AI In Debt Collection: Transforming The Future Of Loan Recovery

Lokesh Saini

Sep 08, 2025

The debt collection industry is evolving and the primary source for this shift is the adoption of Artificial Intelligence (AI). The debt recovery process has always been manual, which results in annoying habits like repeating calls for missed payments, while also having no visibility into the borrower for reasonable action is undertaken resulting in inefficient operations, and these actions also weaken the established relationship. AI can approach debt recovery in varied ways, essentially accommodating all processes beginning with gaining a preliminary understanding of repayment behaviours, initiating their own communication and managing the process, doling out rapid and/or response-based decisions, to automating rudimentary repetitive operational activities, that allow financial institutions to recover more debts, while lowering operational expenses, while achieving compliant activities. AI works to eliminate human error during debt recovery operational activities and provides a fairer and less opaque process as well. Moving forward the demands on lenders have shifted and the debt recovery process is developing into a smarter, more consumer-centric, and most definitely more efficient and effective method of debt recovery.

Core AI Technologies Reshaping Contemporary Debt Collection

AI has been a game changer in this area of debt recovery. Imagine more ambitious lenders, bank collections and collection agencies lead by example on behalf of consumers, SME and corporate segments who have had the opportunity to become smarter and faster, and more human in their lending or debt collection activities by utilizing ai app development. Here are five core AI technologies that are reshaping the area of debt collection:

1. Predictive Analytics

Predictive analytics first examines the historical data of repayments, and behaviour of borrowers, combined with lending patterns to start creating greater parity on if a borrower repays or not at the initial application stage. Predictive analytics enables lenders to decipher systematically and consistently sequencing accounts, determine the steps to take, and identify tactical plans to recover debt in place.

2. Natural Language Processing (NLP)

NLP enables chatbots, virtual assistants, and automated communication tools to engage with borrowers in a natural way. AI-powered debt collection solutions also allow debt collectors to send personalized reminders to borrowers, understand their questions, and respond to them in real-time as if they were human and empathetic.

3. Machine Learning (ML)

Machine learning algorithms learn from borrower behavior and trends in the market. Over time, they become more accurate in helping to refine debt recovery models, to optimize repayment plans, and be able to identify clients who are at risk.

4. Robotic Process Automation (RPA)

RPA takes the repetitive aspect of debt collection away. It can automate some tasks, such as sending reminders, updating notes, and processing payments. This alleviates a manual work burden, fast-tracking timescales for recovery, maximizing repayment rates, reducing human error, and making them available for the more complex cases that cannot be automated.

5. Sentiment Analysis

Sentiment analysis is an important technique as it allows lenders to evaluate the tone, emotion and intent in communications with borrowers. Once lenders understand whether they should be supportive, empathetic, or drive a harder discussion with their borrowers, it allows them to adjust their approach which drives engagement and repayment.

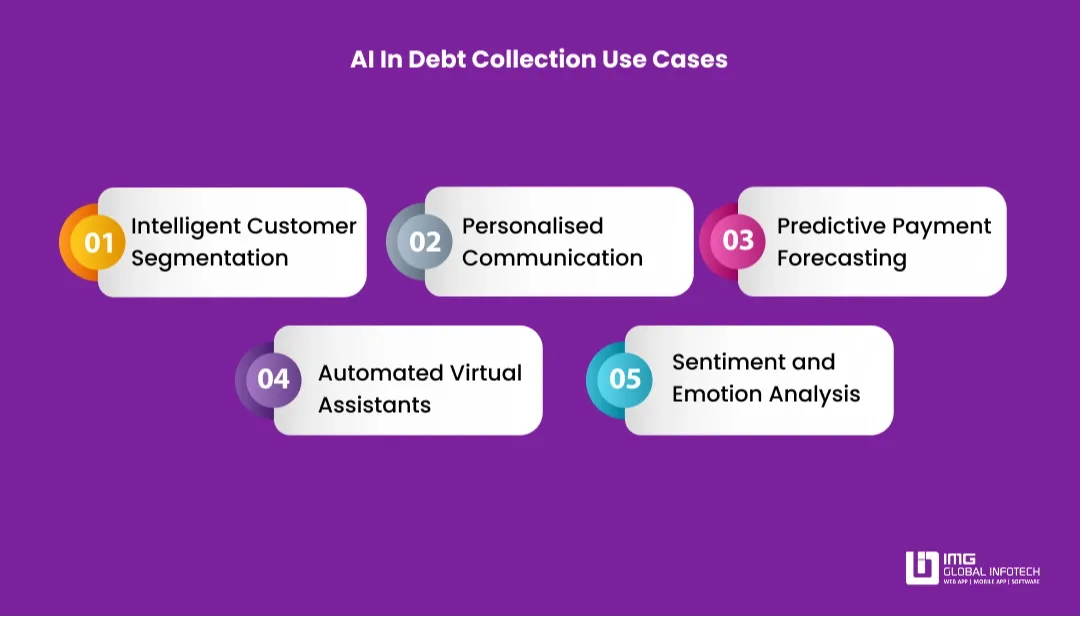

Use Cases of AI in Debt Collections

Artificial intelligence is transforming the way financial institutions and collection agencies manage overdue accounts through the use of automation, insights from data, and the ability to engage personalized communication. By creating an efficient, ethical, and borrower-centric recovery process through artificial intelligence, here are six examples use cases ai in debt collection market forecast:

1. Intelligent Customer Segmentation

This is the best use of artificial intelligence in debt collection that examines repayment history, credit scores, and behavioral trends can help analyze borrowers into groups of "likely to repay", "at risk", and "high risk." This allows agencies to develop different strategies that are tailored to the borrowers' actual behavior, and goals like using flexible repayment plans for borrowers that demonstrate cooperation, or using reminders that are targeted for at-risk borrowers.

2. Personalised Communication

The best fintech apps use Natural Language Processing (NLP) to send personalized messages through an email, SMS, or via a chatbot. Now, instead of sending generic reminders, borrowers are now sent messages that are timely, relevant, and demonstrate purposefully empathically increasing the likelihood of repayment.

3. Predictive Payment Forecasting

Machine Learning models now predict the likelihood of a borrower making a payment, or when they will likely make a payment. This enables agencies to schedule outreach campaigns and efforts in a more efficient and more applicable manner that will create less waste, and better recovery rates overall.

4. Automated Virtual Assistants

Chatbots and voice bots powered by ai and machine learning in debt collection, provide support on a 24/7 basis. They are able to accurately answer questions of the borrower, explain repayment options, and process payments as well. This way more lenders can rely less on human agents in providing these services, while enhancing the overall borrowing experience offering convenience and immediate support for customers.

5. Sentiment and Emotion Analysis

Also ai in debt collection 2026 can also analyze tone and language of interactions with borrowers to identify stress, hesitance, or willingness in cooperation levels. This information is used by collection agents to adjust their tone and strategy - using empathetic tones with borrowers who are showing struggling abilities, while using an assertive tone with borrowers who are showing avoidance.

Advantages of Artificial Intelligence for Debt Collection

Artificial intelligence is transforming the debt collection process, giving financial institutions and collection agencies borrow friendly. Consider the 6 benefits of ai in debt collection:

1. Better Recovery Rates

Using predictive analytics and machine learning, artificial intelligence recognizes the borrowers that are most likely to pay, and identifies when. With that information, lenders can adjust their efforts to recover those debts higher probability of success and higher overall recovery rates.

2. Cost Savings

For lenders, artificial intelligence cuts down the administration needed to run a large operation that repeats the following tasks: that perform a simple task, like: reminders, payments, records. The result is operational efficiency/cost savings, and allows an organization to recognize strategic resource allocation.

3. Better Customer Experience

Generative ai in debt collection also transforms what used to be intrusive credit and debt collector's actions, to positive personal experiences using: chatbots, emails, and voice assistants. Just think to yourself: did I get the latest reminder options for repayment? The result is a greater customer experience, more trustworthy responses, and willingness to repay a lender particularly in an if you will.

4. Real-Time Insights and Decision Making

The adoption of ai automation in debt collections are already delivering on their promise to process large amounts of data, in real time, to provide insights into borrower behavior, payment profiles and financial risk. This gives collection agencies the opportunity to make speedy and data driven decisions and to adjust their overall strategy on the fly.

5. Improved Compliance and Risk Management

Debt collection is one of the most regulated aspects of finance, meaning noncompliance can lead to penalties to be paid by a company. AI will ensure that the communications undertaken will follow the established legal framework as well as the internal policies of the organization. AI will also find suspicious activity and support organizations in detecting fraud early on and mitigate risk.

Challenges & Solutions

There is no doubt that AI in finance is disruptive to the debt recovery process, but this disruptive innovation includes challenges that financial institutions and collection agencies must mitigate. Below are six common and ideas to overcome these challenges:

1. Data Privacy & Security Issues

Collection involves sensitive financial information and personal information. Whenever a finance store or process sensitive data, there is risk to privacy and cybersecurity.

Solutions: Use data encryption and/or security, use secure data storage and protection, develop a compliance plan to account for industry standards and privacy requirements like GDPR. A regular audit while implementing cybersecurity training will further create a better framework for managing data security.

2. High Implementation Costs

Investing in infrastructure, talent and integrating technology to build or develop AI-driven debt collection systems can be a significant cost.

Solution: Consider starting with an AI, something like a scalable solution, chatbots or predictive analytics, when choosing an ai debt collection software approach before moving to fully automate. Additionally working with AI development firms specializing in identifying ways to design and develop your solution can lower costs and timelines.

3. Regulatory Compliance Difficulties

Given that regulations for debt collection can differ from region to region, it is essential that any AI system is designed in a way which complies - otherwise it is risking penalties, as well as reputation.

Solution: Use AI tools with built-in compliance and monitoring capabilities; regularly identify changes in the algorithm from new regulation; the deployment process should include consultation with lawyers.

4. No Human Empathy

To the consumer the use of AI chatbots and automation for debt management can be impersonal, and in fact frustrate a borrower, especially given that they may be in a difficult financial situation dealing with debt collection.

Solution: Consider a hybrid approach, whereby AI will perform routine tasks, but human agents will manage cases that require compassion and negotiation. Finally, features such as natural language processing and sentiment analysis can give a level of empathy to AI interactions that are typically missing.

5. Legacy Systems Integration

Many financial institutions run antiquated legacy systems that cannot easily accommodate modern AI technologies, disrupting operations.

Solution: Invest in middleware solutions or APIs that connect with AI tools, while maximizing your existing processes effectively. Consider a phased approach of transitioning to AI-enabled systems, which protects you from more drastic disruption at this point.

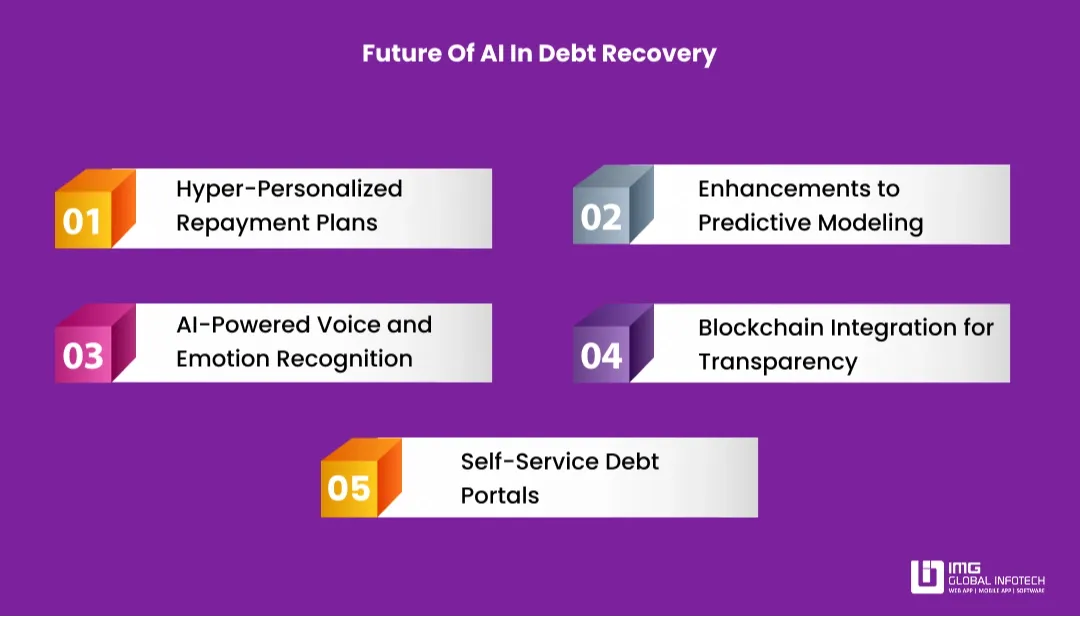

Future Trends in AI-Fueled Debt Recovery

The future of debt recovery is leveraging technology to better refine the debt recovery process in smarter, more ethical and increasingly, more customer focused ways with Artificial Intelligence. Utilizing AI is already changing how lenders and agencies are expected to recover their loans.To further enhance efficiency, implementing debt collection software allows agencies to automate reminders, track payments, and manage accounts seamlessly, improving recovery rates while maintaining a positive customer experience.

1. Hyper-Personalized Repayment Plans

With the promise of AI, lenders will be able to create the personalized repayment plans NEED to the borrower's individual financial histories, expense habits, and sources of income. In doing so, lenders not only will increase repayment rates, but also reduce a borrower's anxiety.

2. Enhancements to Predictive Modeling

The next generation of ML predictions will increase in analytical capability beyond simply predicting those more likely to make the repayment to including suggesting the best time, best manner to approach the borrower as well as, the repayment consideration that is likely to be acceptable for the borrower. By hiring AI software development companies you will result in a higher rate of recovery for lenders.

3. AI-Powered Voice and Emotion Recognition

Voice bots that have the capability to recognize a borrower's emotional state will be able to evaluate how a borrower interacts through tone and stressful levels of speech. This will allow for a more empathetic, context-aware conversation that is able to bridge the gap between automation and human consideration.

4. Blockchain Integration for Transparency

Blockchain technology combined with AI will provide more transparency and security in the debt collection process. There would be records that included immutable communications and payments, which would provide more strength in compliance and limited disputes.

5. Self-Service Debt Portals

AI-based digital platforms will empower borrowers to interact with their debts through personalized dashboards. Borrowers will be able to review their outstanding balances, look for affordable options for repayment, and potentially resolve their debts with limited human support, ultimately improving borrower satisfaction.

Conclusion

We are experiencing a revolutionary shift in debt collection with the help of AI to be more efficient, compliant, and client-centered. From predictive and analytical analytics to automating any tasks, through to sentiment analysis and ethics, we are learning how to recover debts more quickly while maintaining borrower's trust. Financial institutions that adopt such innovations will significantly experience lower costs, higher rates of repayment, and a generally better experience for their clients. As systems evolve, AI will be at the forefront of changing the loan recovery landscape. IMG Global Infotech is a leading Fintech app development company of innovative, AI-driven debt collection solutions that can be customized for your organization.

Lokesh Kumar is the Digital Marketing Manager & SEO Content Strategist at IMG Global Infotech, a top-rated Web & Mobile App Development Company. With extensive experience in digital marketing, SEO, and content strategy, he specializes in boosting online visibility and driving organic growth for startups, SMEs, and global brands. Lokesh is passionate about creating SEO-friendly, user-centric content that not only ranks but also converts. His deep understanding of digital trends and search algorithms helps businesses thrive in a competitive online space.