Top Fintech Apps In India In 2026

Neeraj Rajput

Feb 05, 2026

Take a moment and look around; almost everything today runs through a smartphone. From shopping and learning to managing money, mobile devices have quietly become the center of our daily lives. Banking is no exception. Financial institutions and businesses are rapidly shifting toward digital ecosystems, moving us closer to a truly cashless and connected economy.

Fintech applications are at the heart of this transformation. They’ve made payments instant, transactions more secure, and financial services more accessible than ever. Today, a single app can help users save, invest, pay bills, track expenses, and even apply for loans, putting an entire financial toolkit right in their pocket.

In this blog, we’ll explore the fintech landscape, understand different types of fintech apps, and highlight the best fintech applications to watch in 2026 all explained in clear, easy-to-follow language.

Top Fintech Apps in India in 2026

Here is the list of the top fintech apps in India in 2026 as well:

-

Chime

Chime is a kind of digital banking app that is based on a modern replacement for the traditional banks. It can also help users to save money by eliminating the extra fees and giving helpful banking features. The usage of this app is very simple for the users. Chime is trusted by millions of users for their daily banking needs as well.

Key Benefits of Chime:

- Get salary up to 2 days early

- Fee-free overdraft up to $200

- Automatic savings and round-up features

- Budgeting and spending tracking tools

- No monthly or hidden fees

-

Prism

Prism serves as an effective tool that helps users handle their bills and make payments. The application displays all your bills in a single location while it sends you notifications about upcoming due dates. This helps users avoid late fees and missed payments. Busy individuals find Prism to be an essential tool for their needs.

Top Features of Prism:

- No service or usage fees

- Bill reminders and notifications

- Secure and flexible payment options

- Easy bill tracking in one app

-

Robinhood

Robinhood is a kind of diverse investment app that is especially made for beginners who want to start investing easily. It can allow users to buy and sell their stocks without paying any extra fees and charges to examine the Fintech app development cost. This app can also provide explanations on the investment in a simple way that can help new users to feel confident while investing that's why this app is popular among young investors in the finance market as well.

Key Features of Robinhood:

- Live Market Prices and Updates

- Clean and Simple App Design

- No Commission on Stock Trading

- Buy Small Parts of Shares for Just $1

-

MoneyLion

MoneyLion is an all-in-one fintech application that provides users with complete financial management tools from a single platform. The application enables users to perform banking transactions and make investments and establish credit and access emergency funds as an best expense tracker app india. The application simplifies all financial tasks that people need to complete on a daily basis. MoneyLion serves users who require multiple financial services through one application.

Key Features of MoneyLion:

- Cash advance up to $250 with no fees

- Credit score tracking and improvement tools

- No monthly account maintenance fees

- Automated investing and budgeting tools

- Easy-to-use mobile banking

-

Finch

Finch operates as an intelligent financial technology application that connects both banking services and investment capabilities. The system invests your account funds automatically while providing you with full access to your money at any time. Your funds continue to grow because they remain accessible for your use. Finch provides users with an easy-to-use platform that enables them to work flexibly.

Key Features of Finch:

- No minimum balance required

- Free direct deposits and payments

- Instant access to funds

- The entire balance is automatically invested

- Personalized investment suggestions

-

Coinbase

Coinbase is a well-known app for purchasing and selling cryptocurrency. It is easy to use, even for beginners. This app also focuses on safety and education that can help users understand the digital money. Coinbase has a worldwide user base in the fintech market as well.

Top Features of Coinbase:

- Learning videos with rewards

- Buy and sell over 100 cryptocurrencies

- Easy tax and transaction tracking

- Strong security and insurance protection

-

Acorns

Acorns functions as an investment application that enables users to automatically invest their spare change through their daily purchases for the Best fintech apps in dubai. The application selects Acorns users' daily expenses and uses the remaining balance to create investments. The platform provides beginners with a straightforward method to start investing. Acorns enables users to grow their funds through automated processes that require minimal user effort.

Why Acrons is Helpful:

- No-fee checking account

- Easy learning resources

- Automatic spare-change investing

- Cashback from partner stores

- Ready-made investment portfolios

-

EveryDollar

EveryDollar serves as a budgeting application that assists users in managing their monthly financial expenditures. The application enables users to create budgets through its monthly expense tracking feature from the best finance app in india. The application promotes positive financial behavior while teaching users effective methods of saving money. The solution works well for both family units and individual users.

Main Benefits of EveryDollar:

- Goal tracking for savings or debt

- Helpful financial learning tools

- Simple monthly budget creation

- Clear expense categories

-

CRED

CRED is a premium fintech application that rewards credit card users through its system of granting rewards for their timely bill payments. The application provides users with a unified solution that includes payment processing, rewards systems, credit access, and financial management tools. CRED provides its services to users who demonstrate financial responsibility through their short-term credit features and exclusive brand offers and rent payment options.

Key Benefits of CRED:

- Track Multiple Credit Cards in one place

- Improves financial discipline and credit awareness

- Rewards and cashback for paying credit card banks

- Premium brand deals and exclusive experiences

- Access to short-term credit and personal loans

-

Paisabazaar

The Paisabazaar application serves as a primary financial marketplace application that enables users to compare and apply for various loan, credit card, and insurance products. The website offers users complimentary credit score assessment services together with customized financial advice from the best app for monthly budget india. The platform enables users to make borrowing decisions through its clear product comparisons, which assist them in selecting their ideal financial solutions.

Key Benefits of Paisabazaar:

- Free credit score and credit report access

- Personalized financial product recommendations

- Transparent comparison of interest rates and fees

- Easy online application process

- Compare multiple loan and credit card options

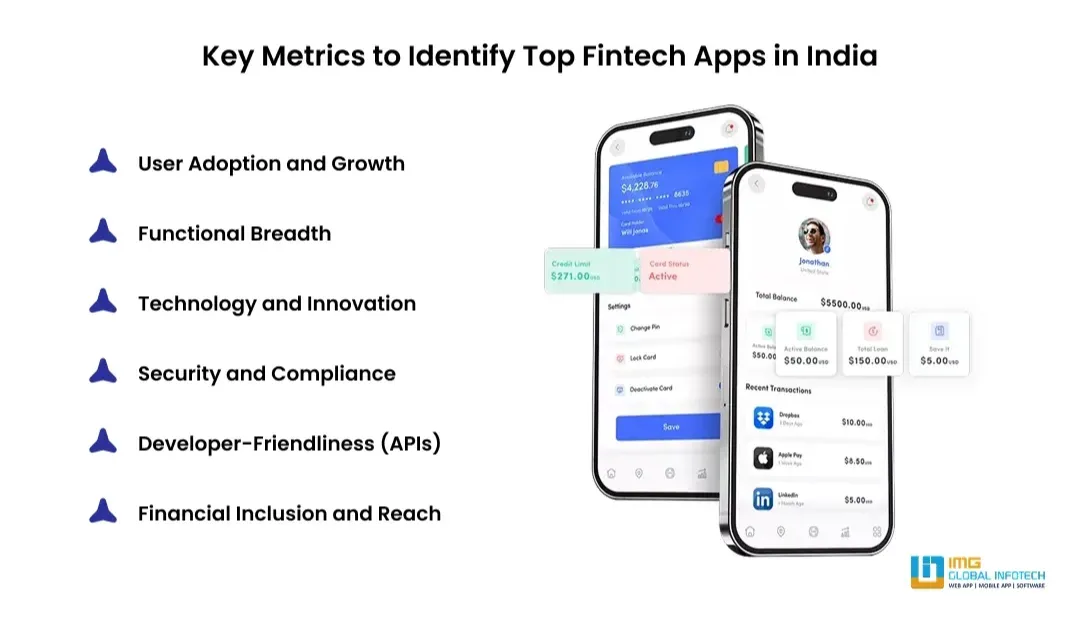

Key Criteria for Ranking the Top Fintech Apps in India

The top fintech applications in India for 2026 will be evaluated through these specific assessment criteria.

User Adoption and Growth

Applications that reach extensive user bases while maintaining active user growth throughout different regions demonstrate their strong market presence.

Functional Breadth

The top applications deliver multiple services to users, which include fundamental payment functions and money transfer services together with credit and investment and business tool capabilities.

Technology and Innovation

The combination of artificial intelligence for personal finance analysis and machine learning for fraud detection, together with open application programming interfaces, enables organizations to provide customers exceptional user experiences.

Security and Compliance

The organization maintains its credibility through strict compliance with data protection standards, which include RBI regulations and continuous risk assessment procedures to hire fintech app developers. The financial sector needs this compliance because it handles highly confidential customer information.

Developer-Friendliness (APIs)

The platform provides developers with comprehensive API documentation and integration capabilities, which allow them to build partnerships with other developers. This leads to increased platform usage, which extends beyond regular consumer access.

Financial Inclusion and Reach

The applications that help people in remote areas and small business owners and first-time investors establish their entry into the financial system will help India expand its digital banking services.

How Startups Can Build a Successful Fintech App in India

The creation of a successful fintech application in India needs more than just an innovative concept because it requires both strategic development and thorough market analysis and top-notch technological capabilities. Here’s a step-by-step guide for startups:

Identify a Specific Problem or Use Case

The process requires identification of user difficulties, which include both complex loan processing methods and unclear credit information and scattered investment platforms. Apps that solve real financial problems win loyal users.

Conduct Market Research & Competitive Analysis

The study should include an assessment of current products together with their required regulatory standards and user interaction patterns. The research should determine which product elements competitors have failed to develop.

Prioritize Regulatory Compliance

Fintech applications in India need to follow RBI rules together with NPCI regulations and SEBI guidelines, which include KYC and AML and data protection requirements to Build a fintech app like wise. Compliance investment from the beginning decreases legal exposure.

Choose the Right Tech Stack

Sound fintech applications require a secure backend system that includes encrypted data protection and expandable cloud computing resources and UPI rail and payment gateway and API system connections.

Design with User Experience in Mind

The process requires simple user onboarding together with easy system navigation and immediate customer support and language support, which is essential for users in India who speak different languages.

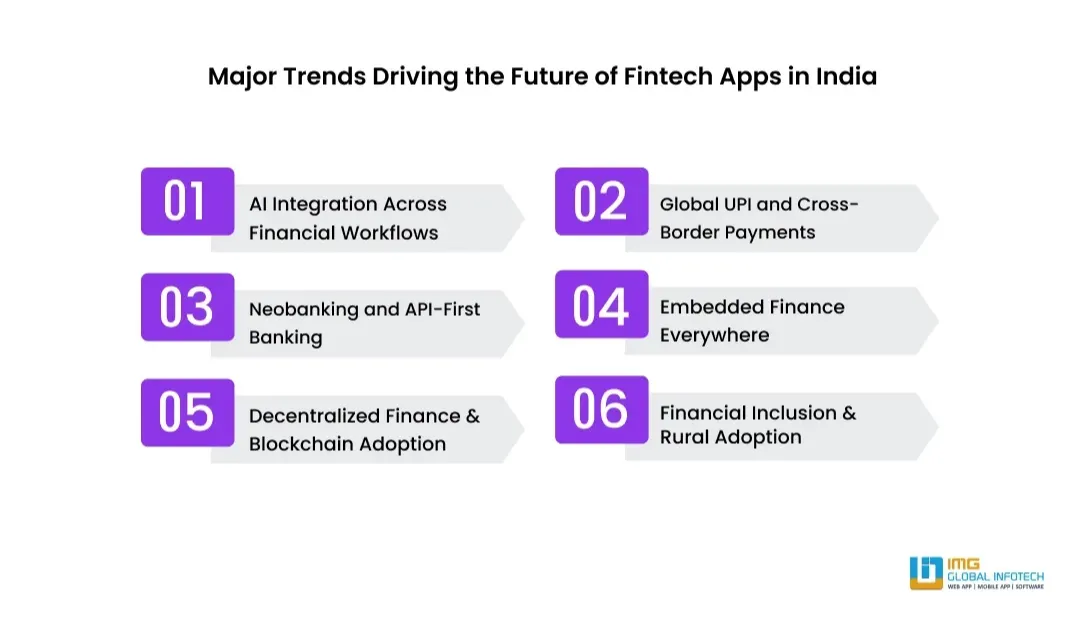

Key Trends Shaping Fintech Apps in India (2026)

The fintech industry in India will experience major changes because of crucial trends that will shape its development.

AI Integration Across Financial Workflows

The application of artificial intelligence technology enables financial applications to provide customized financial planning, detect fraudulent activities, offer intelligent customer support solutions, and deliver predictive analytical capabilities, which enhance application performance.

Global UPI and Cross-Border Payments

UPI, which functions as India's real-time payment system, has developed into an international payment system that enables users to make cross-border transactions to find out the cost to Build personal finance app like Mint and tourist payments through its worldwide payment network.

Neobanking and API-First Banking

Digital-only banks that provide no-cost accounts and fast credit assessments together with customized financial dashboards have become popular among Generation Z and millennial customers.

Embedded Finance Everywhere

Fintech functions, including payment solutions and credit services and digital wallets and insurance products, now operate within non-financial applications that run on shopping and delivery platforms.

Decentralized Finance & Blockchain Adoption

Organizations increasingly adopt blockchain technology because it enables them to use blockchain-based payment networks and smart contract systems for their international transactions and transparent financial record-keeping.

Financial Inclusion & Rural Adoption

The UPI system now enables digital finance access through its localized solutions, which provide support in local languages while using minimal internet resources to serve rural communities and residents of tier-2 and tier-3 cities.

Why Choose IMG Global Infotech for Fintech App Development?

The development partner selection process works as the key factor that determines success in the competitive market to examine the Cost to build a fintech app like cleo. IMG Global Infotech provides financial technology startups and established organizations with services that help them create high-quality financial applications.

Deep Industry Expertise

IMG builds compliant solutions that meet future requirements through its comprehension of India’s financial ecosystem, user behavior, and regulatory framework.

End-to-End Fintech Development

IMG delivers complete development services, which include all aspects of fintech development from ideation through UI/UX design to backend systems development and API testing and implementation.

Cutting-Edge Technology Stack

IMG develops secure, scalable applications by using their expertise in artificial intelligence, machine learning, blockchain technology, cloud computing, secure data encryption, and live data processing.

Compliance-First Mindset

The development frameworks of IMG integrated existing RBI and NPCI regulations together with privacy protocols and authentication methods to streamline compliance procedures.

Focus on Customisation & User Experience

IMG develops customized solutions that enable businesses to create authentic user experiences that drive customer loyalty.

Proven Track Record

IMG generates quantifiable results through its successful development of fintech applications across multiple industries, which include payments, lending, banking, wealth management, insurance, and super applications.

Final Words

The fintech ecosystem of India reached its most inclusive and dynamic state during its 2026 development. The ecosystem extends its growth through UPI super apps which include EveryDollar and Coinbase together with business fintech leaders MoneyLion and credit innovators CRED and wealth management platforms Robinhood and Paisabazaar by our leading Fintech app development company. The future of fintech applications in India shows great potential because of rising AI technologies and global UPI projects and embedded finance solutions and neobanking systems.

The creation of a secure and compliant user-focused fintech application stands as an essential requirement for startups and enterprises which seek to benefit from this market opportunity. Your go-to-market strategy and product success will improve when you select IMG Global Infotech as your development partner.

-

Top 10 Logistics Software Development Companies to Hire in 2026

Top 10 Logistics Software Development Companies to Hire in 2026

-

Top Fintech Trends to Accelerate Business in 2026

Top Fintech Trends to Accelerate Business in 2026

-

Cost to Develop a Logistics App in 2026: A Step-by-Step Budget Guide

Cost to Develop a Logistics App in 2026: A Step-by-Step Budget Guide

-

How to Build an App like Empower: A Complete Guide

How to Build an App like Empower: A Complete Guide

-

How to Create a Home Service App Like Mr. Right?

How to Create a Home Service App Like Mr. Right?

-

How Much Does it Cost to Build a Fintech App like Cleo?

How Much Does it Cost to Build a Fintech App like Cleo?

Neeraj Rajput is the co-founder of a leading IT company with over a decade of experience in technology consulting, product development, and digital transformation. With a passion for solving complex business challenges through smart tech solutions, he shares insights on innovation, leadership, and the evolving IT landscape