security layer feature of OTP verification along with direct two-factor authentication (2FA) and biometric login (fingerprint or face recognition), which are all made to increase the level of security.

Secure authentication is one of the ways to secure user accounts and at the same time, it is a method of compliance with the security standards of fintech that makes the platform reliable for financial transactions.

6. Real-Time Gold Pricing Tracking

Precise and timely gold price updates are crucial for making well-informed decisions. An application should showcase current gold prices accompanied by historical charts, daily price changes, and trend indicators in Personalised digital gold investment app features. Offering live data, users are allowed to choose when to buy or sell gold, which increases their involvement and the regularity of app usage.

7. Transaction History & Portfolio Overview

It is essential for users to be able to access a detailed transaction history that keeps track of every buying, selling, or redemption activity. A well-rounded portfolio dashboard that displays total investment, current value, gains/losses, and gold quantity facilitates transparency.

Providing a clear visualization of financial data enables users to monitor their investment performance and at the same time fosters long-term trust in the platform.

8. Bank Account Linking

A supercharged digital gold app can allow users to securely link their bank accounts for seamless fund transfers that can help to Build Digital Gold Investment App for businesses. It can also provide withdrawal features that can enable users to sell their gold and receive money into their bank accounts without any kind of delay. The faster settlements can also enhance liquidity, which can also boost user confidence to make a suitable platform for every type of investor in the business as well.

9. Customer Support & Assistance

Handling user inquiries about transactions, KYC problems, redemptions, or payments requires dependable customer service. Numerous support channels, including in-app chat, email support, ticket systems, and FAQs, should be provided by the app. In fintech applications, prompt and effective customer service boosts user satisfaction, fosters trust, and dramatically increases retention rates.

10. Transparent Pricing

Transparency is one of the essential factors when it comes to gaining people's trust through a digital gold investment app. It is necessary for users to be able to see clearly before the transaction confirmation the prices of gold, the GST, the fees for the transactions, the storage charges, and the spreads in Digital Gold Investment App Development features. A transparent pricing breakdown removes confusion, lessens disagreements, and thereby increases the level of trust. Users who are clear about the charges can better compare different types of investments and make wise financial decisions free of hidden costs.

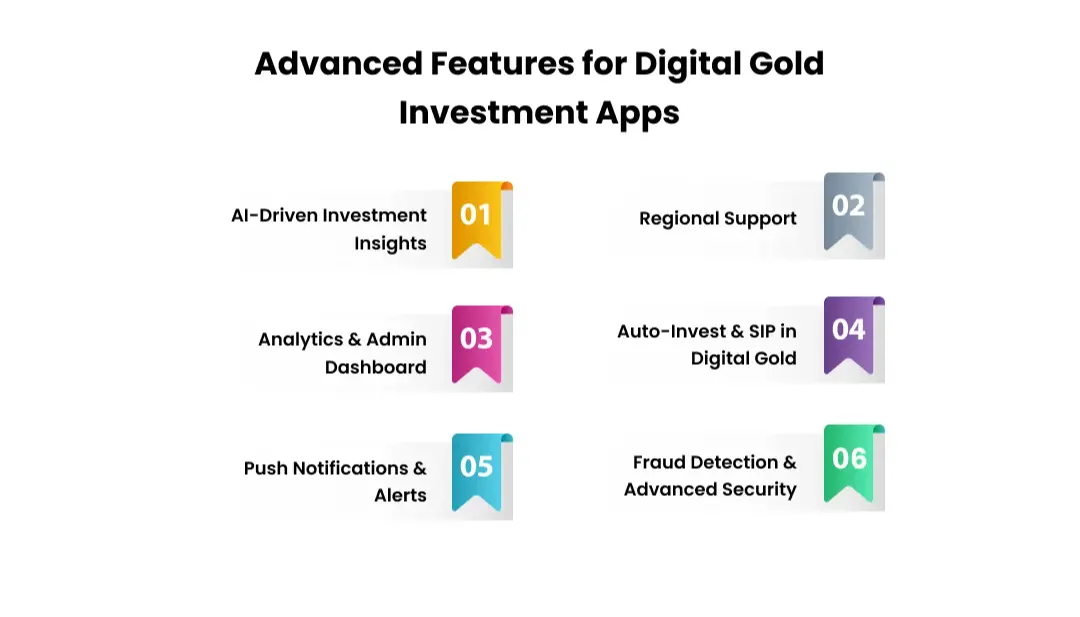

Advanced Features for a High-Performance User Experience

By providing individualized investment insights, artificial intelligence can greatly increase user engagement. In order to provide customized recommendations, AI algorithms can examine price movements, market trends, and user behavior.

AI-Driven Investment Insights

AI can significantly increase the user engagement by providing personalized investment insights for the businesses. AI algorithms can easily analyze the user behavior according to the market trends and price movements to provide the suitable recommendations. Users can make more informed investment decisions with the help of features like buy/sell alerts, price forecasts, and recommendations for portfolio optimization.

Regional Support

It is very important for catering to a diverse user base, especially in emerging markets, with multi-level language support in the gold investment app features. The app should also offer regional languages that can improve the accessibility and user adoption. The localization of content with currency formats and customer support can enhance the user comfort and market research for businesses as well.

Analytics & Admin Dashboard

For app owners to keep an eye on performance, a strong admin panel is essential. Dashboards for advanced analytics offer information on revenue, transaction volume, user behavior, and app performance. Businesses can improve operations, marketing plans, and feature upgrades with the aid of these insights.

Auto-Invest & SIP in Digital Gold

The systematic investment plans (SIPs) for the digital gold can allow users to invest a fixed amount of regular investments. The auto-invest features can be enabled by recurring purchases on a weekly or monthly basis to encourage disciplined investing from the Popular fintech apps. This kind of feature can be especially appealing to millennials and first-time investors that are especially interested in long-term wealth creation with minimal effort in the business operations as well.

Push Notifications & Alerts

Timely notifications play a crucial role in keeping users actively engaged and well-informed about their activities in the digital gold platform features. Push notifications serve various purposes, including price alerts, transaction updates, investment reminders, and promotional offers. By implementing well-thought-out notification strategies, businesses can significantly enhance user retention while ensuring that users do not feel overwhelmed by excessive alerts.

Fraud Detection & Advanced Security

High-performance apps should incorporate end-to-end encryption, real-time monitoring, and AI-driven fraud detection systems in addition to basic security. Cyber threats and unauthorized access are reduced by features like transaction-level authentication, device binding, and suspicious activity alerts.

>>>Also Read: How to Build a Fintech App Like Wise?

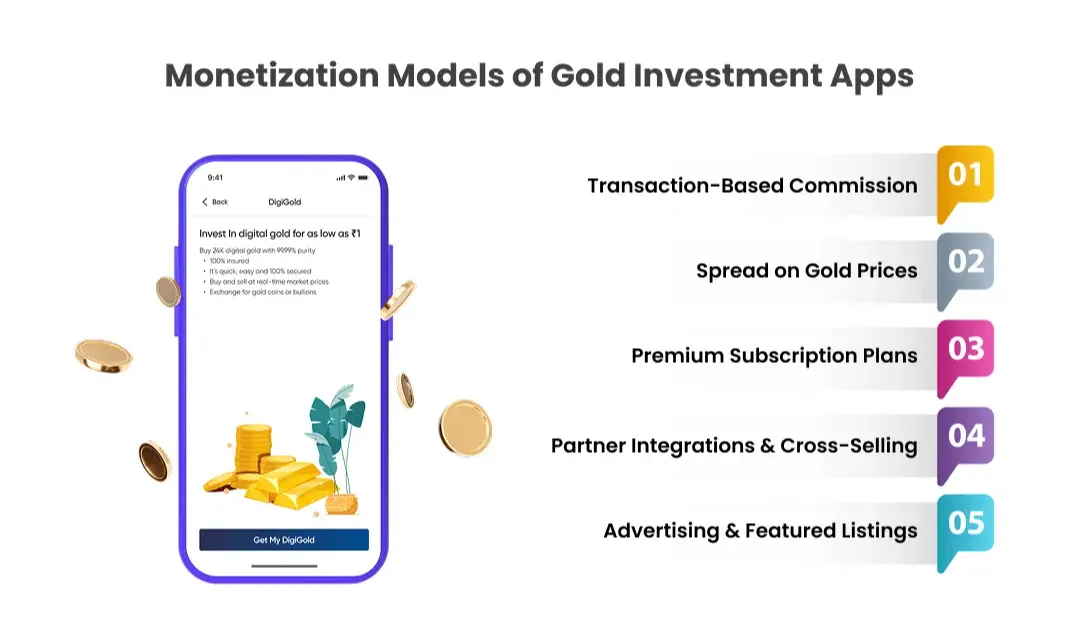

Monetization Models of Digigold Apps

The digital gold eco-sustainable app will have to be developed on a strong foundation of monetization strategy for the mobile gold trading app features. Below are the top business models that can be employed in digital gold platforms.

Transaction-Based Commission

The most popular monetization model is to charge a small fee on every buy or sell transaction. This model guarantees stable income from the growing user base.

Spread on Gold Prices

Some platforms get profit by operating a small spread between buying and selling prices. This type of model works perfectly if real-time price transparency is provided to the customers.

Premium Subscription Plans

There is the possibility of creating new revenue streams by providing premium plans with top-notch features such as AI insights, no transaction fees, prioritized customer support, or extensive analytics.

Partner Integrations & Cross-Selling

Digital gold apps can collaborate with banks, NBFCs, jewelry companies, or insurance firms. Selling related financial products like gold loans or insurance policies along with cross-selling opens up new revenue generation opportunities.

Advertising & Featured Listings

In-app advertisements that are non-intrusive and featured partner listings can also bring in some extra revenue from the AML compliance features for gold apps. Nonetheless, it is very important to strike a good balance between monetization and user experience to prevent app fatigue.

How to Choose the Right Fintech App Development Partner?

The decision about which development partner to choose is of utmost importance in the process of creating a digital gold app that is both secure and scalable.

Proven Fintech Expertise

Go for a development company that has the experience and track record in developing fintech and investment applications. Being aware of financial regulations, compliance, and security standards will then make the whole process of development go smoothly.

Strong Focus on Security & Compliance

The development partner must place data security, encryption standards, and regulatory compliance at the top of their list of concerns from the Fintech app development companies. A solid security framework not only guarantees the safety of users but also enhances the company’s credibility.

Scalable & Future-Ready Architecture

The digital gold app that performs excellently must be constructed on an architecture that is both scalable and permits future growth, as well as feature expansion and processing of a lot of transactions.

UI/UX Excellence

The user interface (UI) that is both intuitive and aesthetically pleasing will lead to increased user engagement in the Digital Gold Investment Apps. Partnering with the developer means concentrating on user-centric design, effortless navigation, and performance enhancement.

Post-Launch Support & Maintenance

Support that continues, updates that are frequent, and monitoring of performance are all parts of the long-term success of the app. It is advisable to select a partner who can provide post-launch support that is dependable.

Closing Statement

High-performance digital gold investment app development needs more than just the basic buying and selling functions. Each feature is essential to secure authentication, real-time pricing, AI-powered insights, and advanced monetization models, thus working out the user experience and the business area.

The competition in the digital gold market will be among the apps that promote security, transparency, personalization, and scalable solutions from our scalable Digital Gold Investment App Development. Companies that combine the right mix of core and cutting-edge features and collaborate with a capable fintech app development company can introduce a digital gold platform ready for the future that keeps pace with the changing user needs and provides value over the long term.

-

Mental Health Chatbot Development: Step-by-Step Guide

Mental Health Chatbot Development: Step-by-Step Guide

-

How AI and Chatbots Are Transforming Doctor On-Demand Apps

How AI and Chatbots Are Transforming Doctor On-Demand Apps

-

How to Build a Telehealth App Like MDLive?

How to Build a Telehealth App Like MDLive?

-

Top Truck Booking App Development Company for Logistics Businesses

Top Truck Booking App Development Company for Logistics Businesses

-

How Much Does It Cost to Hire Hybrid App Developers in 2026?

How Much Does It Cost to Hire Hybrid App Developers in 2026?

-

How Much Does Truck Booking App Development Cost in 2026?

How Much Does Truck Booking App Development Cost in 2026?

Neeraj Rajput is the co-founder of a leading IT company with over a decade of experience in technology consulting, product development, and digital transformation. With a passion for solving complex business challenges through smart tech solutions, he shares insights on innovation, leadership, and the evolving IT landscape