How to Build a Custom Fintech App Like Zerodha

Lokesh Saini

Feb 19, 2026

Remember the scene from The Wolf of Wall Street where ambition meets disruption? That’s the fintech revolution. Today, democratizing financial markets isn’t just a dream—it’s an imperative.

Zerodha, India’s disruptive brokerage giant, exemplifies how revolutionary architecture and consumer-centric design can eliminate traditional barriers in fintech app development. As Naval Ravikant says, “Leverage is the best tool in business”—and fintech platforms use technology brilliantly.

Building a custom fintech app like Zerodha requires understanding multifaceted systems: real-time market data integration, cryptocurrency wallets, algorithmic trading engines, and regulatory compliance frameworks in stock trading app development. You’ll need to navigate labyrinthine regulations while maintaining seamless user experiences.

This journey needs strong technical skills, knowledge of how markets work, and hard work. Whether you’re a business owner or a software developer, building a fintech platform means creating tools that help millions of people manage their money better and make investing easier for everyone. Ready to build the future?

What Is Zerodha & Why It’s a FinTech Success Story

Zerodha is among the most famous online brokerage companies that have brought a revolution to the trading and investing industry in India. Essentially, the Zerodha app is a trading platform that is mobile-based.

This platform makes it very easy for the users to access the stock markets and other financial services in the Top Fintech Apps in India. For example, the services include equities, derivatives, commodities, and mutual funds. Besides, the idea behind launching this app is to make trading more affordable.

However, it has become a game changer in the industry by offering low brokerage fees along with high-quality technology in fintech apps like Zerodha. This is why the platform is considered to be very different from the traditional app seekers.

The Zerodha app is a very useful tool that gives you the capability to trade in stocks, mutual funds, and several other financial instruments from your mobile devices. Some of the features of the Zerodha app include real-time data, charting, and order execution.

Market Opportunities in Stock Trading & Investment Apps

As per the report of Skyquestt, the global stock trading app market size was valued at $9.1 billion in 2025 and it is projected to reach $25.61 billion by 2033, with a growing CAGR of 13.8% during the forecast period from 2026 to 2033 as well.

Key Stock Trading Statistics:

- Stock trading apps generated $24.7 billion in revenue in 2025, a 19.9% increase from the previous year.

- Robinhood had the highest revenue by app across all zero-commission platforms, at $2.9 billion.

- 145 million people used stock trading apps in 2025, surpassing the previous peak in 2022.

- Zerodha and Robinhood have the most users by app, followed by financial services giant Fidelity.

- Robinhood was valued at $112 billion in 2025, with Interactive Brokers valued around the same.

What are the Core Features of a FinTech App Like Zerodha?

Developing apps like Zerodha allows you to incorporate innovative and user-friendly features that will differentiate your platform. The features of the Zerodha trading app listed below will improve the user experience.

Inclusion of Portfolio Management

It is important to develop apps like Zerodha that have sophisticated portfolio management. This will also help users to track their investments meticulously in the Custom Fintech App Like Zerodha. These apps can also offer features like real-time performance tracking along with detailed analytics and reports on asset allocation in business as well.

Robust Security System

Security is an important feature. Due to the sensitive nature of financial transactions, trading apps must incorporate multi-factor authentication (MFA) and biometric login options to ensure security to examine the Fintech App Development Cost. To ensure that only authorized users have access to their accounts, they use fingerprint or facial recognition.

Personalized Notifications

Creating apps like Zerodha that send notifications based on user preferences can significantly increase engagement in the trading app development. As a result, users should be able to set custom alerts for price changes, significant market news, and economic events that may affect their investments.

Advanced Charting Tools

The integration of advanced charting tools can significantly enhance the group of technical analysts’s user experience. The app should offer the various chart types (line, bar charts, and candlesticks) along with customizable indicators such as RSI, MACD, and moving averages as well.

Market Sentiment Analysis

Adding market sentiment analysis helps users to get a better understanding of the overall investor mood in the Zerodha like app development. It can be about certain stocks or the stock market at large. Through this feature, users are able to collect data from social media, news, and other online sources, which will provide them with an overview of sentiments in the market.

Social Trading Features

By adding social trading features that help to increase user engagement and collaboration.

For instance, one of the features is copy trading, which allows users to track the trades of top investors and duplicate them, thus making it easier for beginners to start investing.

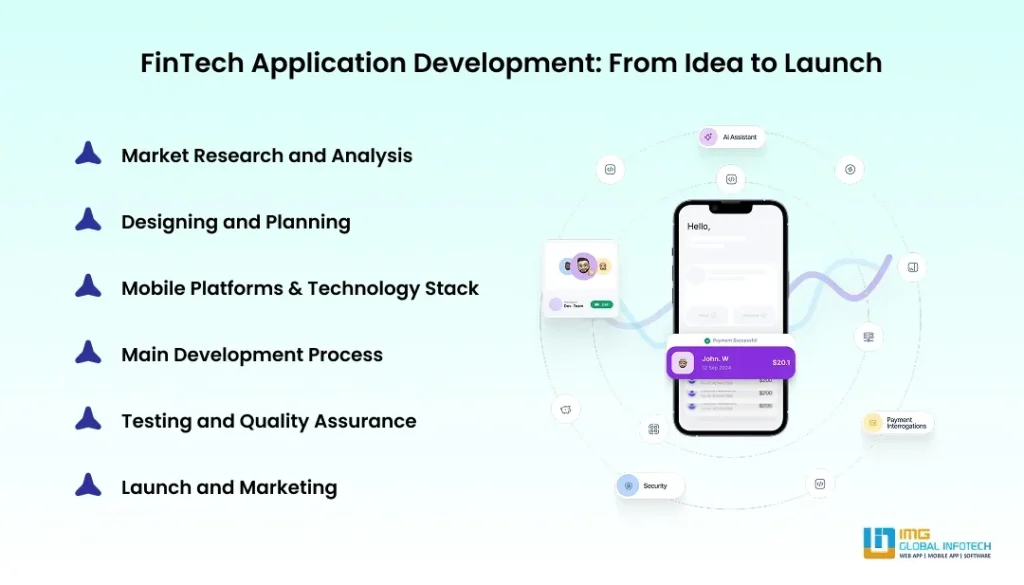

Step-by-Step FinTech App Development Process

Now that you are aware of the size of the trading app market, it is evident that investing in training app development can be an advantage for your business.

You should now develop a trading app like Zerodha by seeking help from an iOS or Android app development company to build a trading app. But before that, let’s have a look at the step-by-step process of developing a trading app like Zerodha:

Market Research and Analysis

Perform a market analysis before you start developing a trading app like Zerodha to understand your target audience better from the Best Fintech Apps. Identify the unique selling points that will make your kite trading app unique.

Designing and Planning

Develop an intuitive and user-friendly interface for your fintech app development. Plan what you would like to include, such as livestock information, graphs, and portfolio management. To conceptualize the flow and design of a Zerodha trading app, wireframes and prototyping are used.

Mobile Platforms & Technology Stack

Decide on the kite trading platform that you would like to target (iOS and Android). Decide on the technology stack that suits your approach to stock trading app development (native or hybrid).

Main Development Process

This is the stage where you code the app as per your plan and design to develop a trading app like Zerodha. You will need to hire mobile app developers who are experts in both mobile and web development.

Testing and Quality Assurance

The next step to developing a trading app like Zerodha is to test your app, like Kite, thoroughly for security, functionality, and performance in AI in Finance. To make sure that the app performs well in different scenarios, simulate different trading scenarios.

Launch and Marketing

Launch yours on the Zerodha trading platform you would like to use, like iOS, Android, and Web. Develop a plan for reaching potential customers in the online trading app development. Use social media, content marketing, and partnerships to market your app like Zerodha.

Cost to Build a Custom FinTech App Like Zerodha

The cost to build a custom fintech app like Zerodha would be $5,000 to $15,000 or beyond.

Note: These are average figures because the main cost majorly depends on assorted factors and the level of app complexity and customization as well.

What are the Challenges in Building a Trading App & How to Overcome Them?

Building a trading app is like walking through a complicated financial maze where technology, law, and users’ wishes come together in the investment app development. You have to be technically sound, comply with the regulations, and deliver the real-time performance that the traders want.

Market Latency & Real-Time Data Processing

Trading apps have higher demands in millisecond-level speed for data processing. You can overcome this by using cloud infrastructure with CDN integration that can implement WebSocket connections for live feeds on database queries as well.

Security & Cybersecurity Threats

Protect sensitive financial information from hacking and fraud. To ensure complete protection, use end-to-end encryption, multi-factor authentication, secure API gateways, regular penetration testing, and compliance with security standards such as ISO 27001 and PCI DSS.

Legal Framework in Regulatory Compliance

To navigate the complex financial regulations across multiple provinces that include KYC, AML, and data privacy laws to examine the Cost to build a fintech app like cleo. You need to partner with compliance experts that implement the automated compliance checks to conduct the regular security assessments as well.

User Experience & Market Education

Complicated trading interfaces may scare away novice traders, whereas experienced traders seek sophisticated tools. Solution: Design a user-friendly interface that allows personalized dashboards, educate users, deliver demo accounts, run tutorial sessions, and keep collecting customer feedback to enhance the platform in a real sense.

Scalability During Peak Trading Hours

During periods of intense trading, apps freeze and open windows crash. Remedy: Outline microservices architecture, deploy auto-scaling cloud capabilities, and integrate load balancing, database sharding, and caching techniques in the share market app development. Carry out stress testing to simulate real-world pressure and ensure smooth handling of multiple user requests.

How to Choose the Right FinTech App Development Company

Choosing the right development company can build or break your digital banking dreams. The right company can bring the expertise with security compliance and innovation that can transform the vision into a scalable platform.

Technical Expertise with Technology Stack

You can also verify their proficiency with all modern technologies like cloud platforms, APIs, and Blockchain to Hire fintech app developers. Then assess their knowledge about programming languages along with database management and security frameworks. You can ask about their DevOps practices with testing methodologies and ability to handle the legacy system as well.

Team Expertise & Communication

Measure their development team’s qualifications with project managers, QA engineers, and support team members in the fintech mobile app development. You need to also check if they will provide dedicated account managers with regular progress updates and transparent communication channels as well.

Proven Track Record & Portfolio Review

Evaluate companies from their past fintech projects, client testimonials, and case studies. Ask for detailed portfolio samples, examine their knowledge of similar apps, check client references, and evaluate the time taken for project completion. Find companies with 5+ years of fintech experience and a history of successful app launches in your target market.

Compliance Certifications with Security Concerns

Confirm that they have essential certifications such as ISO 27001, SOC 2, GDPR compliance, and financial regulatory knowledge in the Zerodha clone app development. Inquire about their security auditing procedures, data protection protocols, penetration testing methods, and incident response plans. Ensure that they have a thorough understanding of KYC, AML requirements, and industry-specific compliance standards.

Post-Launch Maintenance & Support

Get to know their support model after the project, maintenance packages, and the way they update. Ask questions about SLA agreements, bug fix turnaround times, feature upgrade steps, and scaling assistance in the best technology stack for fintech apps. Ensure that they provide round-the-clock monitoring, periodic performance tuning, security updates, and post-launch continuous improvement strategies.

Future Trends in FinTech Trading App Development

The world of finance tech is changing fast! AI, blockchain, and automation are totally changing how people invest. Soon, trading apps will be smarter, faster, and easier to use, all because of the newest tech and info.

AI and Machine Learning

Trading apps powered by AI will give you investment advice made just for you, guess what might happen in the market, and handle your investments for you. Machine learning looks at what’s going on in the market, finds weird stuff, and gives you info right away. Chatbots will help customers out, while robo-advisors will make your investment plans better based on how much risk you can handle and what you want to achieve.

Blockchain Tech and Cryptocurrency

Decentralized finance (DeFi) lets you trade directly with others, cutting out the middleman, lowering costs, and making things more open. Blockchain makes sure your trades are safe and can’t be changed, while trading crypto lets you trade digital money super easily. Smart contracts will do complex trades and settlements and make sure everything follows the rules without anyone having to step in.

Fractional Share Trading

Apps are making investing open to everyone by letting you buy parts of shares with very little money. This lets newbies spread their money around, invest in expensive stocks, and get in on IPOs with just a little bit of cash. Investing small amounts makes it easy for people with less money to start building wealth all over the world.

Social Trading and Community Platforms

People can share their trading tricks, copy successful traders, and automatically do the same trades. Community features like forums, online classes, and advice from experts help people learn together. Fun things like leaderboards and badges keep people interested and build strong trading communities around the world.

Data Analysis & Real-Time Insights

Big data gives detailed market info, guesses how people feel about the market, and predicts what will happen. Dashboards show charts, technical stuff, and news in real time so you can make good choices. APIs connect to outside data, calendars, and global market info so you can do complicated analysis.

Regulatory Tech (RegTech)

Automated systems make sure everything follows the financial rules. RegTech tools constantly check IDs, screen for money laundering, watch trades, and keep track of everything. Cloud-based tools make it easier to report to regulators, lower compliance costs, and reduce legal risks for fintech platforms around the world.

Final Thoughts

Developing a fintech app basically involves the creation of a digital environment that can be relied on, where tech, design, and financial knowledge are all coordinated, rather than merely making software by our leading Fintech software development company. Collaborating with the right investment app development company, you have the opportunity to introduce a safe, user-friendly, and feature-laden platform that enables users to trade, invest, and manage their money confidently and effectively.

Focusing on stock market app development, incorporating intelligent robo-advisory systems, and facilitating frictionless mobile trading platforms, a fintech solution like yours will be able to attract investors, thus nurturing their loyalty in the long run.

Get in touch with us and let us help you develop a robust, forward-thinking investment platform out of your fintech app concept.

-

How to Start Mobile App Development in 2026

How to Start Mobile App Development in 2026

-

How Much Does It Cost to Develop Fintech App Like Revolut in 2026?

How Much Does It Cost to Develop Fintech App Like Revolut in 2026?

-

Duolingo-Like App Development: A Complete Guide

Duolingo-Like App Development: A Complete Guide

-

How Much Does It Cost to Hire Ecommerce Web Developers in India?

How Much Does It Cost to Hire Ecommerce Web Developers in India?

-

How Much Does Machine Learning App Development Cost in 2026?

How Much Does Machine Learning App Development Cost in 2026?

-

Building an eLearning app in 2026? The Trade-Offs No Guide Talks About

Building an eLearning app in 2026? The Trade-Offs No Guide Talks About

Lokesh Kumar is the Digital Marketing Manager & SEO Content Strategist at IMG Global Infotech, a top-rated Web & Mobile App Development Company. With extensive experience in digital marketing, SEO, and content strategy, he specializes in boosting online visibility and driving organic growth for startups, SMEs, and global brands. Lokesh is passionate about creating SEO-friendly, user-centric content that not only ranks but also converts. His deep understanding of digital trends and search algorithms helps businesses thrive in a competitive online space.