Thinking Of Building A Fintech App? A Complete Guide To Features, Costs, And Success

Mohit Mittal

Feb 06, 2026

You have visited your local bank and are standing in a queue, waiting eagerly for your chance. This is the scene that used to be created in traditional times.

You unlock your phone. You pay a bill. You invest spare change. You send money across the world—without stepping inside a bank or speaking to a human. Welcome to the era where finance lives in your pocket.

Don’t you think Fintech has improved banking? If you think like that. You are partially right. And for the rest, you have to understand that it has just not improved; it has quietly replaced it. And here’s the catch: the next big fintech breakthrough probably isn’t coming from a bank. It’s coming from builders like YOU.

Keep in mind that developing a fintech application involves more than creating an attractive user interface and enabling quick payment processes.

This comprehensive guide will help you understand the process of building successful fintech apps by providing an overview of the different components that make up the fintech landscape, tips on creating and implementing key features, estimating total development costs, navigating regulations, and utilizing cutting-edge technologies.

If you are serious about creating a successful fintech application from your innovative idea, you have arrived at the right place; let’s create the future of finance together.

What Is the Fintech App Ecosystem, and Why Does It Matter?

Before building anything, shouldn’t people understand the ecosystem? Fintech isn’t just an app—it’s a whole network. The fintech app ecosystem has many stakeholders, such as users, financial institutions, APIs, third-party services, regulators, and technology, that work together. A developer must consider several things when developing a fintech app: secure data flow, real-time transaction capability, compliance with rules and regulations, and a seamless user experience.

Within the fintech app ecosystem, there are five main components: payment, lending, insurance, investment, and personal finance management. Failure to consider one component may result in a loss of customer trust or, even worse, result in noncompliance.

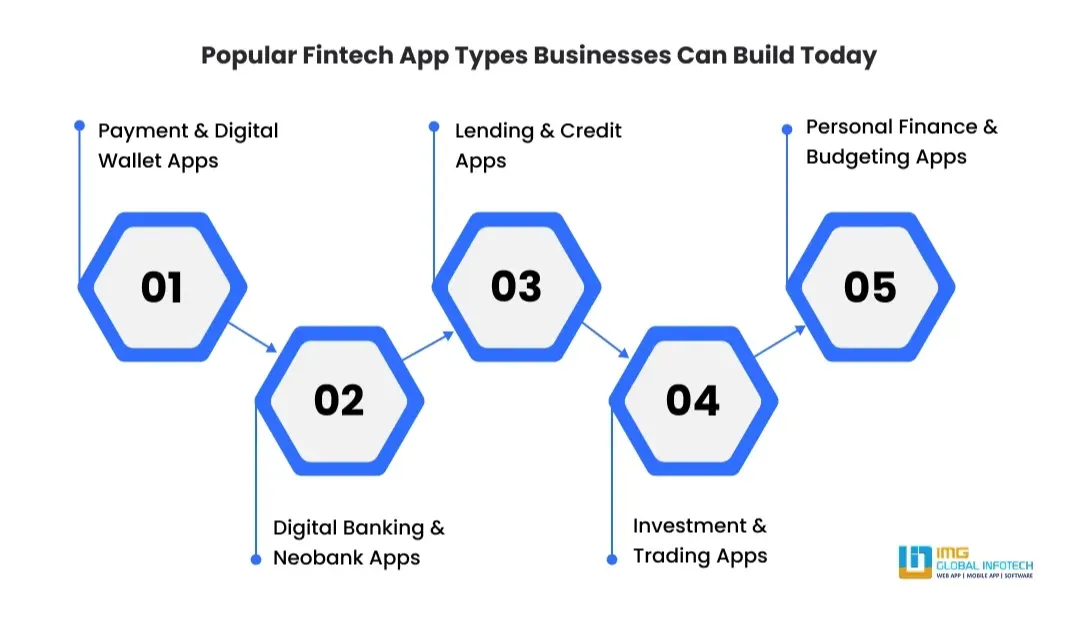

What Types of Fintech Apps Can You Build Today?

Fintech sounds broad. What kinds of apps are we talking about? A lot more than people think. We are talking about apps like Wise or Cleo. Build a fintech app like Wise if you also want to disrupt the market.

-

Payment & Digital Wallet Apps

Instantly managing money has become possible thanks to the many new apps available today. No need for cash or credit cards, smartphone wallets make the old ways of doing business feel outmoded.

-

Digital Banking & Neobank Apps

Neobanks or digital banks offer complete banking services without a physical branch. You can sign up quickly using the app to access smarter insights, lower fees, and take complete control of your finances at any time or place.

-

Lending & Credit Apps

Lending apps offer fast and easy borrowing services, including instant loans, instant credit scores, and flexible repayment terms. They enable fast money access without dealing with the hassle of traditional banks.

-

Investment & Trading Apps

Investing is also rapidly evolving. Today’s investing apps provide users with a simple way to buy and sell stocks, cryptocurrency, and mutual funds, using live pricing and market data, and include tools for beginners.

-

Personal Finance & Budgeting Apps

Personal finance apps help users better understand where they are spending their money, help establish savings goals, and help users learn about habits regarding money. They will act as an intelligent financial coach for you to have in your pocket.

Many of the Best fintech apps today combine multiple services into one powerful platform.

What Are the Key Features Every Fintech App Must Have?

Features make or break an app, right? Especially in finance, users expect perfection.

When you create a fintech app, certain features are non-negotiable. Some of them are given below.

-

Advanced Security & Data Encryption

User Data is protected via security features to keep it safe from hackers. Fraudulent customers don't want to have their finances protected with poor security and passwords.

-

Seamless User Onboarding & KYC

Online Digital Verification (KYC) creates a better customer experience. Verification is simple, fast, and doesn't require paperwork, long wait times at banks, or boring repetitive forms.

-

Real-Time Transactions & Notifications

Customers receive notifications per transaction in real-time with smart alerts. When a transaction is completed, or an update on how much money is left in the bank, customers do not have to wait around, which is frustrating and no longer acceptable.

-

Intuitive Dashboard & User Experience

Customers will have one simple user interface to manage their finances quickly, including tracking all transactions and managing their finances without dreading it.

-

AI-Powered Insights & Smart Automation

The app uses Artificial Intelligence to monitor spending behaviors, detect fraud, and offer Individual Customer Financial Recommendations. The app becomes a personal financial assistant for customers to rely on.

Modern apps also integrate AI in finance to offer smart recommendations, detect fraud patterns, and personalize user experiences.

How to Build a Fintech App That Users Actually Trust?

So, how does one go from idea to app? Here’s a simplified roadmap for building a fintech app successfully.

-

Market Research & Idea Validation

Achieving user trust requires understanding real user pain points, studying competitors, and validating your ideas early—solving real problems helps establish a trusted foundation on which future trust can be built.

-

Define App Type & Core Features

Once you have established the app's core purpose, you need to avoid going overboard with features; keep the app focused and simple so that users will have confidence in it.

-

Choose a Secure Tech Stack

Reliable technology is critical for Fintech apps since they must be invented to handle growth without causing any crashes, data breaches, or latency issues.

-

Design a Clean & Intuitive UX/UI

A user-friendly, minimalist interface will give them more trust in using the app to manage their money without confusion and frustration or having to learn how to use it.

-

Integrate Trusted APIs & Services

Integrating payment gateways, banking APIs, and third-party services that are verified is a must to ensure smooth transaction processes; the fast and accurate flow of data, and reliable, efficient functioning of your financial services.

-

Implement Compliance & Security Testing

Users want to be able to trust apps that will keep their data secure and compliant with regulatory guidelines. Therefore, conducting regular security audits and conducting rigorous testing will help users to feel comfortable using the app.

-

Launch, Monitor & Improve Continuously

When post-launch monitoring, updating, and improving the app show a continued commitment from you to your users, it is also important. The act of continuous improvement will help build users' trust in your app.

To build a compliant fintech app, compliance must be baked into the process—not added later.

How Much Does It Cost to Build a Fintech App?

Let’s talk about money—what’s the budget range? That depends on features, security, and scale. The cost to build a fintech app varies widely. A basic app may cost less, while enterprise-grade platforms cost significantly more.

1. Basic App Cost

The basic app costs $5,000 to $8,000. It is an ideal choice for small businesses with tight budgets. It is budget-friendly and can be helpful for startups looking for an MVP.

2. Mid-Level App Cost

A mid-level Fintech app development cost ranges from $10,000 to $15,000. It is something that growing businesses should look at. If they have a basic platform and are looking for expansion, going for a mid-level app could be a game-changer for them.

3. Advanced-Level App Cost

An advanced-level app cost range starts from $15,000 and can go upwards, depending on your requirements. It is an ideal choice for big businesses that operate with full automation.

Factors influencing the cost of building a fintech app include:

- App complexity and features

- Security and compliance requirements

- Third-party API integrations

- Development team location

- Maintenance and updates

On average, the cost to build fintech app solutions can range from startup-friendly MVPs to enterprise investments. Businesses often compare benchmarks like Cost to build a fintech app like Cleo to estimate budgets.

How Long Does It Take to Build a Fintech App?

Is this a quick project or a long-term one? Definitely a marathon, not a sprint.

The answer to how long does it take to build a fintech app depends on the scope. A basic MVP may take 4 to 5 weeks, while a full-scale solution can take much longer. An advanced app might take 8 to 12 weeks, while a mid-level app takes 5 to 8 weeks.

When building mobile apps for fintech, time is spent on security audits, compliance testing, and performance optimization—steps that can’t be rushed.

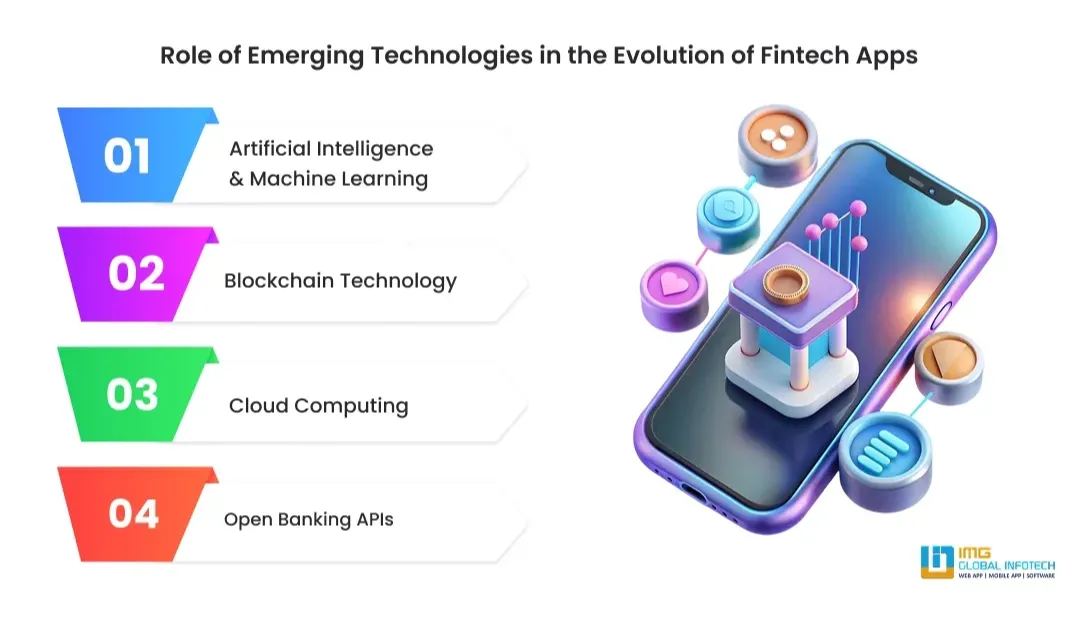

How Are Emerging Technologies Transforming Fintech Apps?

Fintech keeps evolving—what’s driving that change? Emerging tech is rewriting the rules.

Technologies reshaping fintech include:

-

Artificial Intelligence & Machine Learning

AI observes and tracks how users spend their money without their knowledge, detects fraud before consumers feel stressed, and gives users intelligent money tips. AI is essentially like an invisible brain to assist consumers financially.

-

Blockchain Technology

Blockchain shows how each transaction has occurred, is kept in a digital vault with full transparency for all users, and is completely safe and secure against any type of tampering/theft through user verification.

-

Cloud Computing

Cloud technology has created an opportunity for fintech applications to scale rapidly and automatically when they experience unexpected spikes in traffic, while maintaining rapid access to data and ongoing security, regardless of location.

-

Open Banking APIs

Open banking creates an avenue for applications that want to access bank accounts using friendly connectors, so that applications can better serve customers without forcing them to use multiple different platforms.

Companies aiming to develop a fintech app today must future-proof it with these technologies in mind.

Why Should Businesses Work With IMG Global Infotech for Fintech Apps?

Can’t companies just build in-house? They can—but experience saves time and money.

Working with a Fintech app development company that specializes in developing fintech applications like IMG Global Infotech means quicker delivery, adherence to government regulations, and a scalable solution in architecture.

They have experience in all areas of the project process from strategy to design to program creation to test and release to market. Many businesses seeking to hire fintech app developers will select IMG Global Infotech because they will provide them with secure, high-performing solutions and have a transparent price table for their fintech app development cost.

Why choose IMG Global Infotech:-

- Proven expertise in fintech app development

- Strong focus on security and regulatory compliance

- Experienced and dedicated fintech developers

- Scalable, future-ready app architectures

- Transparent pricing and flexible engagement models

- End-to-end development and support services

- On-time delivery with an agile development approach

- Integration-ready solutions with emerging technologies

- Client-centric communication and collaboration

Conclusion: Is Building a Fintech App Worth It in 2026 and Beyond?

So, final verdict—should businesses do it? If done right, absolutely.

Creating a fintech app is more than just writing code and creating a new digital product. It’s creating trust in an era where money is very personal to people. Fintech apps that do well have a sense of being invisible yet strong, complicated yet effortless, and secure yet not intimidating. If done right, they not only execute transactions.

These Fintech apps also integrate with your life — from daily routines to budgeting late at night, and for making large decisions in life.

The true magic happens when thoughtful design, smart technology, and secure systems all come together with a defined purpose. At that point, a fintech application will change from being just an application to being an ongoing source of financial support for users that they can't live without.

As the world of digital money continues to grow, there will be winners who create with empathy, innovation, and long-term vision because in the fintech world, trust is not gained in a day, but if obtained, it will always pay off over time. Hire fintech app developers who will help you achieve your goals.

-

Top 10 Logistics Software Development Companies to Hire in 2026

Top 10 Logistics Software Development Companies to Hire in 2026

-

Top Fintech Apps in India in 2026

Top Fintech Apps in India in 2026

-

Top Fintech Trends to Accelerate Business in 2026

Top Fintech Trends to Accelerate Business in 2026

-

Cost to Develop a Logistics App in 2026: A Step-by-Step Budget Guide

Cost to Develop a Logistics App in 2026: A Step-by-Step Budget Guide

-

How to Build an App like Empower: A Complete Guide

How to Build an App like Empower: A Complete Guide

-

How to Create a Home Service App Like Mr. Right?

How to Create a Home Service App Like Mr. Right?

Mohit Mittal is the co-founder of a leading IT company with over a decade of experience in driving digital transformation and innovative tech solutions. With a strong background in software development, Mobile app development, E-commerce, business strategy, and team leadership, Mohit Mittal is passionate about helping businesses scale through technology. When not solving complex tech challenges, he enjoys sharing insights on emerging trends, entrepreneurship, and the future of IT.