Top 10 Mobile Banking Apps In Australia 2026

Dipti Singhal

Jul 31, 2025

Managing money in Australia has changed dramatically over the past few years, and mobile banking apps are at the heart of that shift. With the rise of cashless payments, instant transfers, and 24/7 account access, banking apps are no longer just a convenience, they’re a necessity. Australia’s leading banks and fintech companies continue to enhance their mobile apps with innovative features such as biometric security, real-time payment systems (PayID and Osko), AI-driven budgeting tools, and integration with digital wallets like Apple Pay and Google Pay.

In this blog, we’ll explore the best mobile banking apps in Australia, comparing their features, security, and unique benefits, helping you choose the best banking app for your financial needs.

Key Features of a Good Mobile Banking App in Australia

With Australians rapidly adopting digital banking, choosing the right mobile banking app comes down to the features it offers. A reliable banking app should combine security, usability, and functionality to meet everyday financial needs. Here are the essential features to look for in an mobile banking app Australia:

1. Bank-Grade Security

Security is the top priority for mobile banking in Australia. The best apps use multi-factor authentication, biometric login (Face ID, fingerprint), encryption, and fraud detection. Compliance with Australian Prudential Regulation Authority (APRA) and Australian Consumer Data Right (CDR) standards ensures user data stays protected.

2. Seamless Payments & Transfers

A good banking app should make payments effortless. Features like PayID, Osko payments for real-time transfers, and BPAY integration are essential for fast and secure transactions across Australia.

3. User-Friendly Interface

Australians expect smooth navigation and easy-to-understand layouts. A clean interface that shows account balances, transaction history, and payment options at a glance makes banking more accessible.

4. Card Management Tools

Top net banking apps allow customers to lock/unlock cards, set spending limits, change PINs, and request replacements instantly from the app, without visiting a branch.

5. Budgeting & Expense Tracking

Money management is easier with built-in spend categorization, savings goals, and expense alerts. Many Australian apps, like CommBank and Up Bank, include smart budgeting tools to help users track and control spending.

6. Digital Wallet Integration

Support for Apple Pay, Google Pay, Samsung Pay, and Fitbit Pay is now expected. This ensures contactless payments are quick and secure at Australian retailers.

7. 24/7 Customer Support

Live chat, secure in-app messaging, and AI chatbots allow customers to get help anytime, essential for resolving urgent banking issues outside branch hours.

8. Multi-Device Access

A great banking app works seamlessly across devices, whether on iOS, Android, tablets, or even wearables, allowing Australians to access their finances anytime, anywhere.

Top 10 Mobile Banking Apps in Australia

Mobile banking in Australia is now more advanced than ever, with apps offering instant payments, powerful budgeting tools, and next-level security. Whether you’re with a big four bank or a digital-only challenger, the right app can transform how you manage your money.

Here’s a detailed look at the 10 best mobile banking apps in Australia and what sets each of them apart.

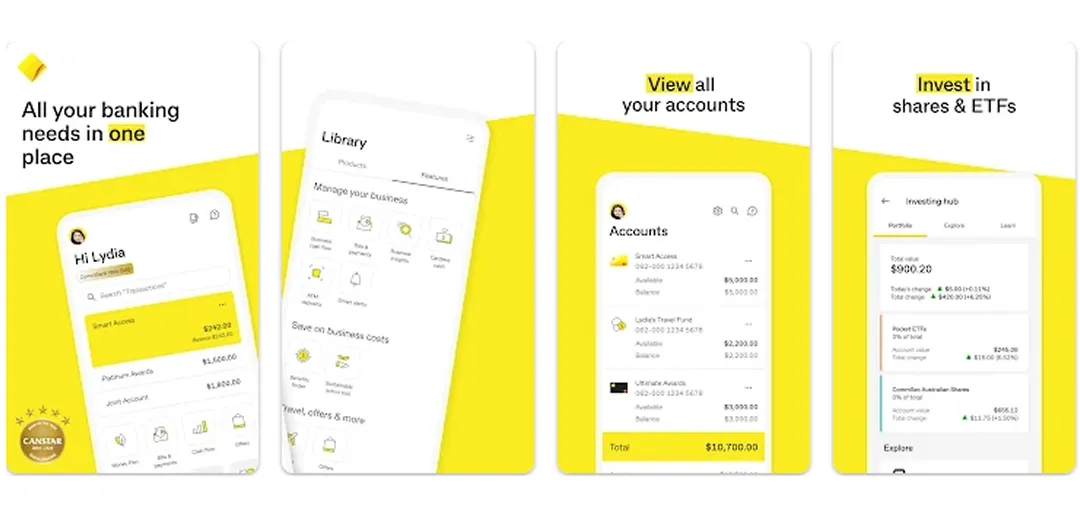

1. CommBank App (Commonwealth Bank of Australia)

The CommBank App also known as commonwealth bank app, is the most downloaded banking app in Australia and for good reason. It combines ease of use, security, and innovative features designed for both everyday banking and long-term financial planning.

Unique Features:

-

Spend Tracker & Goal Tracker – Monitor expenses and save towards set goals

-

Cash Flow View – Predicts upcoming income and bills

-

Lock, unlock, or replace cards instantly

-

Tap & Pay through Apple Pay, Google Pay, and Samsung Pay

-

Benefits Finder – Helps users discover rebates, refunds, and benefits

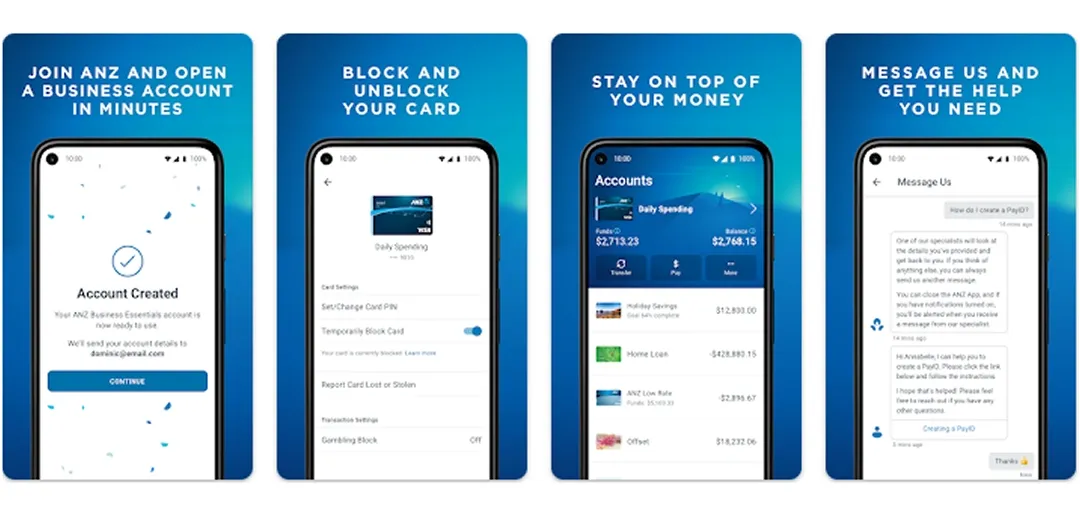

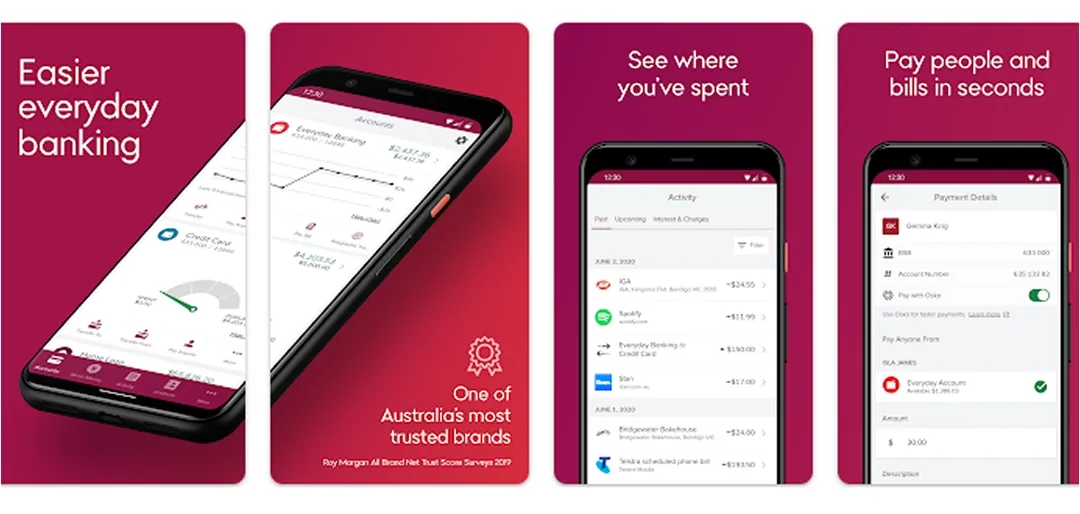

2. ANZ App

ANZ’s banking app is sleek and fast, offering real-time insights and robust security for customers. It’s also home to ANZ Plus, a powerful money management tool.

Unique Features:

-

ANZ Plus – AI-powered financial coaching and insights

-

Card Freeze – Temporarily block cards for security

-

Spending Categories – Group expenses to track habits

-

Fast Osko payments and PayID integration for instant transfers

-

In-app loan and credit card management

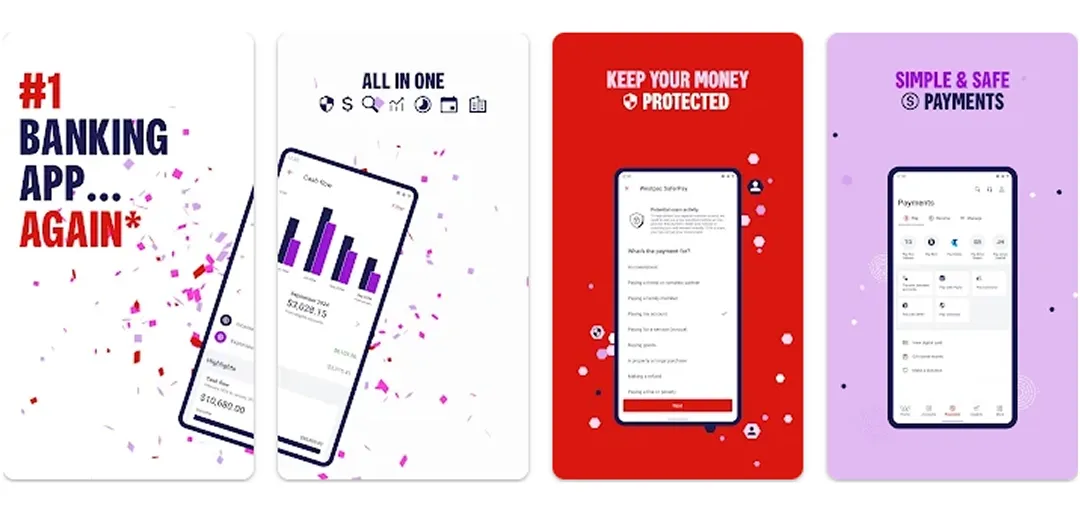

3. Westpac App

Westpac banking app focuses on giving customers more control over their money with advanced card features and expense tracking.

Unique Features:

-

Cardless Cash – Withdraw cash at ATMs without a card

-

Dynamic CVV – A rotating card security code for better online safety

-

Smart Search – Easily find past transactions

-

Push Alerts – Instant notifications for purchases or suspicious activity

-

Spending Insights – Visual reports on income and expenses

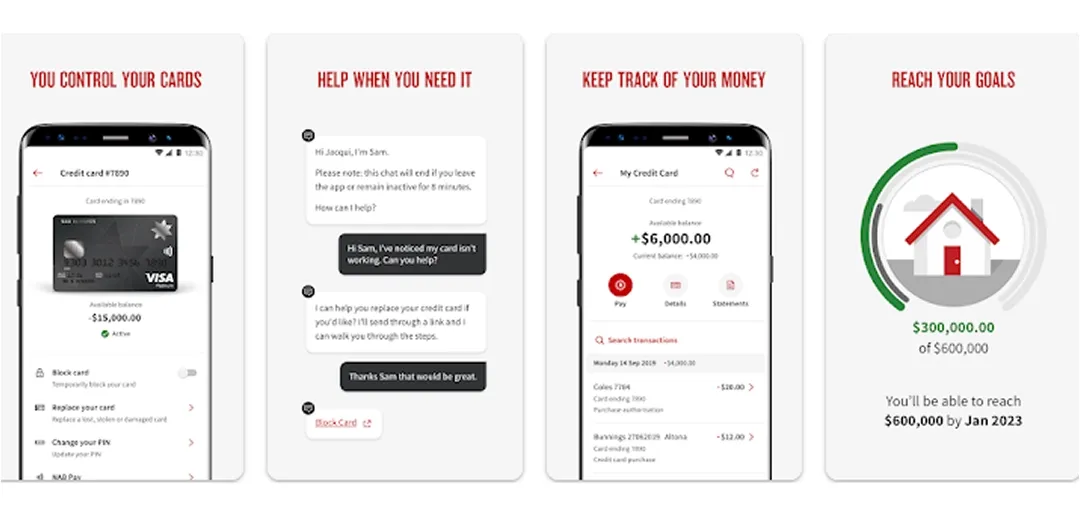

4. NAB App (National Australia Bank)

The NAB internet banking app is built for speed and simplicity. It’s popular for customers who want reliable performance and clean design without unnecessary complexity.

Unique Features:

-

Quick Balance – Check account balances without logging in

-

PayID, BPAY, and international transfers built in

-

Personal Loan applications directly through the app

-

Credit Card Controls – Set limits, block transactions, or manage repayments

-

Secure in-app messaging for customer support

5. Bendigo Bank App

Bendigo Bank offers a community-focused app tailored to everyday users, particularly in regional and rural areas.

Unique Features:

-

Easy BPAY and Pay Anyone features for local payments

-

Fingerprint and Face ID login

-

Ability to set up multiple payment templates for frequent bills

-

Direct account switching for managing multiple Bendigo accounts

-

Simple card activation and blocking

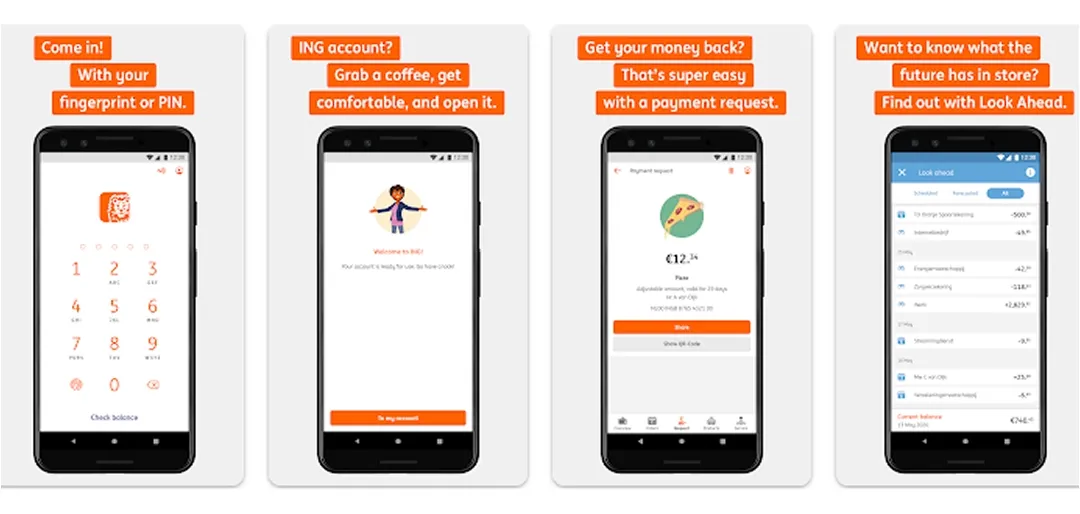

6. ING App

ING bank app is a favourite for tech-savvy Australians who want low fees and easy money management.

Unique Features:

-

Everyday Round Up – Automatically saves the difference from purchases

-

Fee-free international transactions when conditions are met

-

Push notifications for every transaction

-

In-app savings goals tracking

-

Visa Debit card management

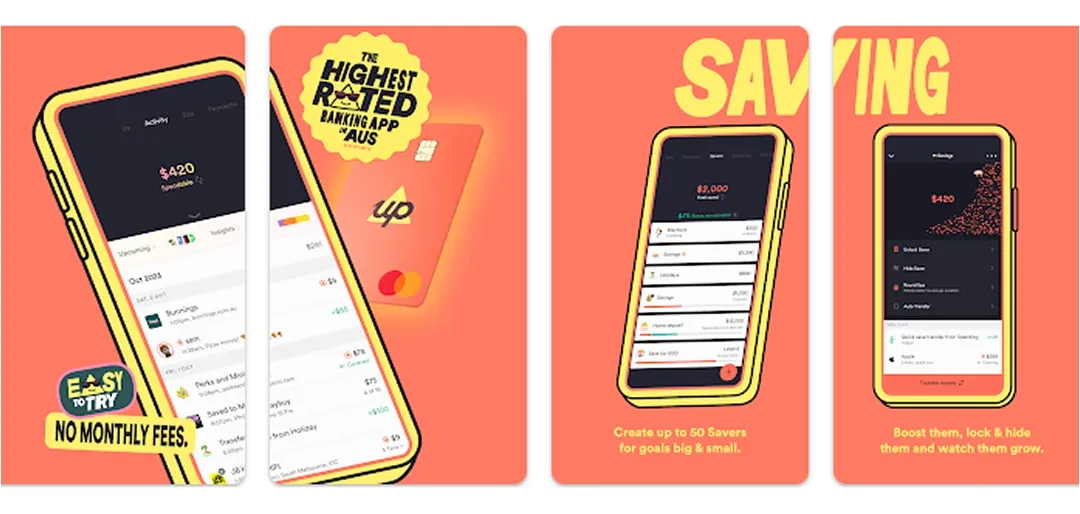

7. Up Bank App

Up Bank is a digital-only bank that’s won over younger customers with its modern interface and gamified savings features.

Unique Features:

-

Instant payments with real-time notifications

-

Pull-to-Save feature for quick savings

-

Auto-Splitting transactions into categories

-

Subscription insights to track recurring payments

-

Bill prediction tool to avoid missed payments

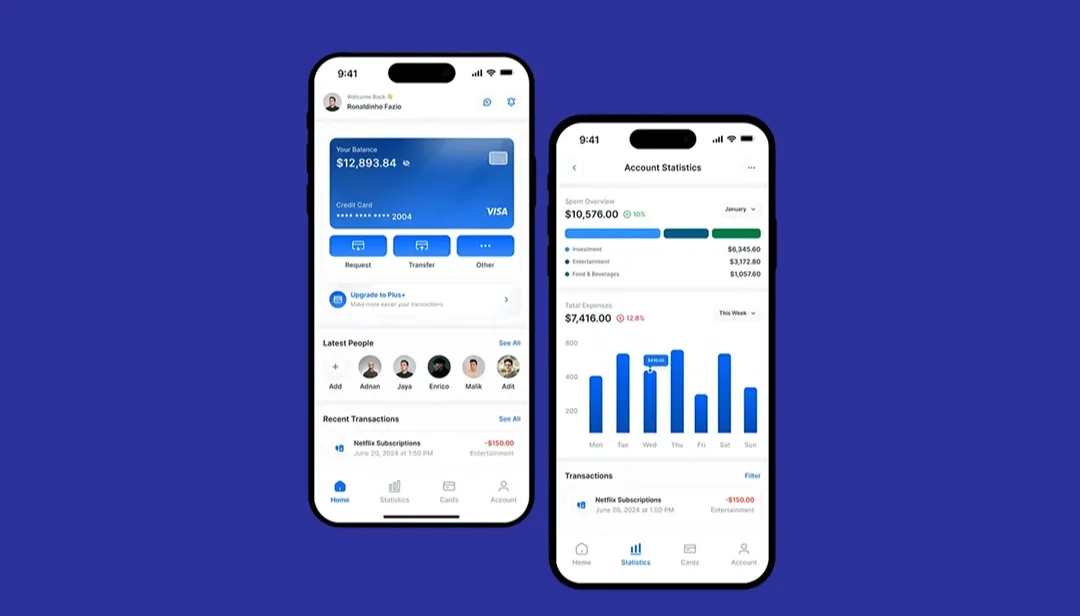

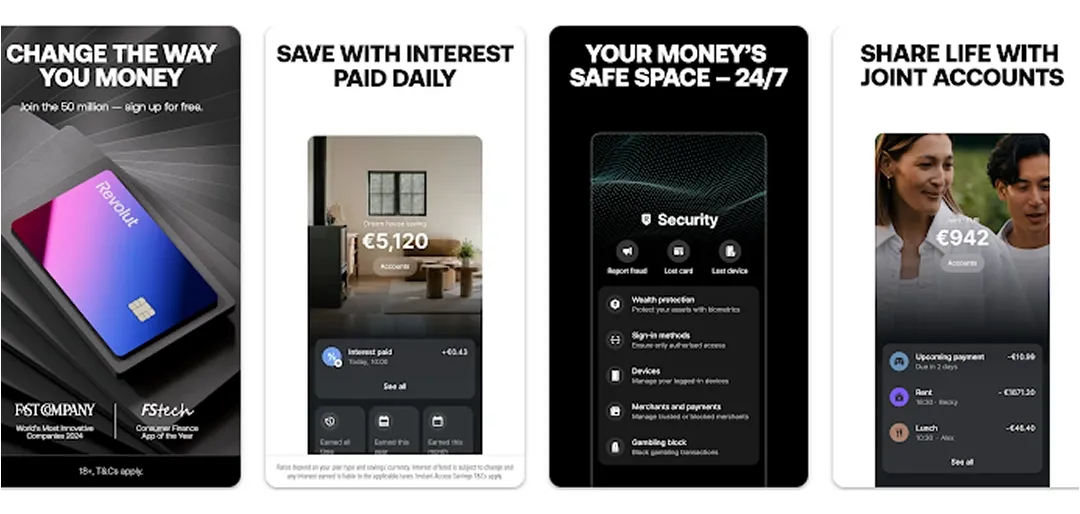

8. Revolut App

Revolut is a global fintech platform that’s gaining traction in Australia, especially with frequent travellers.

Unique Features:

-

Multi-currency accounts in over 30 currencies

-

Real-time currency exchange at interbank rates

-

Fee-free global spending up to certain limits

-

Built-in cryptocurrency exchange

-

Vaults for automated savings in multiple currencies

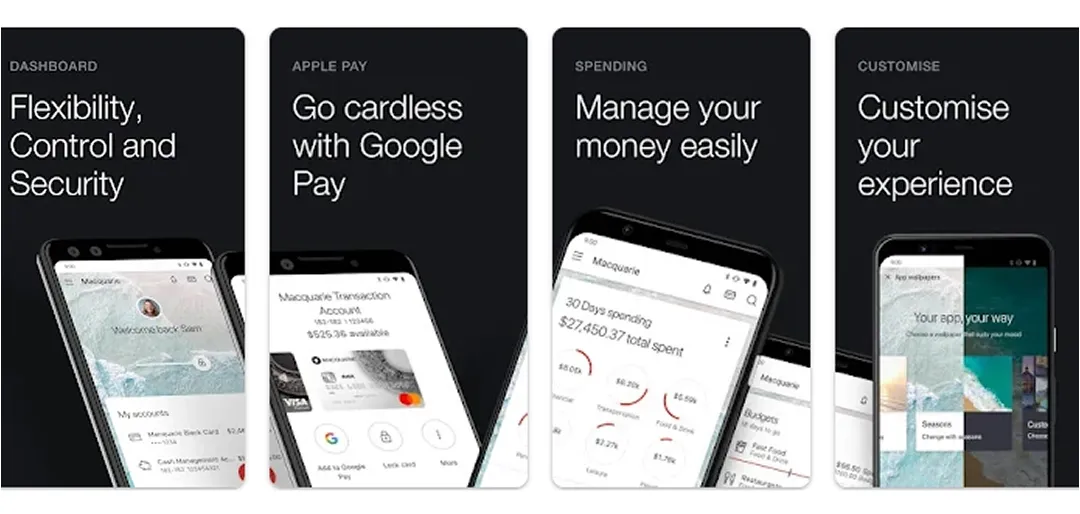

9. Macquarie Bank App

Macquarie Bank’s app is known for its premium design, fast performance, and intelligent money management features. It’s especially popular among customers who value smart insights and modern banking tools.

Unique Features:

-

Detailed spending categorisation with AI-driven insights

-

Predictive search to quickly find past transactions

-

Visual cash flow timeline for income and expenses

-

Real-time transaction notifications

-

Integration with Apple Pay, Google Pay, and Samsung Pay

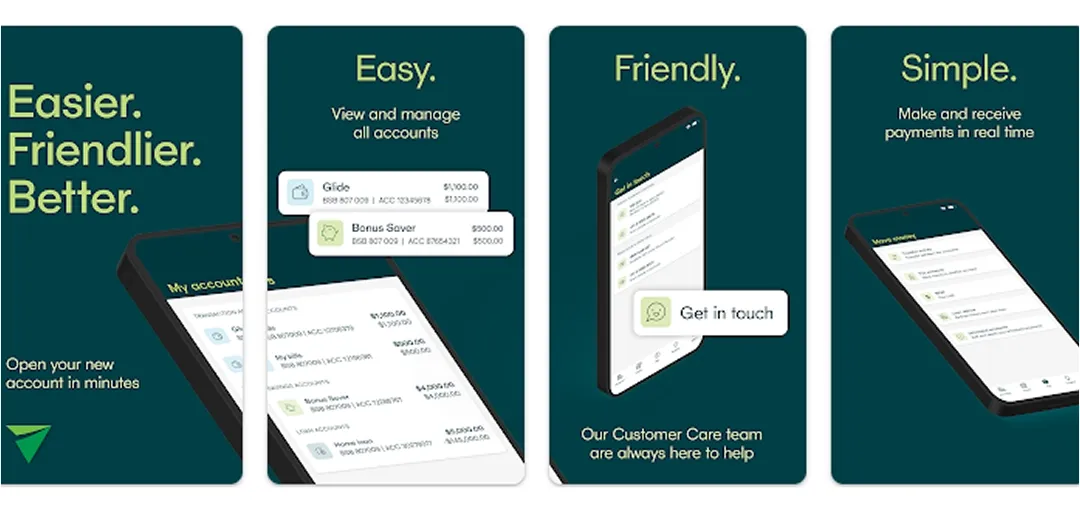

10. MyState Bank App

MyState Bank offers a straightforward app with all the essential banking tools for customers who want simplicity and security.

Unique Features:

-

BPAY and PayID payments

-

Push notifications for account activity

-

Card control features including block and replacement

-

Savings account tracking

-

Clean and minimal interface for easy navigation

Also Read:- Top Mobile App Development Companies Australia

Factors to Consider When Choosing a Mobile Banking App in Australia

With so many mobile banking apps available in Australia, choosing the right one isn’t just about brand loyalty, it’s about finding the app that fits your security needs, lifestyle, and financial goals. Here are the key factors Australians should keep in mind:

1. Security & Compliance

Security is the top priority. Look for apps that offer:

-

Biometric authentication (Face ID, fingerprint login)

-

Two-factor authentication (2FA) for extra protection

-

Encryption and fraud monitoring

-

Compliance with Australian Prudential Regulation Authority (APRA) guidelines

-

Protection under the Australian Financial Claims Scheme (FCS)

2. Payment Options & Transfers

An efficient mobile banking app should support:

-

PayID for instant transfers

-

Osko payments for real-time settlements

-

BPAY for bills

-

International transfer support at competitive rates

3. Ease of Use & Interface

The best app should be simple to navigate, with:

-

Clean dashboard displaying balances and recent activity

-

Quick access to frequently used features (transfers, bill payments, card controls)

-

Consistency across iOS and Android devices

4. Card & Account Management

Choose an app that lets you control your accounts without visiting a branch:

-

Lock/unlock cards instantly

-

Change PINs and set transaction limits

-

Activate or replace cards

-

View and manage multiple accounts in one place

5. Budgeting & Money Management Tools

Modern apps offer tools to help you stay financially organised:

-

Spending categorisation for tracking expenses

-

Goal-based savings tools

-

Bill prediction and reminders to avoid missed payments

6. Digital Wallet Integration

Ensure your banking app works with popular wallets:

-

Apple Pay, Google Pay, Samsung Pay, Fitbit Pay for contactless transactions

-

Smooth integration for online and in-store purchases

7. Customer Support Accessibility

In-app support options are essential:

-

Live chat, secure messaging, or call-back requests

-

24/7 availability for urgent issues

-

Quick issue resolution without visiting a branch

8. Extra Features for Added Convenience

Some apps stand out with added functionalities:

-

Currency exchange for travellers (Revolut, Macquarie)

-

Cashback or reward tracking (CommBank, Up)

-

Bill-splitting and subscription tracking (Up Bank, ANZ Plus)

Also Read: How to Hire Mobile App Developers In Australia?

Cost to Build a Mobile Banking App in Australia

The cost of developing a mobile banking app in Australia can range between $20,000 to $80,000+, depends on the type of app, feature set, and security requirements. A basic app usually includes features like balance checks, fund transfers, PayID, Osko, and BPAY integration, making mobile app development cost in Australia affordable. A complex app adds tools like card management, budgeting features, and real-time notifications. At the top end, an advanced app comes with AI-powered financial insights, multi-currency accounts, predictive analytics, and high-end security measures to meet compliance standards.

Conclusion

Mobile banking apps have redefined how Australians interact with their finances, making transactions faster, smarter, and more secure. From feature-packed apps like CommBank and ANZ to innovative digital banks like Up and Revolut, there’s an app to suit every type of user.

For businesses and fintech startups, this growing adoption creates a huge opportunity. Developing a mobile banking app in Australia requires more than just an appealing interface, it demands robust security, compliance with APRA regulations, seamless payment integrations (PayID, Osko, BPAY), and advanced features like AI-driven budgeting and card management.

Whether you aim to create a basic, mid-range, or advanced banking app, partnering with an experienced banking and fintech app development company can ensure your product meets industry standards while delivering a smooth, customer-focused experience. In Australia’s fast-moving financial technology space, building a secure, innovative banking app could be your next big growth move.

Dipti Singhal is a skilled Content Writing Specialist at IMG Global Infotech, with strong expertise in creating engaging, SEO-optimized content for various industries. She focuses on blending storytelling with effective keyword strategies to help businesses connect with their audience and improve their online visibility. Passionate about delivering high-quality content that drives real results, Dipti plays an essential role in strengthening the company’s digital presence.