Step-by-Step Guide To Developing An App Like STC Pay

Mohit Mittal

Feb 09, 2026

Just imagine this scene: A user will open an app and link their bank account in just 30 seconds and send money worldwide—no fees, no delays. Literally sounds terrifying!!!

That's the STC Pay experience—to do any transaction seamlessly. Now here is a question for you: Can you develop something crazier in 2026?

It's a very clear thing that the fintech landscape has dynamited. Let me explain to you in simple terms: PayPal has revolutionized online payments, and similarly, Stripe has simplified merchant solutions in the app like STC Pay. Now the similar apps like STC Pay can redefine the scope of digital wallets and peer-to-peer transfers.

This guide divides the journey into several critical phases of STC Pay app development: foundation and planning, technology stack selection, regulatory navigation, feature development, and market launch.

Each phase includes real-world examples, pitfalls to avoid, and actionable steps. Let's look at what differentiates successful fintech founders from those who fail.

What is STC Pay and Why Is It So Popular?

STC Pay is an e-wallet and instant money transfer app brought to you by Saudi Telecom Company. The STC Pay app for fintech enables customers to carry out peer-to-peer money transfers, utility bill payments, telephone top-ups, and shopping payments through their smartphones both online and at physical stores.

Besides that, it is a handy and safe method for people to keep track of their money as well as perform banking transactions online to build an app like STC Pay. Therefore, in case you intend to develop a wallet app similar to STC Pay, consulting and hiring a mobile banking development company might be the best idea.

Market Opportunity for STC Pay–Like Apps in 2026

As per the report of Fortune Business Insights, the global mobile wallet market size was valued at $238.26 billion in 2025, and it is projected to be $784.67 billion by 2032 with a CAGR of 18.56% during the forecast period of 2026 to 2032.

Key Market Trends & Insights:

- Latin America is expected to register a significant CAGR of 28.6% over the forecast period.

- By technology, the proximity segment accounted for the largest share of 62.6% in 2025.

- Asia Pacific dominated the mobile wallet market in 2026 with a share of 32.3% and is expected to grow at the fastest CAGR of 28.9% during the forecast period.

- By application, the retail and e-commerce segment accounted for the largest revenue share of 32% in 2026 and is expected to maintain its position over the forecast period.

- By technology, the remote technology segment is expected to grow at the fastest CAGR of 28.6% during the forecast period.

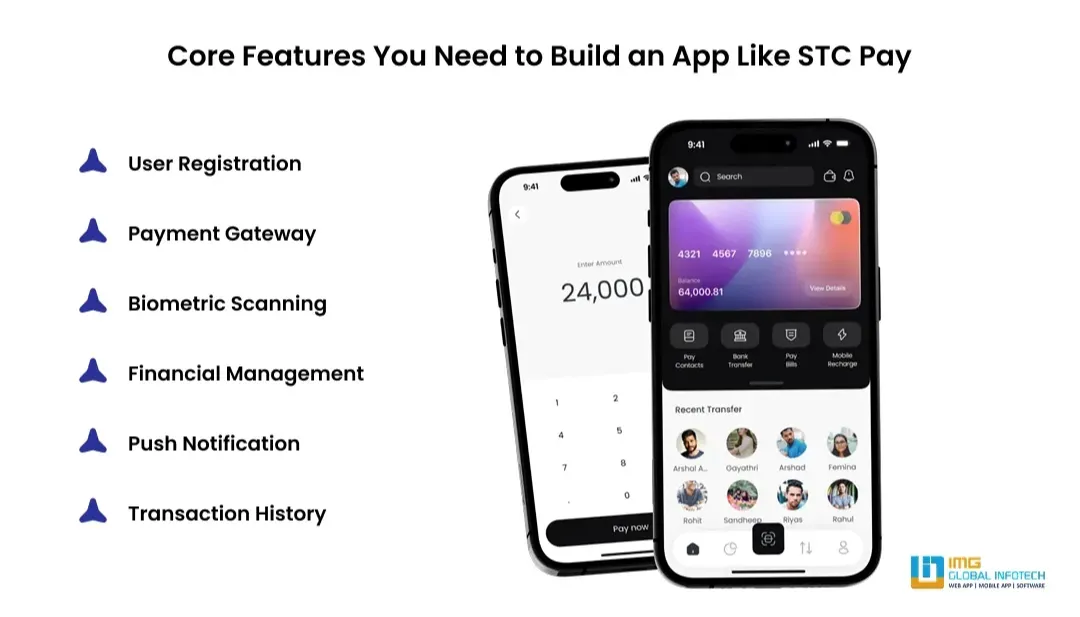

What are the key features of an App Like STC Pay?

It is important to integrate core features to build a scalable digital wallet app like STC Pay for the business. Let's take a closer look at these important STC Pay app features to build an app like STC Pay.

User Registration

The financial application enables visitors to create new accounts through its login system. Users need to register and log in to their accounts through their phone numbers, email addresses, and passwords in an easy and straightforward method.

Payment Gateway

The payment gateway feature needs to deliver safe, easy, and quick transaction processing, which creates an effective user experience in the eWallet app development. The STC Pay application requires you to implement digital wallet payment systems as part of its development process.

Biometric Scanning

EWallet applications with biometric authentication security systems provide high protection for your application. Users can use facial recognition technology to authorize payments and access their accounts. The system provides users with both a speedy login method and a secure verification process.

Financial Management

The money management function serves as the fundamental component that all finance applications need to operate in the digital wallet app development. The function enables users to track their spending, develop their financial plan, monitor their investment activities, and set their financial targets.

Push Notification

Financial application users need to receive notifications that inform them about critical activities happening in their accounts in the FinTech app development. The basic push notification feature allows you to create an eWallet application by using a budget that requires only minimal expenses.

Transaction History

Your fintech application will benefit from a transaction history feature, which helps customers track their spending and understand their financial patterns in the payment app development company. The feature allows users to search for specific transaction details through its built-in search and filter functions.

Step-by-Step Process to Create an App Like STC Pay

Developing an app like STC Pay involves several steps and requires a clear understanding of mobile app development with payment systems, security measures, and compliance with reliable regulations.

Market Research & Planning

It is important to conduct market research to understand the target audience along with competitors to include specific features and services in your app. It is also crucial to build a detailed outline that can define the app's purpose with functionalities and overall vision for the audience as well.

Select the Platform

Now it's time to decide that you want to develop the application on Android, iOS, or both platforms to Hire fintech app developers. Every platform has its unique development requirements and considerations as well.

Design & User Experience

Design a user-friendly and attractive appealing interface for the app. The app design should be focused on simplicity of use and navigation for the users.

Security and Compliance

Implement robust security measures to protect user data and financial transactions. Consider compliance with relevant regulations in AI in finance, such as PCI DSS (Payment Card Industry Data Security Standard).

Development Process

Hire a skilled development team or outsource the development to a reputable app development company that knows how to create an app like STC Pay. The team should consist of mobile app developers, backend developers, designers, and quality assurance testers.

Testing and Launch

Conduct thorough testing of the app to identify and fix any bugs or issues. Perform usability testing to ensure the app meets the desired user experience.

Cost to Develop an App Like STC Pay in 2026

The average cost would be $5,000 to $15,000 or beyond. Well, the major cost depends on diverse factors, app complexity, and the level of the customization. Here is the table that can indicate the average cost to build an app like STC Pay as well.

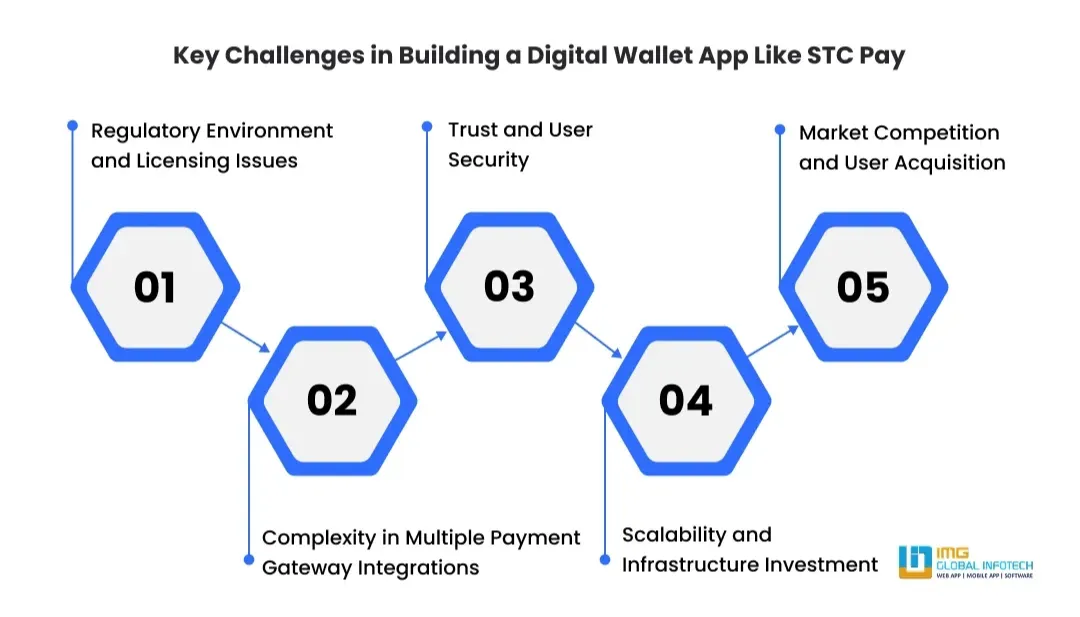

Challenges in Developing a Payment App Like STC Pay

Creating an app like STC Pay involves overcoming many regulatory hurdles, multiple payment gateway integrations, and enterprise-level security in the digital wallet app development services. The success journey involves overcoming technical, financial, and operational hurdles simultaneously while keeping ahead of the intense competition.

Regulatory Environment and Licensing Issues

The payment app industry involves a highly regulated environment requiring licenses, certifications, and financial law compliance to examine the Cost to build an app like etoro. Overcoming KYC/AML regulations, data privacy laws (GDPR, CCPA), and banking regulations in different geographies involves extensive legal knowledge, time, and investment before the app is launched.

Complexity in Multiple Payment Gateway Integrations

Multiple payment gateway, bank, and financial institution integrations involve complex technical issues in the secure payment app development. Overcoming API compatibility issues, transaction failure issues, real-time settlement, and PCI DSS compliance for different integrations involve complex fintech infrastructure expertise and development.

Trust and User Security

Users need to trust their funds and sensitive information with your app. Developing end-to-end encryption, fraud protection systems, two-factor authentication, and biometric security involves continuous investment in Fintech app development cost. A single security incident can wipe out your reputation, resulting in a loss of users and potential legal troubles instantly.

Scalability and Infrastructure Investment

Payment apps process millions of transactions, requiring scalable infrastructure. Overcoming server capacity, 99.9% uptime, peak traffic, and distributed systems in different geographies involves substantial cloud infrastructure investment. Unexpected scalability investments can quickly wipe out profit margins and investor confidence.

Market Competition and User Acquisition

The fintech industry is filled with strong competition from established players such as PayPal, Stripe, and local players of AI in FinTech apps. User acquisition through paid advertising is expensive in custom payment app development. Creating a differentiated app, leveraging network effects, and sustaining growth while managing customer acquisition costs is one of the toughest long-term challenges.

How to Choose the Right FinTech App Development Company

The choice of a FinTech app development partner brings significant importance because it determines the security features and system capacity and user confidence in the software product from the Best fintech apps. A trustworthy organization develops software solutions while possessing expertise in regulatory requirements and financial operations and upcoming technological advancements.

Proven FinTech Industry Experience

Select a company that possesses practical experience in developing FinTech solutions, which includes payment applications and lending platforms and trading systems and digital wallets.

Industry-specific expertise ensures familiarity with financial workflows, compliance standards, security challenges, and user expectations, reducing development risks and accelerating time to market.

Strong Focus on Security & Compliance

The development of FinTech applications requires complete protection measures because these applications handle confidential financial information.

The correct development company needs to implement standard industry security measures, which include data encryption and secure API usage and multi-factor authentication and PCI-DSS and GDPR and local financial law compliance with regulations that apply to your business's target market.

Advanced Technology & Innovation Capabilities

A trustworthy FinTech development partner needs to demonstrate competence in using current technologies in the blockchain in digital wallet apps, which include AI and blockchain and cloud computing, and data analytics.

The technologies create advanced applications that develop scalable intelligent systems that improve fraud detection and personalization and automation and user experience within the competitive environment of FinTech businesses.

Transparent Development Process & Communication

Successful project delivery needs both clear communication and an organized development system. The company you choose should implement agile methodologies, which include providing progress reports and displaying timeline and cost details and allowing you to participate in all development decisions for your app development project.

Post-Launch Support & Scalability

FinTech apps require ongoing updates, monitoring, and feature enhancements after they are launched to Build a fintech app like wise. The right development company provides dependable post-launch support, maintenance, and scalability planning to accommodate growing user bases, changing regulations, and new integrations, ensuring long-term performance and business growth.

Closing Statement

The financial industry has experienced substantial growth since the outbreak and continues to expect additional expansion. The moment has finally come for you to develop a fintech app. You have already learned about the complete process of developing a fintech app together with its required features and associated costs.

FinTech will experience tremendous growth because of the current pace of technological progress and innovation. So, if you are planning to build an app like STC Pay, then you are required to take guidance from one of the best FinTech app development company like IMG Global Infotech creates a top-notch app. Contact us to start your cashless payment application development project, which will help your business achieve new business growth.

-

Importance of Professional Ecommerce Website Development for Startups

Importance of Professional Ecommerce Website Development for Startups

-

How to Build A Premium Grocery App Like Kroger?

How to Build A Premium Grocery App Like Kroger?

-

The Role of AI in Credit, Banking, and Investment Services: Trends Shaping the Future

The Role of AI in Credit, Banking, and Investment Services: Trends Shaping the Future

-

How to Develop a Trading Platform Like Robinhood? A Complete Guide

How to Develop a Trading Platform Like Robinhood? A Complete Guide

-

Hire Gold Investment App Developers: Cost, Skills & Benefits

Hire Gold Investment App Developers: Cost, Skills & Benefits

-

Thinking of Building a Fintech App? A Complete Guide to Features, Costs, and Success

Thinking of Building a Fintech App? A Complete Guide to Features, Costs, and Success

Mohit Mittal is the co-founder of a leading IT company with over a decade of experience in driving digital transformation and innovative tech solutions. With a strong background in software development, Mobile app development, E-commerce, business strategy, and team leadership, Mohit Mittal is passionate about helping businesses scale through technology. When not solving complex tech challenges, he enjoys sharing insights on emerging trends, entrepreneurship, and the future of IT.