BNPL App Development: Complete Guide

Lokesh Saini

Oct 07, 2025

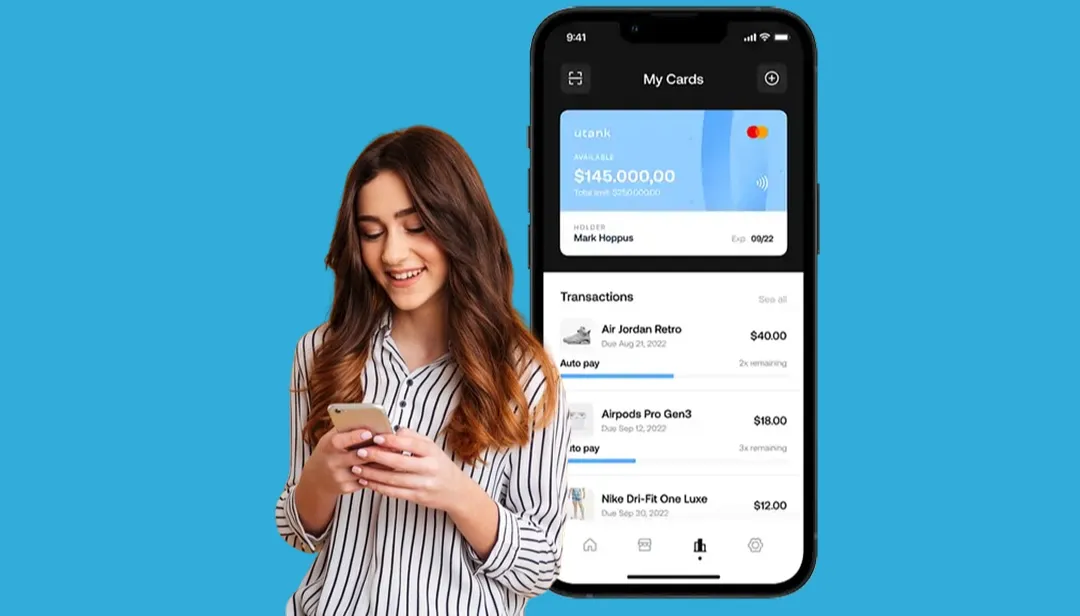

The Buy Now, Pay Later (BNPL) option has changed the digital payments landscape by giving customers the option to buy items instantaneously and pay in installments with no interest. With eCommerce and online shopping experiencing tremendous growth, BNPL apps have risen in popularity among millennials and Gen Z shoppers which has improved conversion rates and customer retention for businesses. BNPL concepts require secure payment gateways, performing credit risk assessments, and delivering an intuitive user experience to ensure safe, simple transactions.

If you want to build a solid BNPL app, this BNPL App Development Guide will discuss the required features, technology stack, and process for development. If you are a start-up or an established business learning how to create a secure, robust and user-friendly BNPL platform is crucial to seizing the growing digital finance opportunity.

What Is BNPL?

Buy Now, Pay Later (BNPL) is a modern payment product that allows a customer to purchase products and or services instantly and pay for the purchase over a period of time. Most installations are interest free but vary by lender. BNPL is growing in popularity and use predominant in the online retail and eCommerce sector. BNPL products work to simplify the transaction process, improve purchasing power, and create customer satisfaction. Merchants of all sizes and industries benefit from BNPL by encouraging higher sales on products, and increasing repeat purchases. Buzzwords to describe BNPL include: instant credit services; instant gratification; flexibility; improved purchase power; simplicity. Many BNPL platforms have the following features: credit checks, payment tracking for each installment, secured payments to the merchant and other forms of integration into the merchant's store.

Why Invest In BNPL App Development?

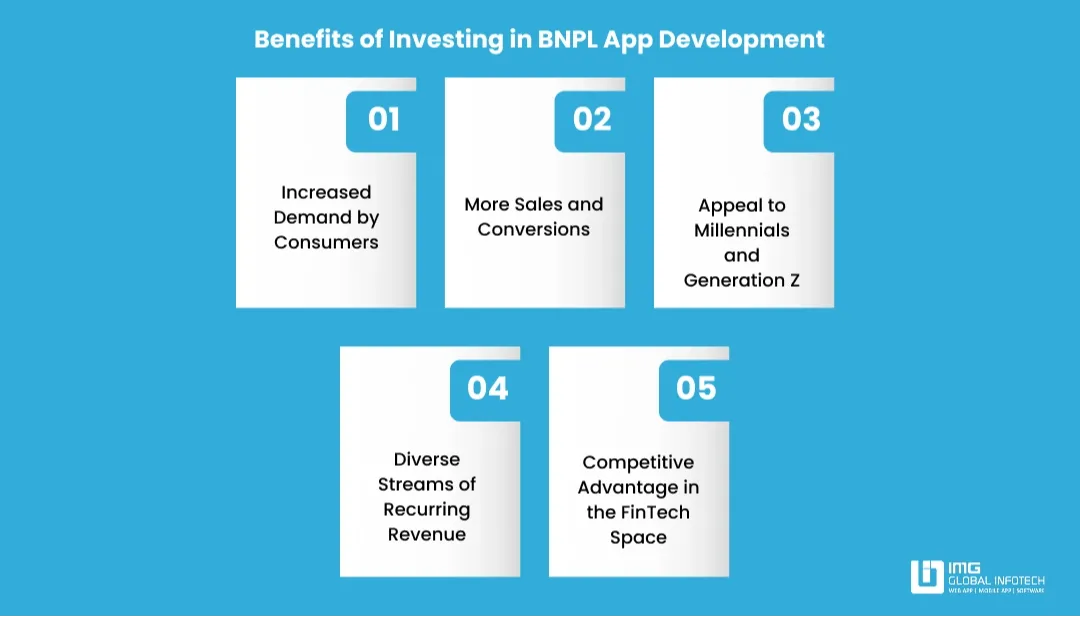

In recent times, the Buy Now, Pay Later (BNPL) sector has transformed the online shopping experience and has grown at an incredible pace. A BNPL app for business or a startup can be a very profitable undertaking. Here are five key reasons a business should consider BNPL app development:

1. Increased Demand by Consumers

As online shopping has become more popular, more consumers are looking for more flexible payment options. BNPL apps enable users to buy products immediately and pay later in manageable installments, which makes purchasing less difficult and more appealing to consumers, especially to younger generations.

2. More Sales and Conversions

Merchants that offer BNPL options typically see increased sales and improved conversions. When consumers can eliminate or lower their initial financial obligation, they are more likely to complete their purchases, which translates to more revenue for merchants and other businesses that utilize BNPL solutions.

3. Appeal to Millennials and Generation Z

It's possible that younger generations like Millennials and Gen Z might be more likely to use other methods beyond credit cards for purchases. Because BNPL apps are great for these demographics, the barrier to entry is low for businesses to win over a generation that is digitally savvy, interested in ease, and appreciates financial flexibility.

4. Diverse Streams of Recurring Revenue

Other sources of revenue accrue to businesses through merchant fees, late fees, or some monetized partnership with financial institutions. The many various ways to monetize BNPL apps will create some predictable cash flow and years of profitability for your business.

5. Competitive Advantage in the FinTech Space

By incorporating a BNPL option into your business, your business demonstrates and focuses on being a progressive, innovative brand. As the digital finance space continues to develop into a very competitive space, having a BNPL app component or service can help distinguish your brand, target a larger user base, and increase customer retention.

Essential Features Of A BNPL App

1. User Registration & KYC Verification

Users can register securely via email, phone number or social media and a KYC (Know-Your-Customer) verification process follows the registration to ensure compliance and fraud protection in BNPL transactions.

2. Credit Assessment & Approval

The BNPL app provides credit assessment and evaluation in real-time using either AI or third-party APIs to determine eligibility for installment plans, reducing lender's risk of default and enhancing consumer accountability on lending options and plans.

3. Flexible Installment Plans

Provide multiple repayment options (weekly, bi-weekly, monthly) and let users choose a repayment option to suit their budget and preference.

4. Seamless Checkout

Integrate BNPL options as part of the user journey directly in the online store/app to facilitate a seamless one-click checkout to increase conversions and improve customer satisfaction.

5. Payment Gateway Integration

Securely process transactions by trusted Payment Gateways integrated in the platform with many payment modes (debit/credit cards, UPI, wallets, and net banking) available for the convenience of users.

6. Loan Management Dashboard

Show users a clear view of their active installments, payment history, upcoming dues and outstanding balances in the Loan Management Dashboard to gain transparency and control.

7. Push Notifications & Alerts

Prompt reminders about upcoming payments, upcoming dues, and offers help to improve repayment rates, and reports from users can reinforce and improve user engagement.

8. Rewards & Loyalty Programs

Cashback, Discounts, and Reward Points issued to users, for on-time payments, and repeat usage on the App will enhance retention and encourage user engagement.

9. Monitoring of Fraud Detection & Security

Enable advanced security measures, including robust encryption and AI based fraud detection for user data protection and to ensure secure financial transactions.

10. Admin Panel & Analytics

Having an Administrator Access Panel to monitor Users activity, repayments, reports and merchant monitoring will streamline operations and help your company make informed, data-driven business decisions.

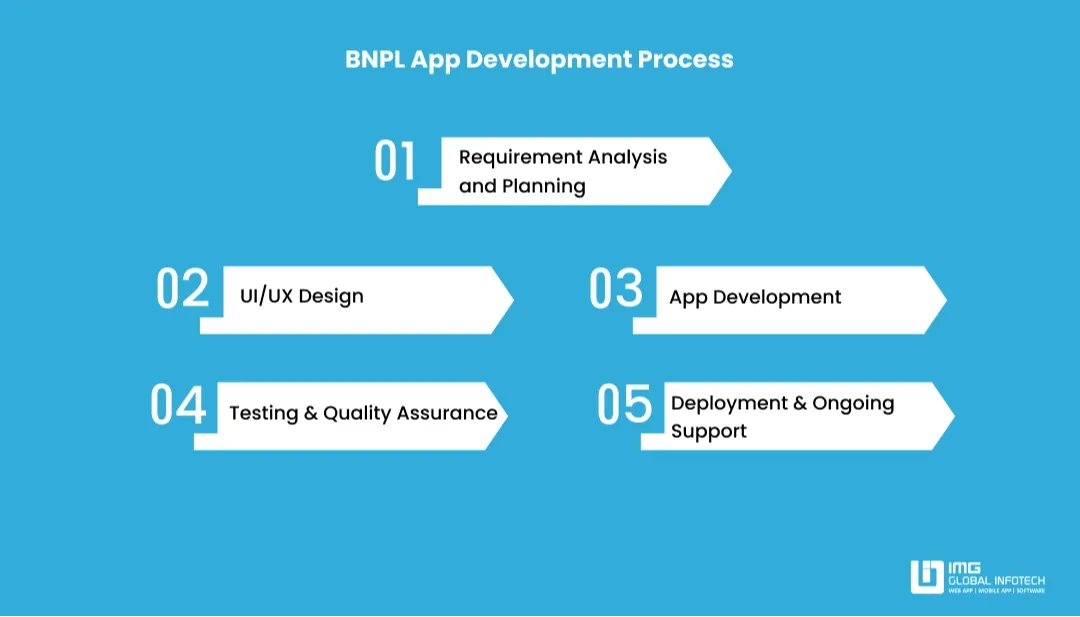

Step-by-Step Process to Develop a Buy Now Pay Later App

The process of creating a Buy Now, Pay Later (BNPL) app requires experience in FinTech, payment gateways and compliance regulations. Engaging a professional FinTech app development company will ensure that your application is sturdy, secure and scalable. Below are five fundamental steps involved in developing BNPL application:

1. Requirement Analysis and Planning

In the initial steps of developing a BNPL application, it is necessary to understand your goals, customer base, and the needs of the market. The Fintech app development company will conduct a competitive analysis of payment models and determine the application's basic features, such as repayment installment plans, credit assessment, and monitoring user repayments. A thorough project roadmap will be produced, including timelines, the technology stack, and any compliance regulations necessary for your app. The definition of the functional and non-functional requirements will clarify the application development process for all the necessary stakeholders who require the application to be aligned with your company objectives and industry compliance guidelines.

2. UI/UX Design

Designing an intuitive and user-friendly interface is of utmost importance for a BNPL application. The design team creates wireframes, mockups, and interactive prototypes for both users and merchants. Some important UI/UX considerations to keep in mind are; simple onboarding process, uncomplicated checkout process, easy installment repayment breakdowns, and easy navigation. These UI/UX design characteristics produce an easy and engaging experience for the user which will expedite adopting a BNPL application to use.

3. App Development

While developing the app, the company builds the frontend and backend systems and integrates key features, such as credit score scoring, installment management, a secure payments gateway, push notifications, and fraud detection. The Trading app development team ensures compatibility across iOS, Android, and web-based environments. APIs for third-party services, like credit bureaus and payment processors, are also integrated into the app functionality to allow for real-time approval and secure financial transactions.

4. Testing & Quality Assurance

After development is complete, the app is thoroughly tested to find bugs, performance issues, and exposures related to security. Quality assurance engineers will ensure that functionality, user experience, load, and regulations specific to financial technology are also tested as part of the process. This process is vital to ensuring the app is reliable, security-proficient, and offers a high-quality experience for users and merchants.

5. Deployment & Ongoing Support

After a successful testing period, the app would be deployed to app stores and integrated into merchant partners' checkout flows. The Loan app development company would provide ongoing support post-launch, including updating features and performing maintenance, server monitoring, and enhancement deployments to support performance, security, and user satisfaction.

>>>Also Read: How to Build A Fintech App Like Wise?

How Much Does Buy Now Pay Later App Development Cost?

A Buy Now, Pay Later (BNPL) mobile application is born out of the developing culture around green fintech, secure payments, and user experience. The Buy now pay later platform development cost typically falls between $8,000 and $15,000 or more, based on features, platform, the complexity of design, and development team. Advanced capabilities, such as performing credit checks, managing installments, detecting fraud, and accepting payments from a variety of payment partners, add complexity to app development and therefore will directly impact your BNPL app development cost. Ultimately, the key factors that influence the Cost to build a buy now pay later app are as follows:

1. App Functionality and Complexity:

The further away from basic functionality you go towards implementing complex features such as real-time credit checks, multi-installment options, automatic notifications, and rewards programs the higher the BNPL app development cost. Budgeting for a simple BNPL app or one with basic installment plan functionality is likely to be cheaper than developing one with more advanced features.

2. Platform Type (iOS, Android, and/or Cross Platform):

If your Buy now pays later platform development only needs to be developed for a single platform (either iOS or Android), you will inherently pay less than you might for a cross-platform solution which will require more coding and testing overhead. And if cost savings are the primary concern but your goal is to deliver a superior user experience, developing a native (iOS or Android) application will yield higher performance, whereas developing a cross-platform application may be less expensive and faster but you might lose some performance benefits.

3. UI/UX and Design (and Development):

Having a clean, intuitive, and easy-to-use UI for your BNPL app is crucial. While designing and implementing a more complex, interactive dashboard and a seamless checkout process will increase the Buy now pay later platform development cost, these features will also likely impact your users' experience and their engagement within your app, thereby having a greater impact to cost to develop bnpl app.

4. Development Team and Location:

Hourly billing rates vary, depending on geographic location. For example, BNPL mobile app development company in India bill $12-25 /hour, while development teams in the USA or Western Europe bill $15-$25/hour. You will also need to budget for a choreographed, full-stack, or multidisciplinary team to cover frontend, backend, and quality assurance in your organization.

5. Maintenance and Compliance:

In addition to initial Cost to build a buy now pay later app, you must budget for ongoing costs, which will include updating the buy now pay later apps usa, monitoring your servers for uptime, and complying with the financial regulatory environment.

Why Choose IMG Global Infotech For BNPL App Development?

At IMG Global Infotech, we are dedicated to developing BNPL apps that are secure, scalable, and easy to use for today's financial needs. Our experience in BNPL app development services is expansive. We will take you through the process, from feature and concept design to regulatory compliance, our team of experts has you covered. We offer seamless payment gateway integration, credit assessment workflows, installment management, and, most importantly, will provide an exceptional user experience. As your digital payments and eCommerce partner, we can assure you that your buy now and pay later apps will be robust, reliable, and performant; helping with customer engagement, loyalty, and long-term business development.

Conclusion

The BNPL app market offers tremendous potential in a rapidly expanding digital payments and eCommerce market. For well-deserved success in the BNPL app market, AI in finance needs secure payment gateways, flexible installment payment plans, credit assessment in real time, and a seamless user experience. Paying attention to intuitive design, strong security, and regulated financial compliance will go a long way in a company's ability to retain and cultivate customers. Partnering with professional buy now pay later bnpl app development development company like IMG Global Infotech will provide a BNPL app that is scalable, secure, rich with features, and will help your business gain market share and improve revenue in the future.

-

What Are the Top Ecommerce Development Trends to Watch in 2026?

What Are the Top Ecommerce Development Trends to Watch in 2026?

-

How Much Does AI Astrology App Development Cost in 2026?

How Much Does AI Astrology App Development Cost in 2026?

-

How to Choose the Right AI Consulting Company in the USA?

How to Choose the Right AI Consulting Company in the USA?

-

D2C Ecommerce Website: Complete Development Guide for Startups

D2C Ecommerce Website: Complete Development Guide for Startups

-

How to Build a Custom Fintech App Like Zerodha

How to Build a Custom Fintech App Like Zerodha

-

How to Start Mobile App Development in 2026

How to Start Mobile App Development in 2026

Lokesh Kumar is the Digital Marketing Manager & SEO Content Strategist at IMG Global Infotech, a top-rated Web & Mobile App Development Company. With extensive experience in digital marketing, SEO, and content strategy, he specializes in boosting online visibility and driving organic growth for startups, SMEs, and global brands. Lokesh is passionate about creating SEO-friendly, user-centric content that not only ranks but also converts. His deep understanding of digital trends and search algorithms helps businesses thrive in a competitive online space.