Moneylion - Case Study

MoneyLion

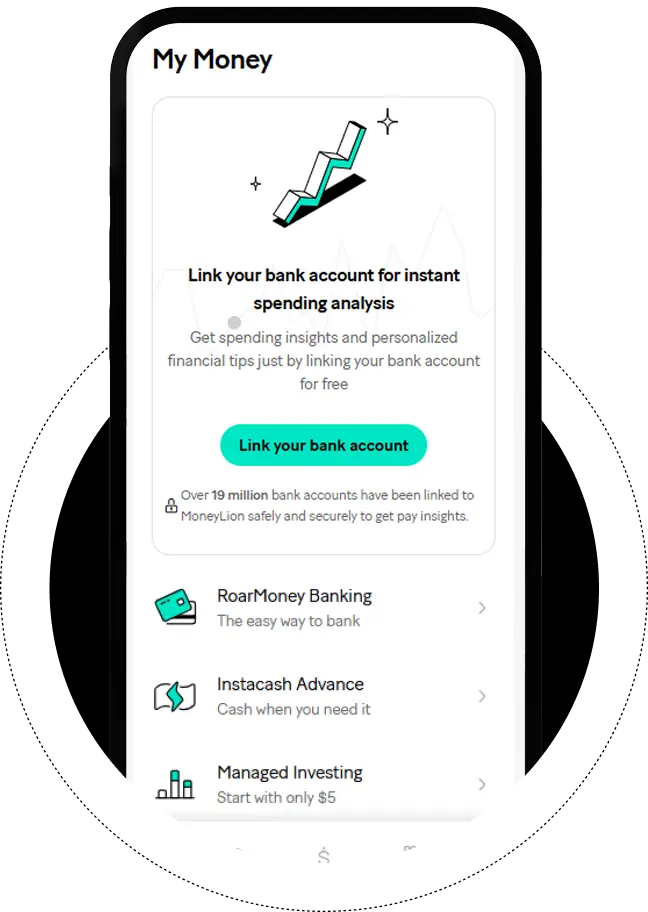

The MoneyLion app is one of the paramount examples of mobile banking app development solutions. This app makes it easy for users to borrow, earn, invest, win, and manage money. In this case study, we will explore some key details about an app like MoneyLion.

Industry

Fintech

Country

New York

App Download

2Cr+

What is a loan app like MoneyLion?

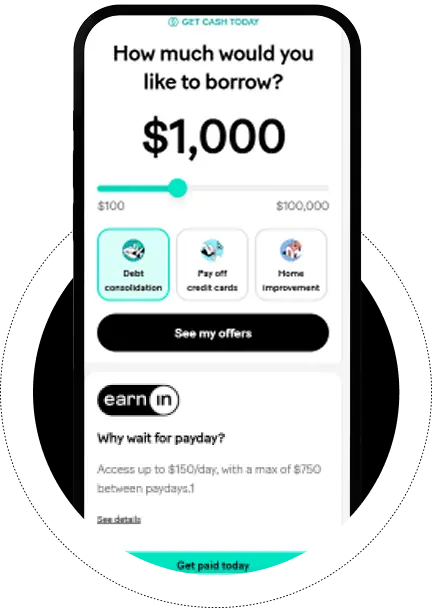

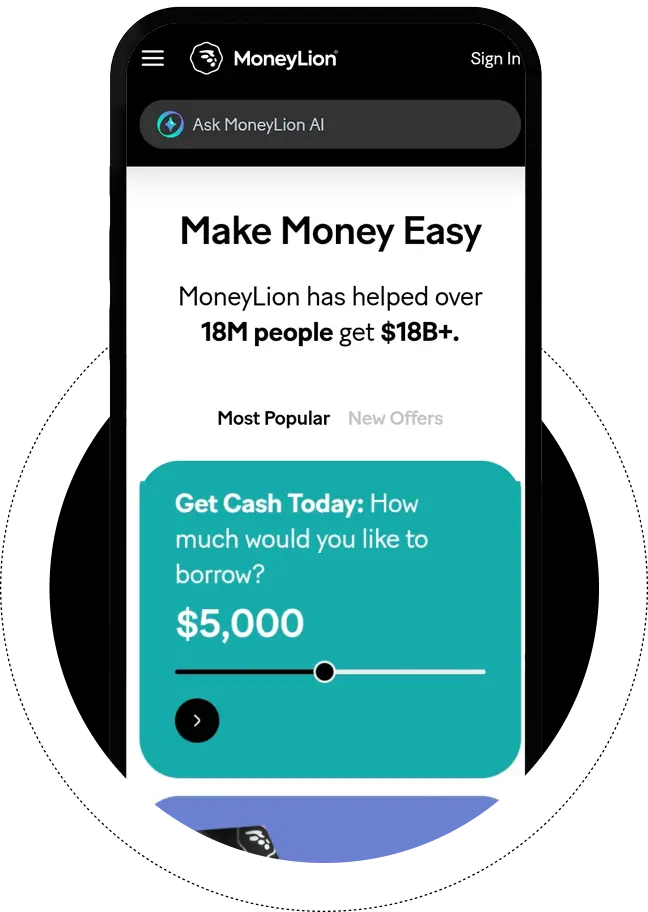

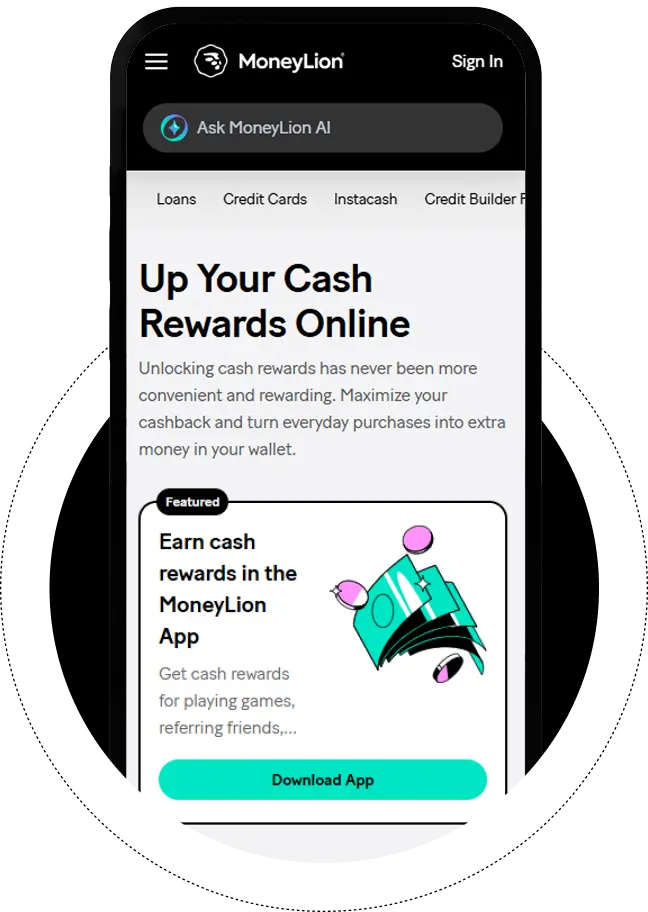

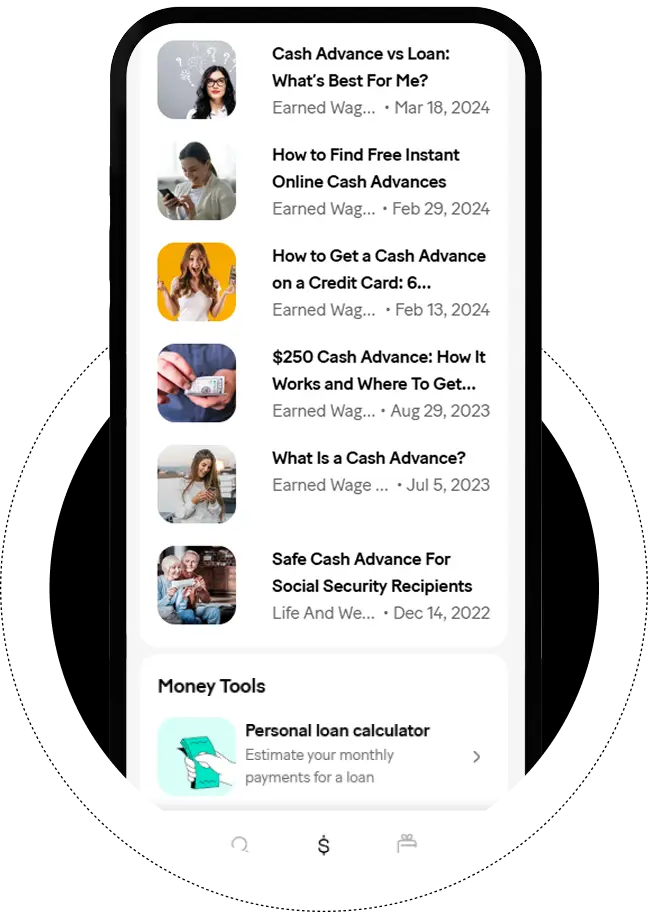

MoneyLion is not only an app; it is a financial marketplace that empowers users to make the right financial decisions at the right time. The concept of an app like MoneyLion is that every pocket has different requirements, and MoneyLion is here to help. It is also known as one of the top instant cash advance apps available on the internet. One of the best things that sets it apart from other finance apps is offering deals and offers to win reward amounts. Some of its top competitors are apps like Truebalance, Mpocket, and Moneyview. The app is available over all major platforms, like Web, Android, and iOS, making money management easy for users.

Business Goal

The business goal of MoneyLion is to empower everyone to make the best financial decisions. Using technology, the ultimate goal is to make money management easy and possible for all, especially those actively thinking about it for their financial future. A loan app like MoneyLion is breaking stereotypes about financial management and providing a diverse way for people to make the most of their finances. Having existing customers, the future goal is to increase the number of customers and improve the financial well-being of their users.

Project Idea

The project focused on developing a finance management platform that expands as a cash advance app for the users. Clients want to develop an app like MoneyLion to help users from different demographics with their money needs and management and launch it on all platforms, such as Web, Android, and iOS.

Project Challenges

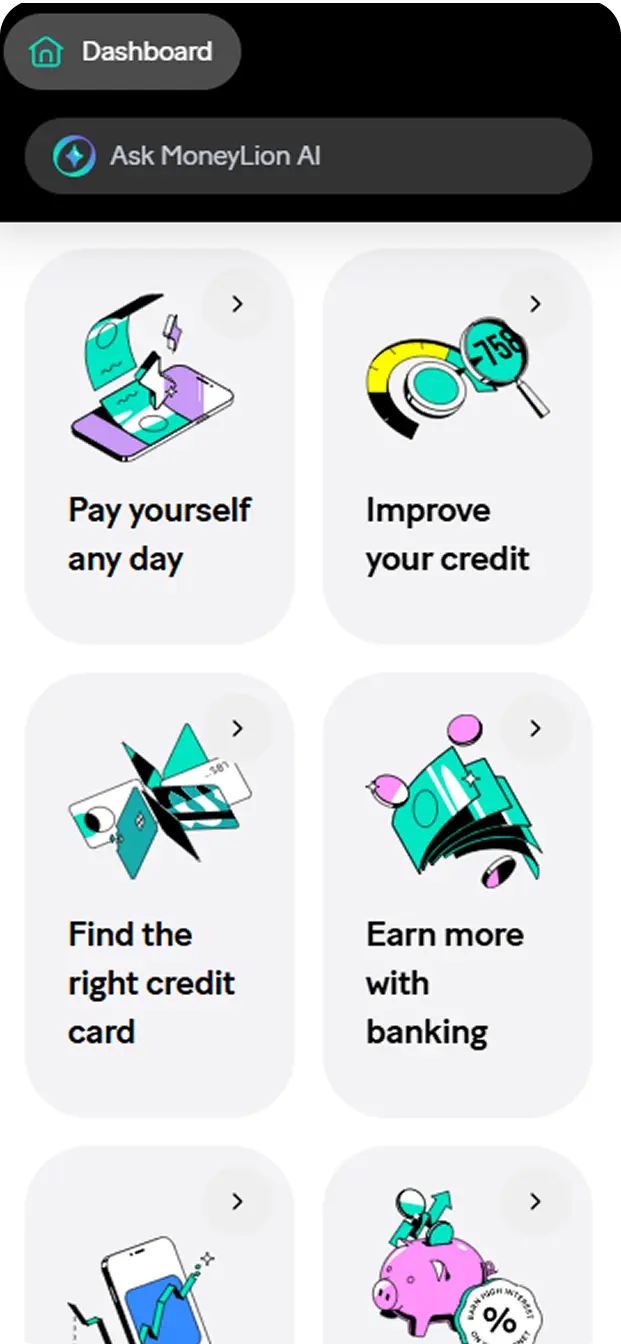

The primary challenge was to implement features and functionalities that help users with their diverse needs, such as earning more with banking, improving credit scores, applying for advanced cash, finding the right credit card, fraud detection, and other key features. One of the key features that drew more effort is implementing the feature that users can use to find out whether they qualify for financial products via browsing and comparing. Our team took the challenge positively, and it resulted in a superb app like MoneyLion.

Proposed Team & Time to be Involved

Team Members

01 App Developer

01 UI UX

01 QA

01 Project Manager

Timeline

12 Week

Research

1 Week

Design

2 Week

Development

6-8 Week

Deployment

1 Week

Features Loan App Like MoneyLion Offers

Result

As a result, an app like MoneyLion got widespread success among all types of customer segments. The cash advance app helps users gain better control over their finances, apply for loans, access pre-approved loans, maintain their payments, and improve their credit scores. MoneyLion became the preferred app for managing personal finances after receiving great reviews for its impactful financial tools, user-centric design, and smooth operation. As a trusted mobile banking app development solution, IMG Global Infotech specializes in fintech app development. If you also want to develop a fintech app like MoneyLion, we are here to assist you. Schedule a consultation with your fintech or cash advance app idea, like Truebalance or MoneyLion.

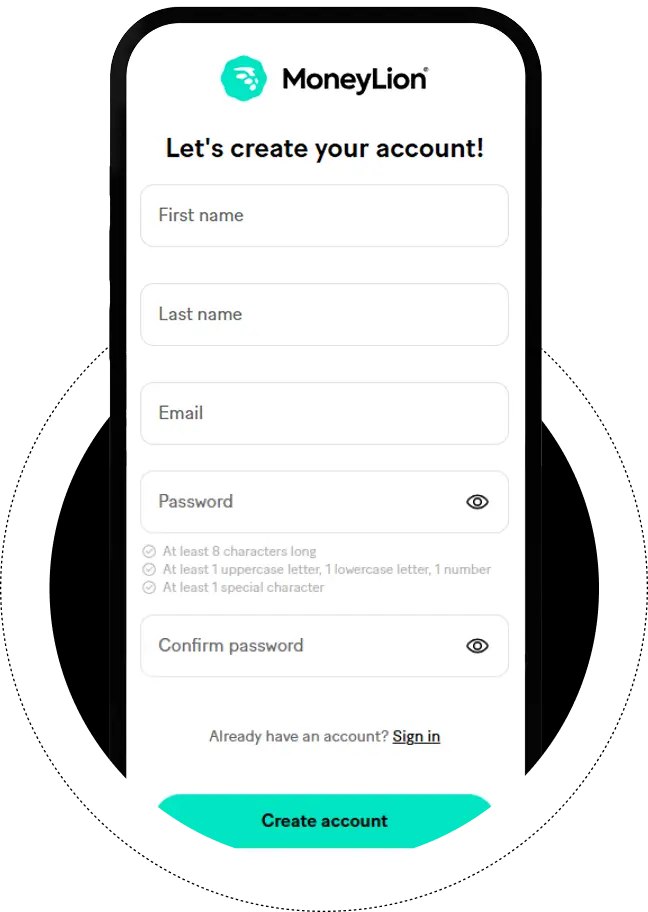

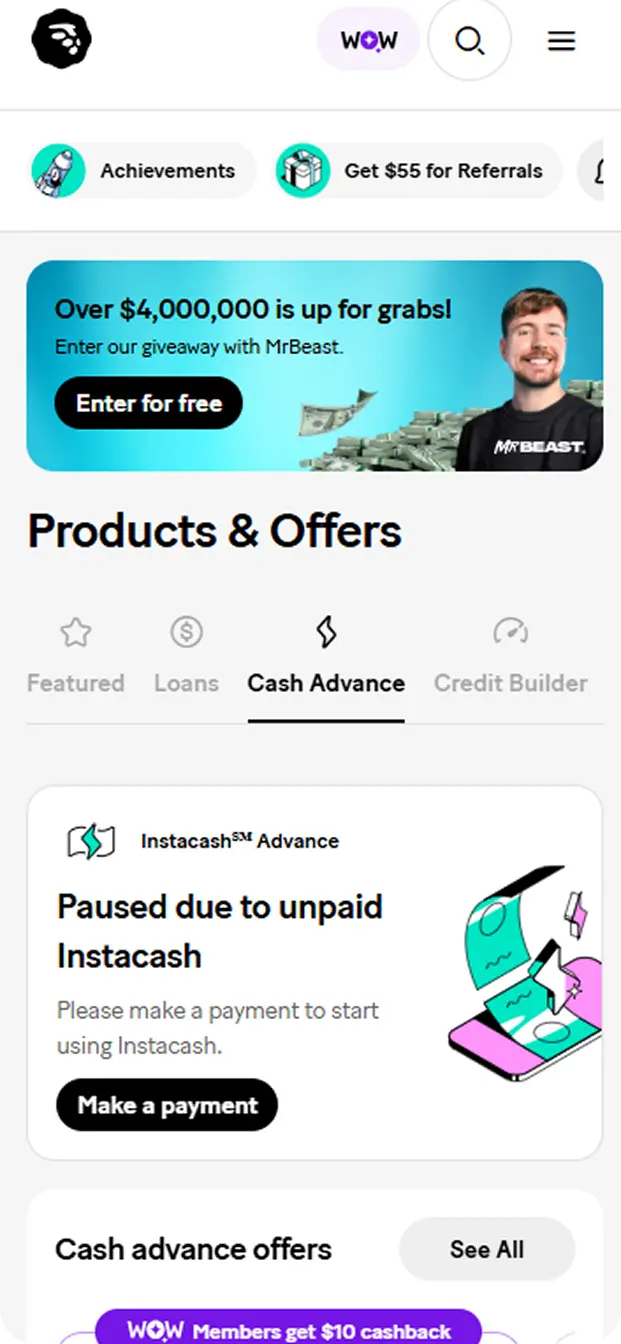

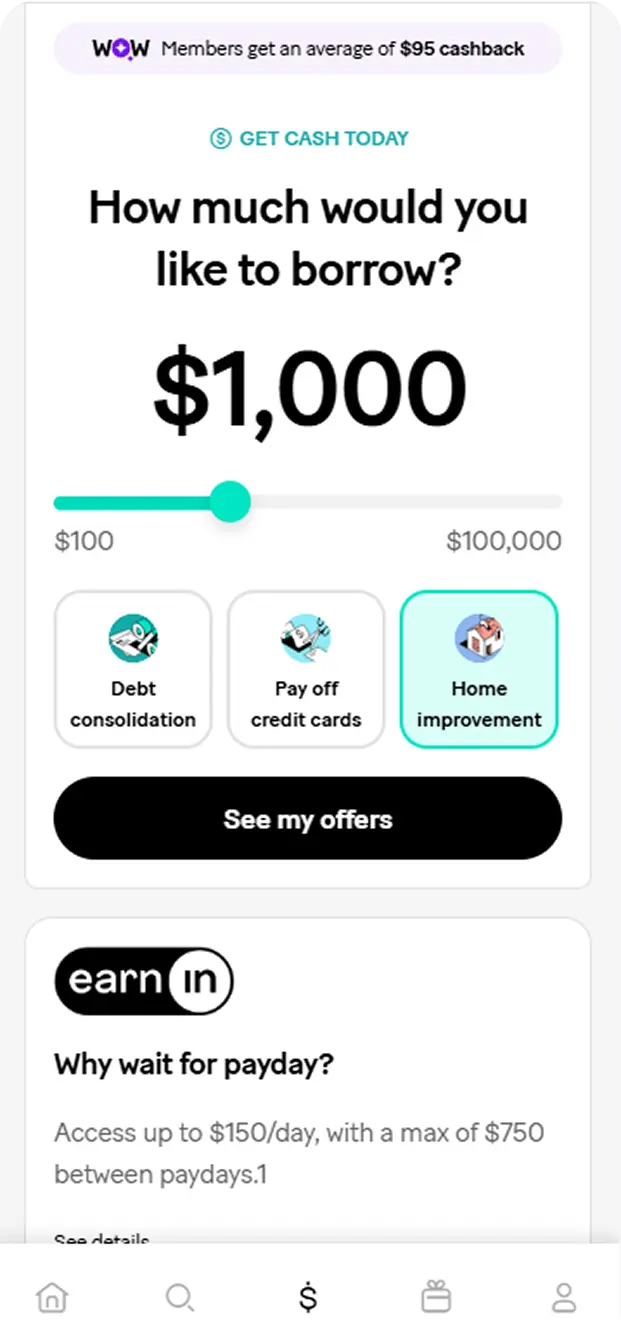

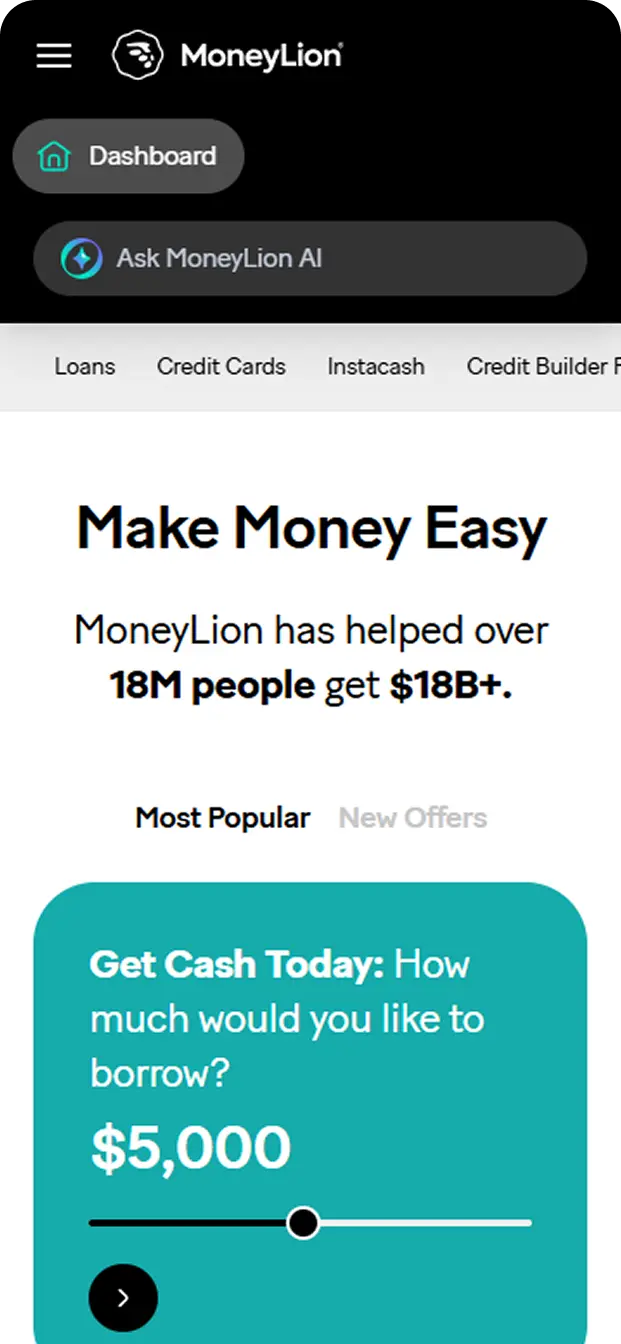

Our Solution

As a solution, we have shaped our client’s idea as a cash advance app like MoneyLion. After analyzing all the requirements shared with us, we began with planning, then we moved on to processes like wireframing, graphic designing, intuitive UI/UX development, and backend coding. Once all was done, we rigorously tested it and delivered a robust loan app to our client. Using the latest tech stack, IMG Global Infotech ensured a personalized fintech experience for end users.

AI-Powered Features to Make Your MoneyLion-Like App Stand Out

Enhance your digital finance platform with next-gen AI features that simplify financial management, improve user engagement, and provide personalized banking experiences for maximum satisfaction.

AI-Driven Financial Recommendations

Use AI to analyze spending patterns, income, and financial goals to offer personalized savings tips, investment advice, and credit insights, ensuring better financial decisions for users.

Predictive Expense & Budget Forecasting

Machine learning models predict upcoming expenses, cash flow trends, and potential overdrafts, helping users stay ahead with smarter budgeting and real-time financial alerts.

AI-Powered Customer Support Chatbots

Deliver 24/7 instant support with AI chatbots that handle loan queries, payment issues, transaction history, and account troubleshooting without human intervention.

Smart Personalization & Dynamic Offers

AI customizes the user experience by suggesting tailored loan offers, credit card deals, and investment plans based on financial behavior, improving engagement and retention.

Tech Stack

Build Your Next-Gen Money Lending App with Our Team of Experts

App Screens

Other Case Studies

AstroTalk Casestudy

By reaching new audiences in new places, you may expand your business and enlighten your horoscope with mobile astrology software like AstroTalk.

Zillow Casestudy

With the help of our experts and property finder apps like Zillow, find the best properties. Using our app could greatly improve the visibility of your real estate business as well.

Blinkit Casestudy

Does your grocery delivery business need solutions? Our professionals can create a grocery app that is similar to Blinkit in terms of its sophisticated features and intuitive user interface.

TaskRabbit Casestudy

Simply click to send plumbers, cleaners, and more. We can develop a home service app that enhances customer satisfaction and facilitates business operations, similar to TaskRabbit.