How Much Does It Cost to Develop Fintech App Like Revoult in 2026?

Lokesh Saini

Feb 18, 2026

What if I could tell you that the future of banking can fit in your pockets and it would cost less to build a single bank branch? Trust me, it’s just not an imagination; this digital disruption is real and authentic. Sounds terrible but real!!!

Now picture this scenario: a digital wallet that can’t just hold money—it can create an entire financial universe for you from the Fintech app like Revolut. That’s a magic trick of Revolut’s app and everyone wants to act like you were stuck with this change.

The fintech ecosystem isn’t coming because it arrived while the traditional banking system were struck in paperwork. In simple words, if you have seen the movie (The Big Short), you can easily witness the complete democratization of the finance market through technologies.

Here is a million-dollar question—seriously. What does it cost to build the next Revolut for your fintech universe?

The answer isn’t simple because it’s a cocktail of diverse factors. Before you dive into the development deep end, let’s dissect what makes these digital banking darlings tick—and what price tag comes attached to that timepiece.

Why are Fintech Apps Like Revolut So Popular?

Revolut and similar fintech applications have figured out the perfect formula of offering most of the features that traditional banks lack, such as instant transactions, multi-currency wallets, cryptocurrency trading, and budget analytics, all in an easy-to-use application.

These apps have removed the concept of hidden charges, eased the transactions, and given financial control to the users themselves to examine the Cost to build an app like etoro. This is more than just banking; it’s giving customers the power of finance at the speed of light, without the red tape.

Which Factors can Affect the Cost to Develop a Fintech App Like Revolut?

The project development process will become more efficient through the project development stages, which calculate required costs for all project construction activities. The actual cost to create an app similar to Revolut requires research on multiple elements of development. You should consider all the following factors.

App Size and Complexity

The cost will depend on both the app’s size and its required features. The costs will rise when developing a complex application that contains AI user data evaluation, blockchain components, chatbot features, and API integration capabilities.

Team of Developers

The type of developers will impact your overall cost to build a clone like Revolut. The assessment requires you to check two main factors, which include developer expertise and developer location.

Mobile App Design

The type of UI/UX app design for your project has a large impact on the cost to build an app like Revolut to examine the Fintech app development cost. Fintech applications require designers to create user-friendly interfaces that attract users through their initial visual presentation.

Choice of Platforms

The selection of platforms will affect the cost to develop an app like Revolut. The available platforms for selection include Android, iOS, and Hybrid platforms in Revolut-like app development. The app’s purpose and intended users will determine your organization of platform types and quantities.

Third-Party Integration

The app development process becomes more complicated when developers include third-party services that contain payment gateways and social media platforms to Hire fintech app developers. The users will receive a better experience with the brand through this feature.

Users will find it convenient to make payments through various channels that third-party integrations provide, which include media sharing platforms and multiple payment methods.

How Much Does It Cost to Develop a Fintech App Like Revolut?

The average cost to develop a fintech app like Revolut would be $5,000 to $15,000 or beyond. The major cost mainly depends on diverse factors, app complexity, and the level of modifications.

Technology Stack Required for a Revolut-Like Fintech App

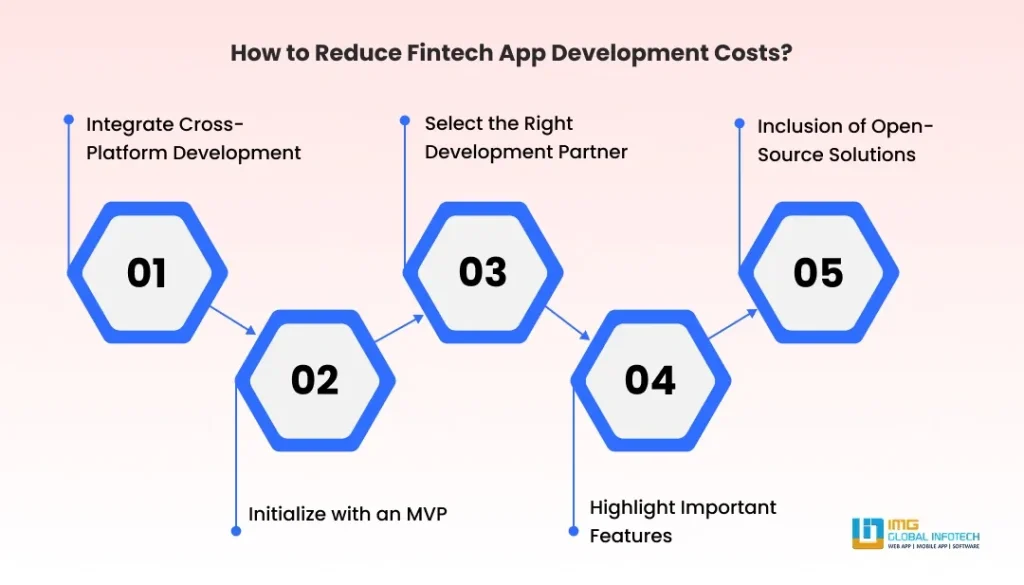

How to Reduce Fintech App Development Costs Without Compromising Quality?

To reduce the fintech app development cost mainly focuses on developing an MVP along with cross-platform frameworks from the Fintech app development company. It is also essential to prioritize core features along with an experienced offshore team with open-source tools to avoid scope creep and rework as well.

Integrate Cross-Platform Development

It is not compulsory to develop separate apps for iOS and Android; you can utilize frameworks like Flutter or React Native to build a single codebase for both in AI in finance. This process can reduce the fintech app development in terms of time and expenses.

Initialize with an MVP

Create a Minimum Viable Product (MVP) to get you started quickly with basic features. This technique reduces upfront costs, shortens development time, and allows for early customer feedback.

You can test your concept before committing to full-scale production, avoiding unnecessary features that may not appeal to customers.

Select the Right Development Partner

Outsourcing is a good option with proficient developers, especially in Europe and Gulf countries. The best thing about this process is constant quality assurance by the proven fintech experience along with good communication skills and a well-defined development process in the Custom fintech app development. It can minimize the costly mistakes and rework process in any project.

Highlight Important Features

You should only list must-have, high-impact features in the first edition. Don’t stuff the app with scrape tools. Giving top priority to the user’s registration, account management, and simple transaction functionalities will not only be cost-effective but will also satisfy the core users’ needs. Subsequent phases can include more features in the app as well.

Inclusion of Open-Source Solutions

In the case of tasks, authentication, charting, and analytics, use open-source tools and APIs. This eliminates the necessity to create everything anew, thus making the whole mobile app development services duration cheaper in the Fintech software development. Just check that the tools are safe and well supported and correspond to your app compliance standards.

Future Trends in Fintech App Development

The fintech sector is rapidly changing, mainly due to the technological innovations and the changing demands of the consumers. Here is a list of the top trends that will shape the future of financial applications:

AI-Powered Personalization

Artificial intelligence has allowed fintech applications to take their in-depth financial advisor service to the next level in the Neobank app development. Machine learning algorithms are used to study the customers’ spending habits, forecast potential cash flow problems, and come up with highly personalized investment suggestions.

Embedded Finance Integration

Seamless financial experiences integrated directly into non-financial platforms are what the future holds. E-commerce sites can provide instant checkout loans, ride-sharing apps can offer insurance, and social media can facilitate peer-to-peer payments. embedded finance is breaking down the traditional banking boundaries.

Decentralized Finance (DeFi) Adoption

DeFi powered by blockchain technology is opening up the financial services market to everyone by cutting out the intermediaries from Top fintech apps in india . Smart contracts allow the automation of lending, borrowing, and yield farming without the need for any traditional gatekeepers.

Biometric Security Enhancements

Passwords are becoming antiquated as biometric authentication gains prominence. Advanced facial recognition, voice identification, behavioral biometrics, and even heartbeat patterns are all improving fintech security.

Why Should You Choose a Professional Fintech App Development Company?

Developing a fintech application requires more than programming skills because developers must manage complicated legal requirements while building secure systems that provide users with perfect interfaces. The following reasons demonstrate that working with experienced experts represents your best financial decision.

Regulatory Compliance Expertise

Fintech developers possess specialized knowledge about financial laws, which includes understanding PCI-DSS and GDPR and KYC and AML regulatory frameworks. The team understands how to create compliant applications from the beginning because they have worked through cross-border compliance challenges.

Industry-Grade Security Implementation

Fintech applications require strong security measures because they process highly sensitive financial information in AI in fintech apps. Development companies create secure systems through multi-level security measures, which include complete encryption and protected application interfaces and security testing and system weakness evaluations.

Scalable Architecture Design

Fintech application developers create scalable systems that can accommodate both future business expansion and additional software functions for the Role Of Artificial Intelligence In Fintech. The team designs systems that maintain operational efficiency during rising transaction rates and user growth and data accumulation.

Faster Time-to-Market

Professional fintech development teams use tried-and-true frameworks, pre-built modules, and established workflows to shorten development cycles to examine the Cost to build a Revolut-like app. Their experience anticipating challenges, avoiding common pitfalls, and implementing efficient processes ensures that your app reaches users more quickly. In today’s competitive fintech landscape, this speed advantage can mean the difference between gaining market share and becoming a late candidate.

Conclusion

The development of a banking and financial services fintech application that resembles Revolut will lead you to achieve professional success throughout your career from the reliable FinTech app development company. Your app development team requires proper strategy and the correct development process to transform your app vision into an operational product.

The project offers substantial benefits to stakeholders but demands both a major financial investment and detailed knowledge about the fintech industry and banking sector, plus the actual development expenses for a Revolut-like fintech application. The process of determining key product features that impact development costs becomes essential for organizations to make effective financial management and operational planning choices.

-

How Much Does It Cost to Hire Ecommerce Web Developers in India?

How Much Does It Cost to Hire Ecommerce Web Developers in India?

-

Duolingo-Like App Development: A Complete Guide

Duolingo-Like App Development: A Complete Guide

-

Building an eLearning app in 2026? The Trade-Offs No Guide Talks About

Building an eLearning app in 2026? The Trade-Offs No Guide Talks About

-

How Much Does Machine Learning App Development Cost in 2026?

How Much Does Machine Learning App Development Cost in 2026?

-

15 Expert Tips for Hiring the Best Android Developers

15 Expert Tips for Hiring the Best Android Developers

-

Zocdoc Clone App Development: Complete Guide

Zocdoc Clone App Development: Complete Guide

Lokesh Kumar is the Digital Marketing Manager & SEO Content Strategist at IMG Global Infotech, a top-rated Web & Mobile App Development Company. With extensive experience in digital marketing, SEO, and content strategy, he specializes in boosting online visibility and driving organic growth for startups, SMEs, and global brands. Lokesh is passionate about creating SEO-friendly, user-centric content that not only ranks but also converts. His deep understanding of digital trends and search algorithms helps businesses thrive in a competitive online space.